Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pleas show all work and fill out the table, thank you! 2.) A company is considering purchasing a new automated machine that is expected to

Pleas show all work and fill out the table, thank you!

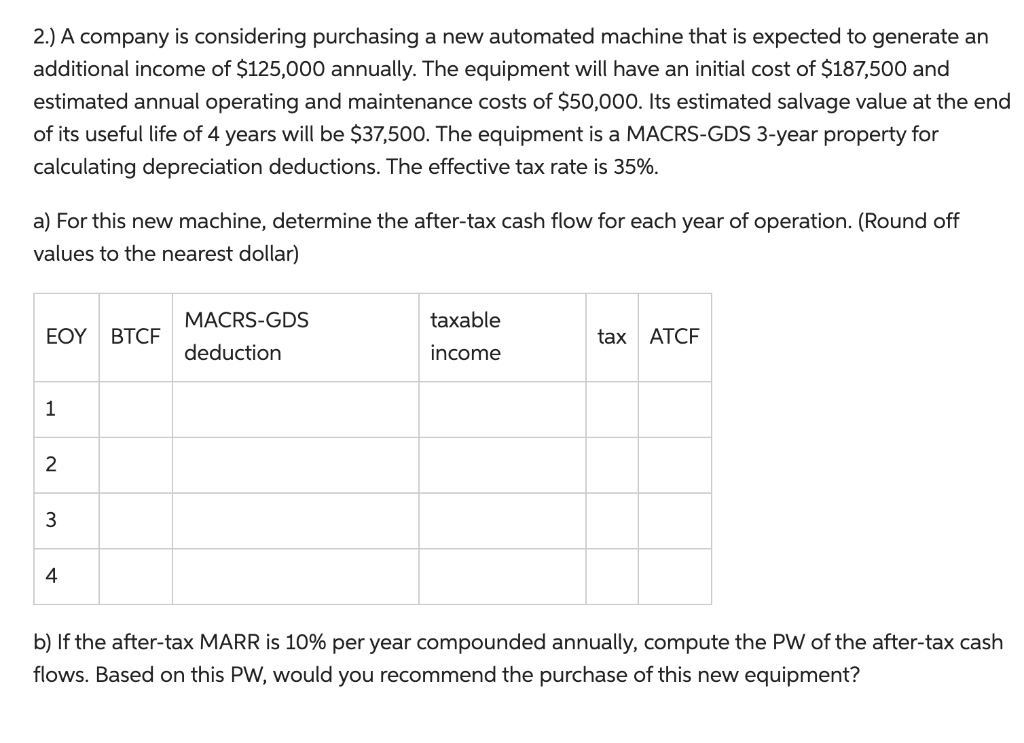

2.) A company is considering purchasing a new automated machine that is expected to generate an additional income of $125,000 annually. The equipment will have an initial cost of $187,500 and estimated annual operating and maintenance costs of $50,000. Its estimated salvage value at the end of its useful life of 4 years will be $37,500. The equipment is a MACRS-GDS 3-year property for calculating depreciation deductions. The effective tax rate is 35%. a) For this new machine, determine the after-tax cash flow for each year of operation. (Round off values to the nearest dollar) b) If the after-tax MARR is 10% per year compounded annually, compute the PW of the after-tax cash flows. Based on this PW, would you recommend the purchase of this new equipment? 2.) A company is considering purchasing a new automated machine that is expected to generate an additional income of $125,000 annually. The equipment will have an initial cost of $187,500 and estimated annual operating and maintenance costs of $50,000. Its estimated salvage value at the end of its useful life of 4 years will be $37,500. The equipment is a MACRS-GDS 3-year property for calculating depreciation deductions. The effective tax rate is 35%. a) For this new machine, determine the after-tax cash flow for each year of operation. (Round off values to the nearest dollar) b) If the after-tax MARR is 10% per year compounded annually, compute the PW of the after-tax cash flows. Based on this PW, would you recommend the purchase of this new equipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started