Answered step by step

Verified Expert Solution

Question

1 Approved Answer

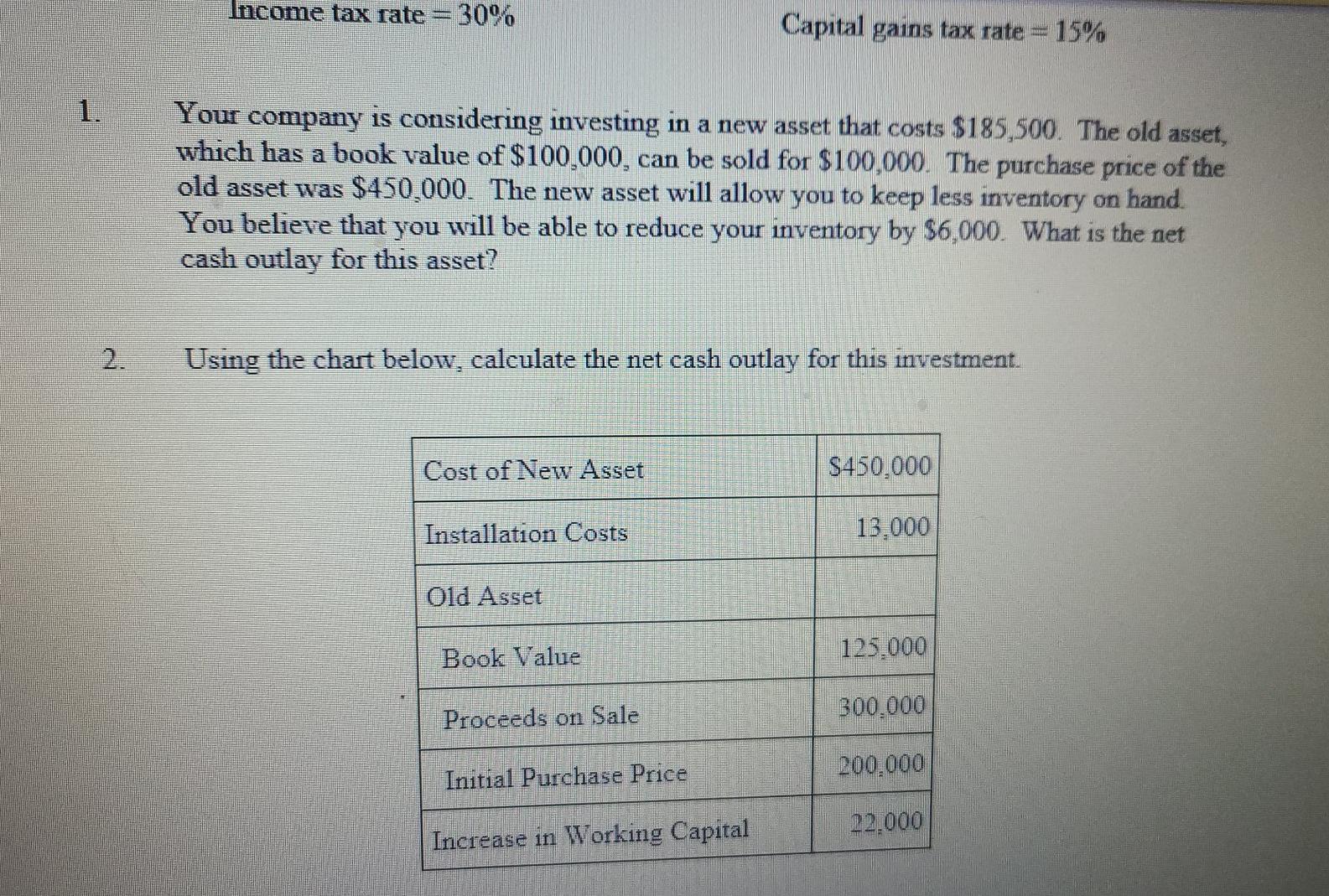

please add formulas. thank you Income tax rate = 30% Capital gains tax rate = 15% Your company is considering investing in a new asset

please add formulas. thank you

Income tax rate = 30% Capital gains tax rate = 15% Your company is considering investing in a new asset that costs $185,500. The old asset, which has a book value of $100,000, can be sold for $100,000. The purchase price of the old asset was $450,000. The new asset will allow you to keep less inventory on hand You believe that you will be able to reduce your inventory by $6,000. What is the net cash outlay for this asset? 2 Using the chart below, calculate the net cash outlay for this investment. Cost of New Asset $450,000 Installation Costs 13,000 Old Asset Book Value 125.000 Proceeds on Sale 300.000 200.000 Initial Purchase Price 22.000 Increase in Working CapitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started