pleas put right answers and expaline, thank you ASap

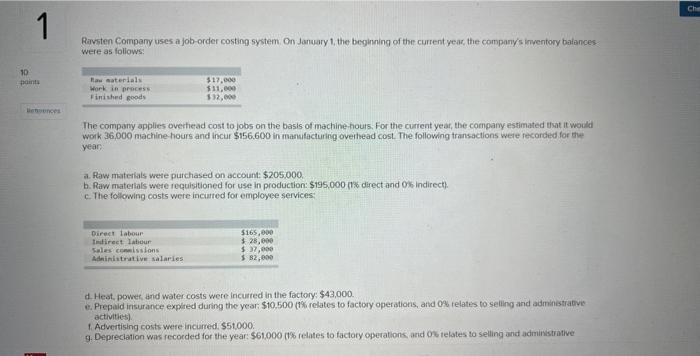

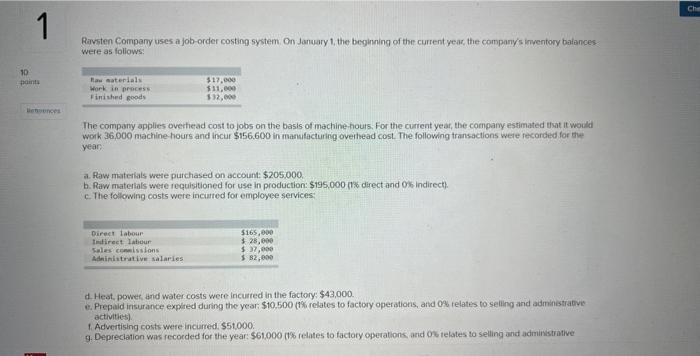

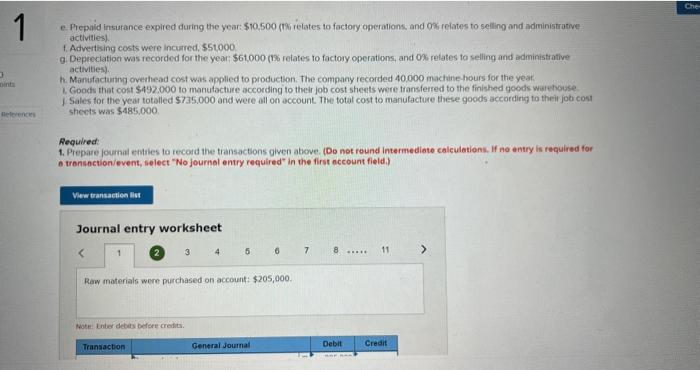

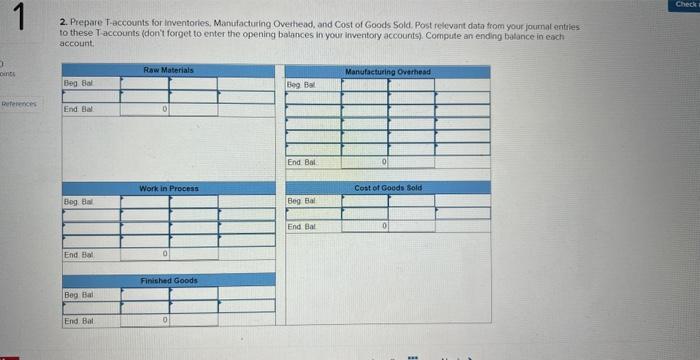

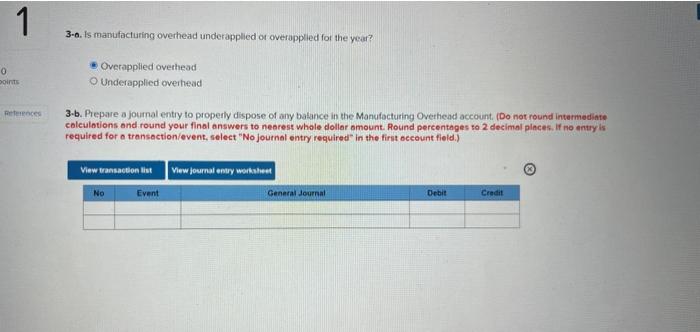

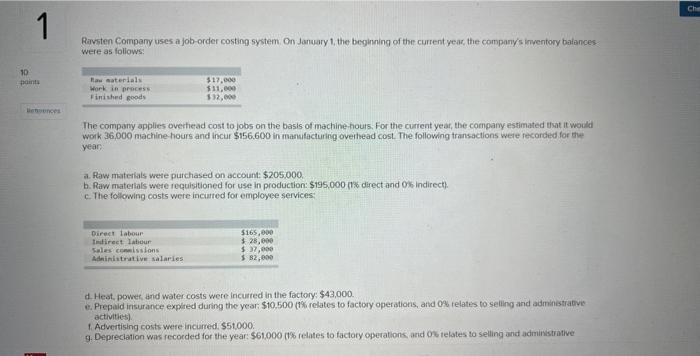

Raviten Company uses a job-order costing system. On January 1, the beginning of the current yeat, the company's inyentory balances were as follows: The company applies overhead cost to jobs on the basis of machine houls. For the current year, the company estimated that it would work 36,000 machine hours and incur $156,600 in manufacturing oveibead cost. The following transactions were fecorded for the year: a. Raw mateisals wete purchased on account: $205,000. b. Raw materials were requistioned for use in production: $195,000 (T8 direct and 0 5 indirect. c. The following costs were incurted for employee services: d. Heat, powec and water costs were incuited in the factory: $43,000. e. Prepaid insurance explied during the year: $10,500 (39, relates to factory operations, and 006 relates to selling and administrabve activities). 1. Advertising costs were incurred. $51,000. 9. Depreclation wis recorded for the year: 561,000 (15 relates to factory operations, and os telates to selling and adminstrative e. Prepaid insurance explied during the year: $10,500 (t9 relates to factory operations, and 0 , relates to seiling and administrative: activities). 1. Advertising costs were incurred, 551,000 9. Depreciation was recorded for the year $61.000 (188 relates to factory operations, and os relates to selling and administrative activities). h. Manufacturing ovethead cost was applied to production. The company recorded 40.000 machine hours for the year. 1. Goods that cost $492.000 to manufacture according to theli job cost sheets were transferred to the finished qoeds watehouse I Sales for the year totalled $735.000 and were oll on account. The total cost to manufacture these goods according to theit job cost sheets was $485,000 Required: 1. Prepare jouthal entites to record the tiansactions given above. (Do not round intermediate calculations. If no entry is required for n trensection/event, felect "No journal entry required" in the firat nccount fleld.) 2. Prepare T-accounts for inventories, Manulacturing Ovetheod, and Cost of Goods Sold. Post relevant data from your jourmat enties to these Taccounts (don't forget to enter the opening bolances in your inventory accounis). Compute an ending botance in esch account: 3-a. Is manufacturing overhead underapplied on overapplied for the year? Overapplied overhead Underapplied overhead 3.b. Prepare a joumal entry to properly dispose of any batance in the Manufacturing Overhead account, (Do not round intermediate coleulotions and round your final answers to nearest whole doller amount. Round percentages to 2 decimal places. If no antry is required for a transection/event, select "No journal entry required" in the first occount field.) Raviten Company uses a job-order costing system. On January 1, the beginning of the current yeat, the company's inyentory balances were as follows: The company applies overhead cost to jobs on the basis of machine houls. For the current year, the company estimated that it would work 36,000 machine hours and incur $156,600 in manufacturing oveibead cost. The following transactions were fecorded for the year: a. Raw mateisals wete purchased on account: $205,000. b. Raw materials were requistioned for use in production: $195,000 (T8 direct and 0 5 indirect. c. The following costs were incurted for employee services: d. Heat, powec and water costs were incuited in the factory: $43,000. e. Prepaid insurance explied during the year: $10,500 (39, relates to factory operations, and 006 relates to selling and administrabve activities). 1. Advertising costs were incurred. $51,000. 9. Depreclation wis recorded for the year: 561,000 (15 relates to factory operations, and os telates to selling and adminstrative e. Prepaid insurance explied during the year: $10,500 (t9 relates to factory operations, and 0 , relates to seiling and administrative: activities). 1. Advertising costs were incurred, 551,000 9. Depreciation was recorded for the year $61.000 (188 relates to factory operations, and os relates to selling and administrative activities). h. Manufacturing ovethead cost was applied to production. The company recorded 40.000 machine hours for the year. 1. Goods that cost $492.000 to manufacture according to theli job cost sheets were transferred to the finished qoeds watehouse I Sales for the year totalled $735.000 and were oll on account. The total cost to manufacture these goods according to theit job cost sheets was $485,000 Required: 1. Prepare jouthal entites to record the tiansactions given above. (Do not round intermediate calculations. If no entry is required for n trensection/event, felect "No journal entry required" in the firat nccount fleld.) 2. Prepare T-accounts for inventories, Manulacturing Ovetheod, and Cost of Goods Sold. Post relevant data from your jourmat enties to these Taccounts (don't forget to enter the opening bolances in your inventory accounis). Compute an ending botance in esch account: 3-a. Is manufacturing overhead underapplied on overapplied for the year? Overapplied overhead Underapplied overhead 3.b. Prepare a joumal entry to properly dispose of any batance in the Manufacturing Overhead account, (Do not round intermediate coleulotions and round your final answers to nearest whole doller amount. Round percentages to 2 decimal places. If no antry is required for a transection/event, select "No journal entry required" in the first occount field.)