Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please add an explanation to answers, thank you! 10. Davis Co. purchased equipment on January 2, 20X4 for $100,000. The equipment's estimated life is 3

Please add an explanation to answers, thank you!

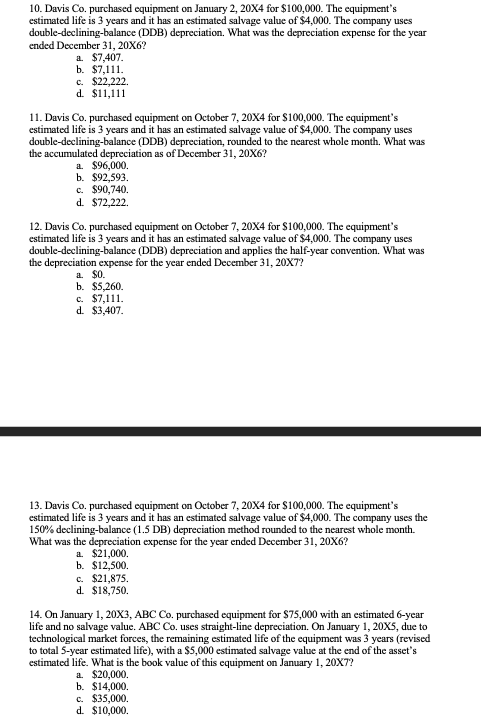

10. Davis Co. purchased equipment on January 2, 20X4 for $100,000. The equipment's estimated life is 3 years and it has an estimated salvage value of $4,000. The company uses double-declining-balance (DDB) depreciation. What was the depreciation expense for the year ended December 31, 20X6? a. $7,407. b. $7,111. c. $22.222 d. $11,111 11. Davis Co. purchased equipment on October 7, 20X4 for $100,000. The equipment's estimated life is 3 years and it has an estimated salvage value of $4,000. The company uses double-declining-balance (DDB) depreciation, rounded to the nearest whole month. What was the accumulated depreciation as of December 31, 20X6? a $96,000 b. $92,593 c. $90,740. d. $72,222. 12. Davis Co. purchased equipment on October 7, 20X4 for $100,000. The equipment's estimated life is 3 years and it has an estimated salvage value of $4,000. The company uses double-declining-balance (DDB) depreciation and applies the half-year convention. What was the depreciation expense for the year ended December 31, 20X7? a. So. b. $5,260. c. $7,111. d. $3,407 13. Davis Co, purchased equipment on October 7, 20X4 for $100,000. The equipment's estimated life is 3 years and it has an estimated salvage value of $4,000. The company uses the 150% declining-balance (1.5 DB) depreciation method rounded to the nearest whole month. What was the depreciation expense for the year ended December 31, 20X6? a. $21,000. b. $12,500. c. $21,875. d. $18,750. 14. On January 1, 20X3, ABC Co. purchased equipment for $75,000 with an estimated 6-year life and no salvage value. ABC Co. uses straight-line depreciation. On January 1, 20X5, due to technological market forces, the remaining estimated life of the equipment was 3 years (revised to total 5-year estimated life), with a $5,000 estimated salvage value at the end of the asset's estimated life. What is the book value of this equipment on January 1, 20X7? a $20,000 b. $14,000. c. $35,000. d. $10,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started