Pleas show all equations and work as needed. Sections a-d have already been answered and the work is attached. I only need e, f, and g answered.

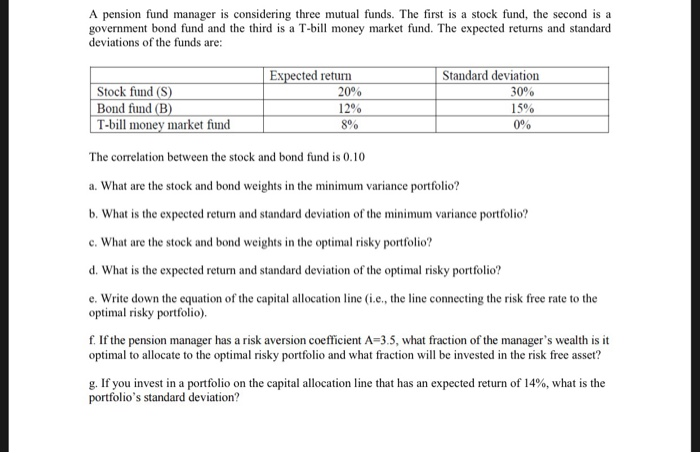

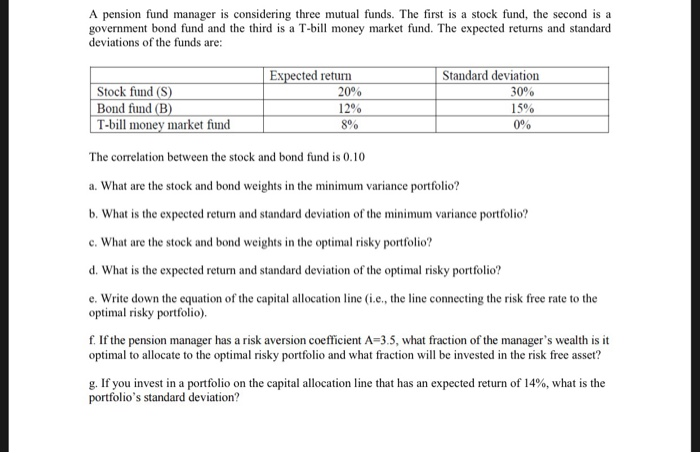

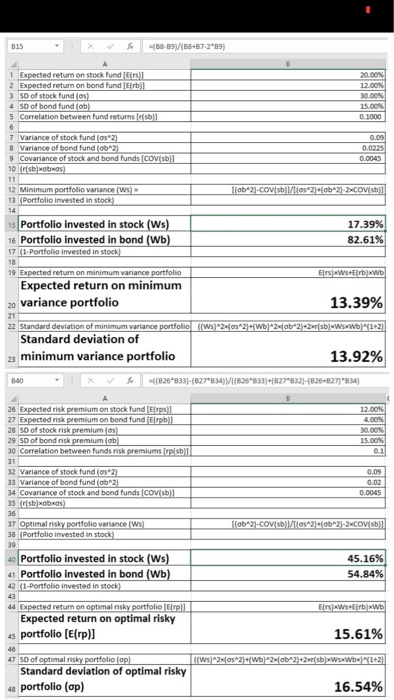

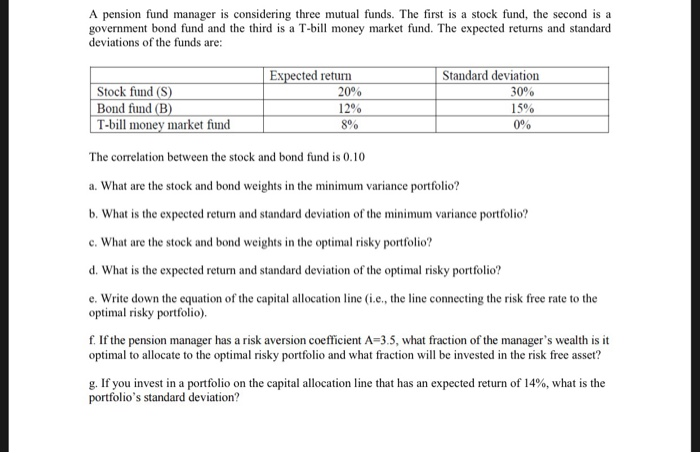

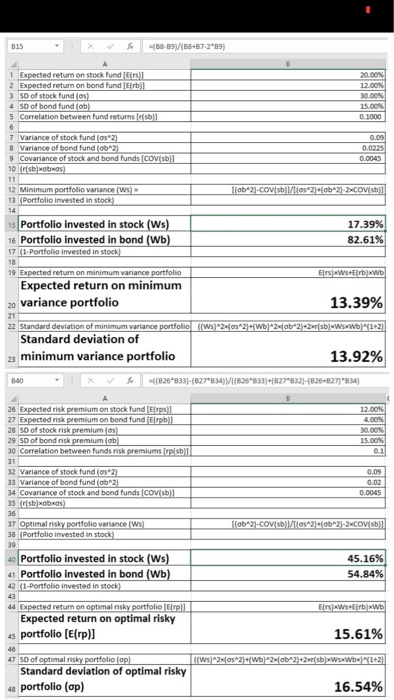

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a government bond fund and the third is a T-bll money market fund. The expected returns and standard deviations of the funds are: Expected returm Standard deviation 30% 20% 12% Stock fund (S) Bond fund (B) T-bill money market fund The correlation between the stock and bond fund is 0.10 a. What are the stock and bond weights in the minimum variance portfolio? b. What is the expected return and standard deviation of the minimum variance portfolio? c. What are the stock and bond weights in the optimal risky portfolio? d. What is the expected return and standard deviation of the optimal risky portfolio? e. Write down the equation of the capital allocation line (i.e., the line connecting the risk free rate to the optimal risky portfolio) f. If the pension manager has a risk aversion coefficient A-3.5, what fraction of the manager's wealth is it optimal to allocate to the optimal risky portfolio and what fraction will be invested in the risk free asset? g. If you invest in a portfolio on the capital allocation line that has an expected return of 14%, what is the portfolio's standard deviation? 8 9 1 Expected return on stock fund Ers)l 4 SD of bond fund(ob Variance of bond fund (ab 2) Covariance of stock and bond funds (Covsb 0.0045 10 2 Minimum portfollio variance(ws) Portfolio invested in stock (Ws) Portfolio invested in bond (Wb 17.39% 82.61% 7 (3-Portfolio invested in stock) 9 Expected return on minimum variance portfolio Expected return on minimum 20 variance portfolio 21 22 Standard deviation of minimum variance portfolio ((WS Pa osz rwbja2x rrr sbj wy bre 13.39% Standard deviation of minimum variance portfolio 13.92% B40 x((826 833-(827"834)VI(826 833)+(827 832)-(826+827)"834) 26 Expected risk premium on stock fund[Elrps) 28 5D of stock risk premium (as) 30 Correlation between funds risk premiumsrpsb)l 1200% 30.00% 32 Variance of stock fund fos 2) 33 Variance of bond fund ob 2) 34 Covariance of stock and bond funds Cov sbl 0.02 35 36 3 Optimal risky portfolio variance (ws 38 (Portfolio invested in stock 39 Portfolio invested in stock (Ws) 41 Portfolio invested in bond (Wb) 42 (1-Portfolio invested in stock) 45.16% 54.84% 44 Expected return on optimal risky portfolio [Elrp)l Expected return on optimal risky s portfolio [E(rp)] 15.61% Standard deviation of optimal risky portfolio (op) 16.54% A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a government bond fund and the third is a T-bll money market fund. The expected returns and standard deviations of the funds are: Expected returm Standard deviation 30% 20% 12% Stock fund (S) Bond fund (B) T-bill money market fund The correlation between the stock and bond fund is 0.10 a. What are the stock and bond weights in the minimum variance portfolio? b. What is the expected return and standard deviation of the minimum variance portfolio? c. What are the stock and bond weights in the optimal risky portfolio? d. What is the expected return and standard deviation of the optimal risky portfolio? e. Write down the equation of the capital allocation line (i.e., the line connecting the risk free rate to the optimal risky portfolio) f. If the pension manager has a risk aversion coefficient A-3.5, what fraction of the manager's wealth is it optimal to allocate to the optimal risky portfolio and what fraction will be invested in the risk free asset? g. If you invest in a portfolio on the capital allocation line that has an expected return of 14%, what is the portfolio's standard deviation? 8 9 1 Expected return on stock fund Ers)l 4 SD of bond fund(ob Variance of bond fund (ab 2) Covariance of stock and bond funds (Covsb 0.0045 10 2 Minimum portfollio variance(ws) Portfolio invested in stock (Ws) Portfolio invested in bond (Wb 17.39% 82.61% 7 (3-Portfolio invested in stock) 9 Expected return on minimum variance portfolio Expected return on minimum 20 variance portfolio 21 22 Standard deviation of minimum variance portfolio ((WS Pa osz rwbja2x rrr sbj wy bre 13.39% Standard deviation of minimum variance portfolio 13.92% B40 x((826 833-(827"834)VI(826 833)+(827 832)-(826+827)"834) 26 Expected risk premium on stock fund[Elrps) 28 5D of stock risk premium (as) 30 Correlation between funds risk premiumsrpsb)l 1200% 30.00% 32 Variance of stock fund fos 2) 33 Variance of bond fund ob 2) 34 Covariance of stock and bond funds Cov sbl 0.02 35 36 3 Optimal risky portfolio variance (ws 38 (Portfolio invested in stock 39 Portfolio invested in stock (Ws) 41 Portfolio invested in bond (Wb) 42 (1-Portfolio invested in stock) 45.16% 54.84% 44 Expected return on optimal risky portfolio [Elrp)l Expected return on optimal risky s portfolio [E(rp)] 15.61% Standard deviation of optimal risky portfolio (op) 16.54%