Answered step by step

Verified Expert Solution

Question

1 Approved Answer

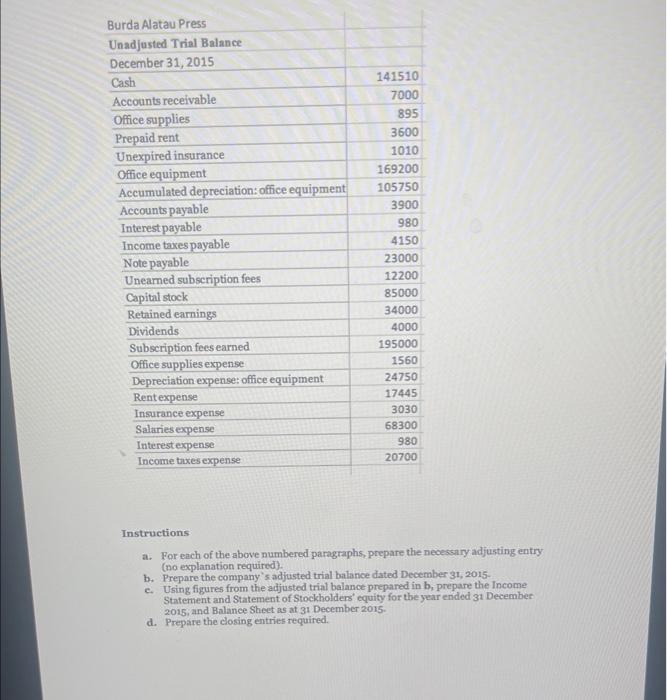

PLEASE #12,13!!! Burda Alatau Press is a publishing house based in Kazakhstan which is selling 28 different magazines on Kazakhstani market of which 24 are

PLEASE #12,13!!! Burda Alatau Press is a publishing house based in Kazakhstan which is selling 28 different magazines on Kazakhstani market of which 24 are purchased directly from its immediate parent company Burda Russia based in Russian Federation. Some clients pay subscription fees in advance for the magazines, others are billed after magazines have been delivered. Advance payments are credited to an account entitled Unearned Subscription Fees. Adjusting entries are performed on a monthly basis. An unadjusted trial balance dated December 31, 2015, follows. (Bear in mind that adjusting entries have already been made for the first 11 months of 2015, but not for December.)

Other Data

1. Burda Alatau Press invests some of its excess cash in certificates of deposit (CDs) with its local bank. Accrued interest revenue on its CDs at December 31 is $500. None of the interest has yet been received. (Debit Interest Receivable.)

2. Accrued but unrecorded subscription fees earned at December 31 amount to $6,250.

3. Records show that $5,500 of cash receipts originally recorded as Unearned

Subscription Fees had been earned as of December 31.

4. Office supplies on hand at December 31 amount to $115.

5. The company purchased all of its office equipment when it first began business. At

that time, the equipment`s estimated useful life was six years (or 72 months).

6. On October 1, 2015, the company renewed its rental agreement paying $1,800 cash

for six months rent in advance.

7. On March 1 of the current year, the company paid $4,140 cash to renew its 12-month

insurance policy.

8. Accrued but unrecorded salaries at December 31 amount to $5,760.

9. On 1 June 2015, the company borrowed money from the bank by signing a $34,200,

10 percent, 12-month note payable. The entire note, plus 12 months` accrued interest,

is due on May 31, 2016.

10. The company`s tax specialist estimates that income taxes expense for the entire year

is $25,450.

11. Additional $4,500 dividends have been declared with the payment planned to be

made in February 2016.

12. UnpaidutilitiesforthemonthofDecemberare$1,750.

13. OnNovember1,BurdaAlatauPresslent$10,000toBurdaKyrgyzstanon90-day

note earning 12% interest.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started