Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please add a long intro and long conclusion when put an answer write as i as a portifolio manager i prefer .. every single

please add a long intro and long conclusion

when put an answer write as "i" " as a portifolio manager i prefer .."

every single information is included

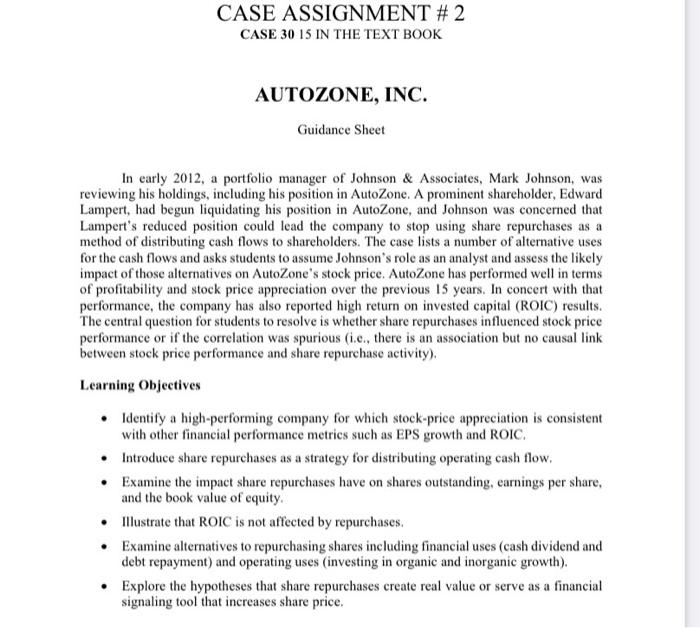

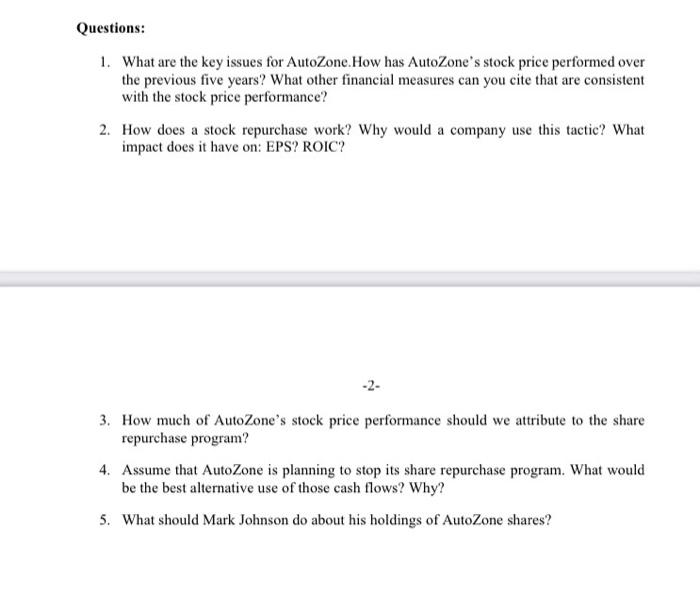

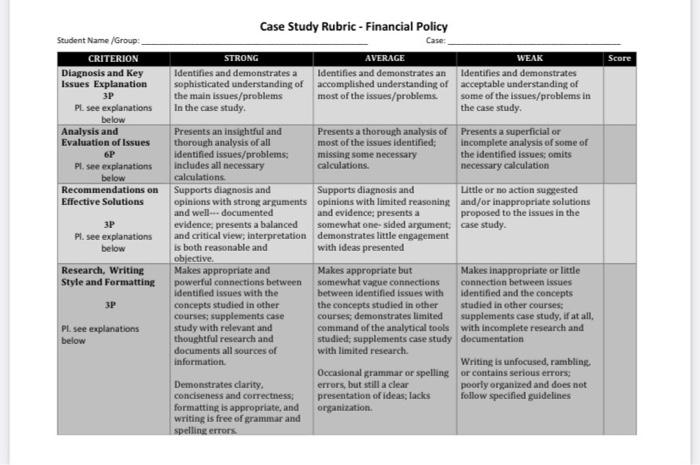

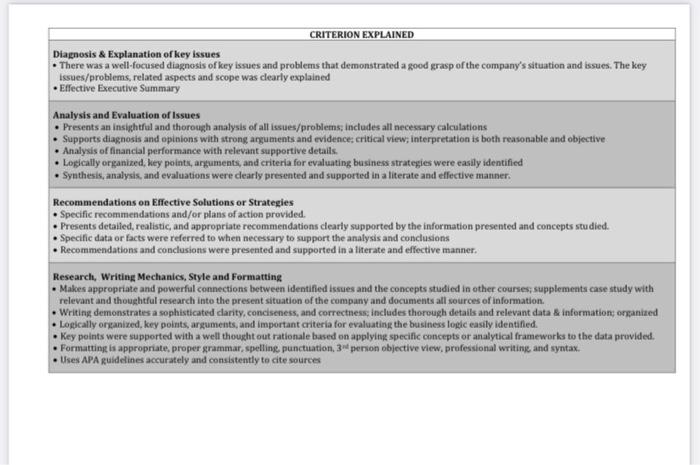

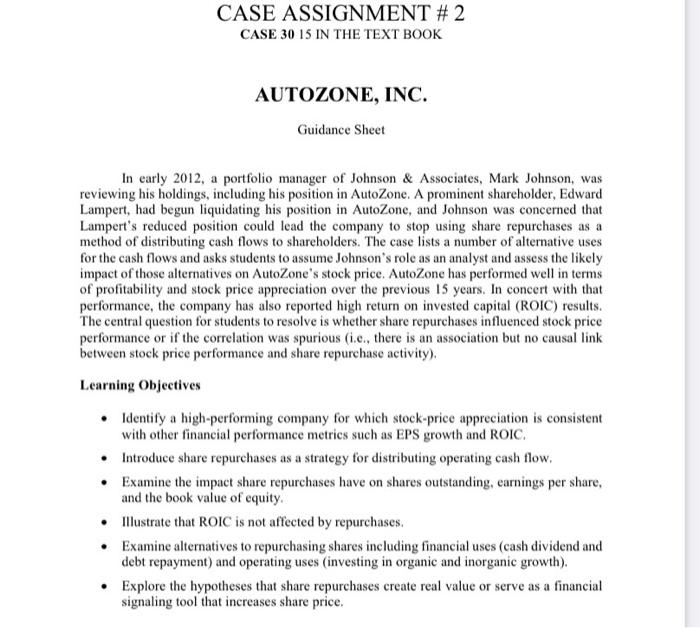

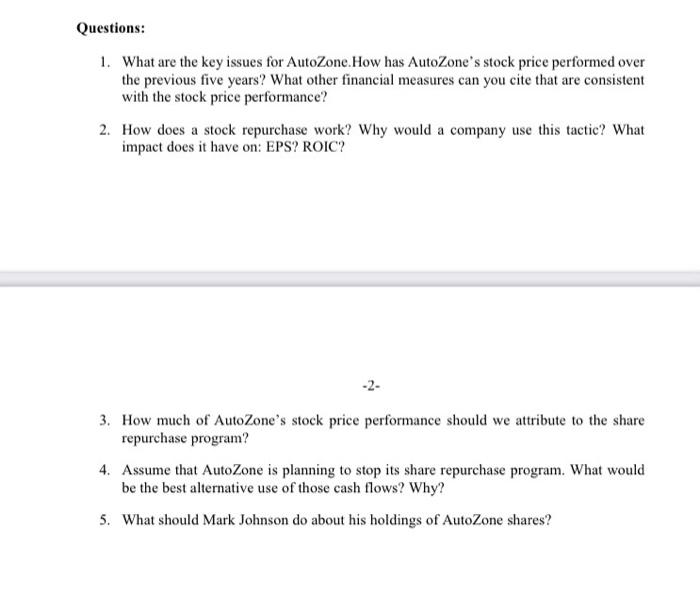

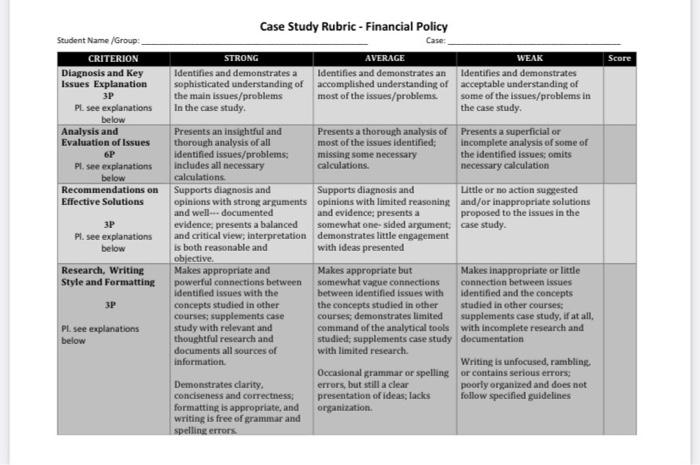

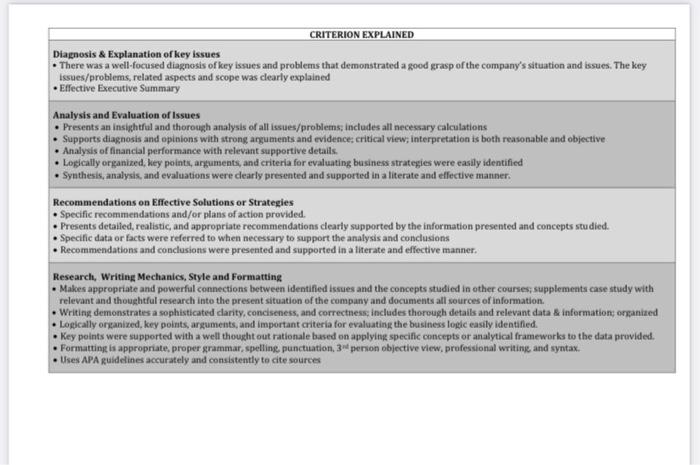

In early 2012, a portfolio manager of Johnson \& Associates, Mark Johnson, was reviewing his holdings, including his position in AutoZone. A prominent shareholder, Edward Lampert, had begun liquidating his position in AutoZone, and Johnson was concerned that Lampert's reduced position could lead the company to stop using share repurchases as a method of distributing cash flows to shareholders. The case lists a number of alternative uses for the cash flows and asks students to assume Johnson's role as an analyst and assess the likely impact of those alternatives on AutoZone's stock price. AutoZone has performed well in terms of profitability and stock price appreciation over the previous 15 years. In concert with that performance, the company has also reported high return on invested capital (ROIC) results. The central question for students to resolve is whether share repurchases influenced stock price performance or if the correlation was spurious (i.e., there is an association but no causal link between stock price performance and share repurchase activity). Learning Objectives - Identify a high-performing company for which stock-price appreciation is consistent with other financial performance metrics such as EPS growth and ROIC. - Introduce share repurchases as a strategy for distributing operating cash flow. - Examine the impact share repurchases have on shares outstanding, earnings per share, and the book value of equity. - Illustrate that ROIC is not affected by repurchases. - Examine alternatives to repurchasing shares including financial uses (cash dividend and debt repayment) and operating uses (investing in organic and inorganic growth). - Explore the hypotheses that share repurchases create real value or serve as a financial signaling tool that increases share price. 1. What are the key issues for AutoZone.How has AutoZone's stock price performed over the previous five years? What other financial measures can you cite that are consistent with the stock price performance? 2. How does a stock repurchase work? Why would a company use this tactic? What impact does it have on: EPS? ROIC? 2 3. How much of AutoZone's stock price performance should we attribute to the share repurchase program? 4. Assume that AutoZone is planning to stop its share repurchase program. What would be the best alternative use of those cash flows? Why? 5. What should Mark Johnson do about his holdings of AutoZone shares? Case Study Rubric - Financial Policy Diagnosis \& Explanation of key issues - There was a well-focused diagnosis of key issues and problems that demonstrated a good grasp of the company's situation and issues. The key issues/problems, related aspects and scope was dearly explained - Effective Executive Summary Analysis and Evaluation of Issues - Presents an insightful and thorough analysis of all issues/problems, includes all necessary calculations - Supports diagnosis and opinions with strong arguments and evidence: critical view; interpretation is both reasonable and objective - Analysis of financial performance with relevant supportive details. - Logically organized, key points, anguments, and criteria for evaluating business strategies were easily identified - Synthesis, analysis, and evaluations were dearly presented and supported in a literate and effective manner. Recommendations on Effective Solutions or Strategies - Specific recommendations and/or plans of action provided. - Presents detalied, realistic, and appropriate recommendations dearly supported by the information presented and concepts studied. - Specific data or facts were referred to when necessary to support the analysis and conclusions - Recommendations and conclusions were presented and supported in a literate and effective manner. Research, Writing Mechanies, Style and Formatting - Makes appropriate and powerful connections between identified issues and the concepts studied in other courses; supplements case study with relevant and thouehtful research into the present situation of the company and documents all sources of information. - Writing demonstrates a sophisticated darity, conciseness, and correctiess includes thorough details and relevant data s information; organiaed - Logically organized, key points, arguments, and important criteria for evaluating the business logic easily identified. - Key points were supported with a well thought out rationale based on applying specific concepts or analytical frameworks to the data provided. - Formatting is appropriate, proper grammar, spellinge punctiation, 3st perion objective view, profesional writing and syntax. - Uses APA guidelines accurately and consistently to cite sources Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started