Answered step by step

Verified Expert Solution

Question

1 Approved Answer

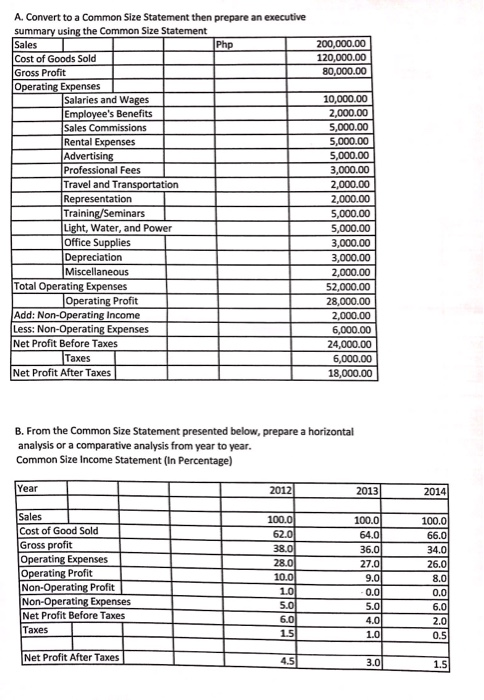

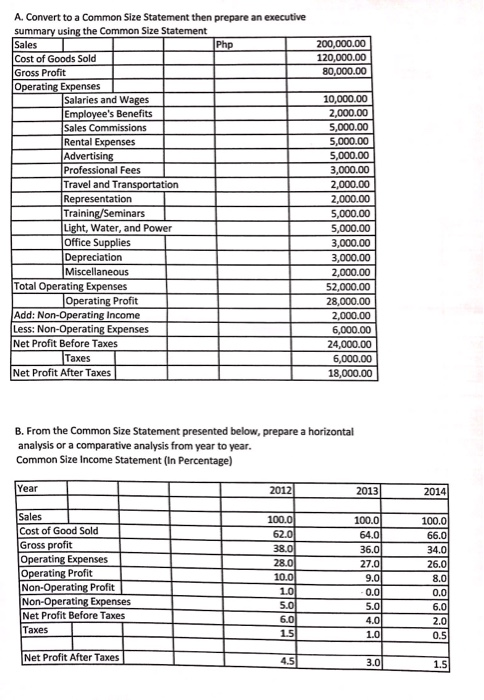

Please add the computation and explanation. Thank you! A. Convert to a Common Size Statement then prepare an executive summary using the Common Size Statement

Please add the computation and explanation. Thank you!

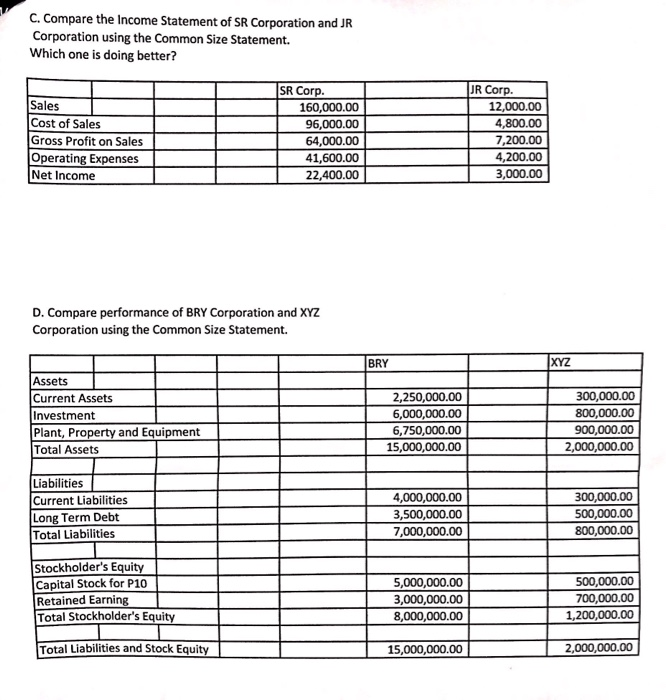

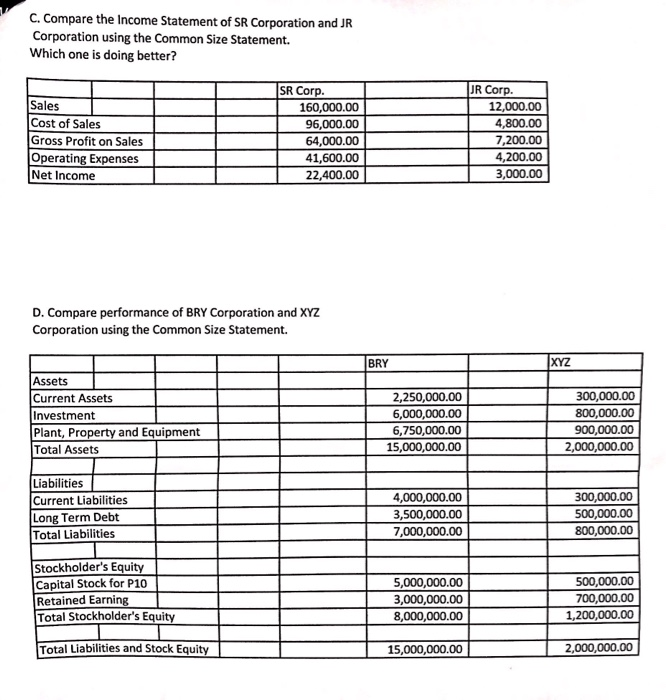

A. Convert to a Common Size Statement then prepare an executive summary using the Common Size Statement Sales Cost of Goods Sold Gross Profit Operating Expenses Php 200,000.00 120,000.00 80,000.00 10,000.00 Salaries and Wages Employee's Benefits Sales Commissions Rental Expenses Advertising Professional Fees Travel and Transportation Representation Training/Seminars Light, Water, and Power Office Supplies Depreciation Miscellaneous Total Operating Expenses Operating Profit Add: Non-Operating Income Less: Non-Operating Expenses Net Profit Before Taxes Taxes 2,000.00 5,000.00 5,000.00 5,000.00 3,000.00 2,000.00 2,000.00 5,000.00 5,000.00 3,000.00 3,000.00 2,000.00 52,000.00 28,000.00 2,000.00 6,000.00 24,000.00 6,000.00 Net Profit After Taxes 18,000.00 B. From the Common Size Statement presented below, prepare a horizontal analysis or a comparative analysis from year to year. Common Size Income Statement (In Percentage) Year 2012 2014 2013 Sales 100.0 62.0 100.0 66.0 100.0 Cost of Good Sold 64.0 Gross profit Operating Expenses Operating Profit Non-Operating Profit Non-Operating Expenses Net Profit Before Taxes Taxes 38.0 36.0 34.0 28.0 27.0 26.0 10.0 9.0 8.0 0.0 1.0 5.0 0.0 5.0 6.0 6.0 4.0 2.0 1.5 1.0 0.5 Net Profit After Taxes 4.5 3.0 1.5 C. Compare the Income Statement of SR Corporation and JR Corporation using the Common Size Statement Which one is doing better? SR Corp. 160,000.00 JR Corp. Sales 12,000.00 Cost of Sales 96,000.00 64,000.00 41,600.00 22,400.00 4,800.00 7,200.00 4,200.00 3,000.00 Gross Profit on Sales Operating Expenses Net Income D. Compare performance of BRY Corporation and XYZ Corporation using the Common Size Statement. BRY XYZ Assets 2,250,000.00 300,000.00 800,000.00 900,000.00 2,000,000.00 Current Assets Investment 6,000,000.00 Plant, Property and Equipment Total Assets 6,750,000.00 15,000,000.00 Liabilities 4,000,000.00 3,500,000.00 7,000,000.00 300,000.00 500,000.00 800,000.00 Current Liabilities Long Term Debt Total Liabilities Stockholder's Equity Capital Stock for P10 500,000.00 700,000.00 1,200,000.00 5,000,000.00 3,000,000.00 Retained Earning Total Stockholder's Equity 8,000,000.00 2,000,000.00 Total Liabilities and Stock Equity 15,000,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started