Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please add the name of person in the question before the answer to avoid confusing thankyou. 1 Sam and Jan's insurer requires advisors to be

please add the name of person in the question before the answer to avoid confusing thankyou.

1 Sam and Jan's insurer requires advisors to be mutual fund licenced to sell segregated funds. Sam just received his mutual fund licence and Jan has had hers for about a year. They often help each other by su another despite who is acting on the behalf of the insured. How will the insurer handle this situation?

a. O

Ask Jan and Sam to form a formal partnership so that they can continue working with each other.

b. O Request that Jan and Sam stop working together immediately until they have a formal agreement to share commissions and business.

c. O Use Jan's behaviour as an example of misconduct for disclosure.

d. O Approve Jan and Sam's partnership and their willingness to support each other in their businesses.

2 Kelly's life insurance policy is up for renewal and her advisor, Dan, calls to make an appointment with her. Dan explains over the phone that the best option is to apply for a new policy so that she can get a lover price than the rene rate. He also says that with her application, he will get a commission when the policy is approved. She is glad that she will be able to save some money and makes the appointment to apply for the new policy Has Dan acted objectively?

a. No. Dan should only make a recommendation when he knows what Kelly's needs are and which product is best for her.

b. O Yes. Although he is getting a commission from the renewal, the new policy will be cheaper for Kelly and they will both benefit.

c. O No. He should not recommend a new policy since he is getting a commission when she can just renew her current policy.

d. O Yes. He is putting Kelly's interests first by recommending a policy that will save her money.

3 Caroline recently met with a client, Jeff, who put her in an uncomfortable situation. Jeff owns a car dealership and will only give Caroline his insurance business if she refers her dients to him. The commission Caroline will receive his business is substantial, but she is unsure whether she should refer her clients to him. What might help Caroline make a decision?

a. O Setting up a written contract with the client so that she is protected if her clients are not happy.

b.

Reviewing her options and speaking with her supervisor to make sure she is following the regulator's rules.

c O

Explaining to her clients that insurance regulators do not allow referrals to unlicensed individuals and encourage him to get a licence

d. O Setting up a percentage of commission for each client she refers to his business so that she earns a commission in both places.

4 Neville meets with his client, Raymond, to complete an insurance application. They meet in the evening at Raymond's home and before starting the application, they have a chat over a beer. Raymond states that he goes month on a winery tour and often has such a good time that he does not always remember the experience. After their beer. Neville completes the insurance application. What should Neville keep in mind while sulmiting the applicatis

a. Raymond is now a friend and client and Neville needs to make sure that he does not share confidential information with him.

b. O Neville should make sure that he collects the premium for the application and submits everything together.

C. Raymond trusted Neville when sharing personal information about his life and this information should be kept confidential.

d. Neville is representing the insurer and is obligated to share the information about Raymond's drinking weekends.

5 Kieran completes an analysis for his new client. He has three options for coverage that each meet at Least some of the client's objectives. The most expensive policy matches all the client's objectives and Kieran will earn the highest commission from it. What should be his next step?

A. The amount of commission Kieran earns should not affect his recommendation.

b. Kieran should recommend the most affordable option that will meet his client's needs.

c. Kieran should tell the client that he will earn a higher commission from the most expensive option.

d. The client's budget should be taken into account before making a recommendation.

6 Kira meets with a client and completes an insurance application. She had highlighted each space in the application that needed a client signature, but when she gets home, she finds one space blank. Kira calls the dient and explains that they missed a signature. The client gives Kira permission to sign on their behalf and verbally confirms they understand the section of the application they have not signed. What should Kira do?

a. O Ask her manager to witness the client's verbal approval to sign the document on their behalf so that the client cannot later say their permission was not given.

b.O Make an appointment with the client to get their signature and maintain her integrity.

c. O Sign and submit on the client's behalf so the application is not delayed and make an appointment with the client to sign a form to confirm their permission later.

d. O Follow the principle of diligence and sign the document as her client entrusted her to do.

7. Felicia has been an insurance agent for several years. In her spare time she makes jewelry as gifts for her friends and family. She also donates some of the items she makes to the local hospital which sells the jewelry to supp hildren. Felicia should:

a. O Notify the regulator of her jewelry making activities immediately.

b. O Submit a request for review of her jewelry making activities to the regulator.

c. O Continue with her jewelry hobby. No notification is required.

d. Cease her jewelry hobby. Existing licensees cannot have any outside activities.

8 As a financial advisor, Damian is often on the road. He drives to his clients' houses for their appointments and brings his clients' files with him. Damian often works very late and does not go back to the office after his appointmen done. He usually has his clients' files with him when he goes home. What should he do with the clients' files?

a. O Keep a locked filing cabinet at his home to keep the files in.

b. Put the client files into his locked trunk so they cannot be seen.

c. O Leave the files separate and organized in his locked car.

d. Take the files into his home and keep them safe and out of sight until he returns to the office.

9. Sariq collects premiums from his clients on a Friday and is unable to get to the financial centre to submit the funds. He keeps the money separately from his own in his car with the intention to submit it first thing the following Monday morning. Over the weekend, he goes on a trip with his family and has trouble with his car. He needs to use the money he collected on Friday to fix his car, but has enough money in his own bank account to sover his dients premiums, which he will do on Monday before work. Has Sarig acted ethically?

A No. Sariq needed to first contact his clients to gain permission before using the premium money for his own personal use.

b. Yes. Sarig is replacing the premiums on Monday with his own money and so there will be no issue since the premiums will be paid in full.

c.O Yes. As long as Sarig acts in the best interests of his clients and himself, there is not an issue.

d. O No. The clients trust Sariq and he should not use premium money for his own personal needs.

10 Desmond is very busy and has decided to give some of his younger clients to a junior insurance advisor. He has provided the junior advisor a list of clients that he believes will be a good fit and asked the junior advisor to contact each client and set up an appointment to introduce herself. What must Desmond do to ensure that he is dealing with his clients in the best way possible?

a. O Make sure the junior insurance advisor has all the relevant information on the clients.

b.Provide the clients with adequate notice of his intention to withdraw and transfer them to another advisor.

c. O Attend the client meetings with the junior advisor so that he can make sure that they know he has withdrawn his services.

d. Work with the junior insurance advisor to make sure that his clients are correctly advised rather than withdrawing his services.

11.Jimmy works as an insurance advisor and property developer in Sherbrooke. He meets with new insurance clients in one of the areas he is developing. While disclosing their financial assets, the clients say that they are interested in purchasing a property in the new development area. Jimmy says he thinks the development will be very profitable. The couple agrees that it will be a good investment and let him know that they will keep him updated so their insurance needs can be adjusted. Jimmy sets a date to complete their insurance application. Has Jimmy followed best practices when dealing with his clients?

a. Yes. By advising his clients of potential investment opportunities, Jimmy is following best practices by acting with integrity, competence and the utmost faith.

b.O No. Jimmy has not disclosed the conflict of interest or maintained objectivity by encouraging his clients to invest in the property he is developing.

c. O Yes. Jimmy has properly gathered all the financial information as well as his client's financial goals to evaluate their needs.

d. O No. Jimmy has not made a recommendation for insurance before setting up the appointment to fill out an insurance application.

12 Elizabeth sends in an insurance application for her client and receives notification there will be a rating on the policy. Based on conversations with the client, she knows that the dient really needs the coverage and increase in premium. The insurance company requests that Elizabeth gives them approval for the changes on the insurance plan by the end of the day and the client is out of town. Elizabeth should:

a. O Ask the insurance company to reduce the death benefit so that the premiums do not increase.

b.O Send approval immediately and discuss the details with the client when they return.

c. Call the insurance company and request an extension for the approval until her client is back in town.

d. Email the client with the changes and send approval to the insurance company so the client does not lose their coverage.

13. Gus is starting a new insurance practice and would like to make sure that he is honestly representing himself and his services. In which situation would Gus be making an error with his promotional

a. Distributing flyers to the community offering his services and listing the products that he provides.

b. O Adding his recently-acquired (FP designation and "Financial Planner" to his business cards.

c. O Putting up a sign outside his office naming his new practice, "Gus Insurers and Associates".

d. O Putting a sign in the window of the office listing areas of specific expertise that Gus specializes in.

14. Caras clients, Emily and Dave, have just had a baby and she would like to do something nice for them. She signs them up for a baby registry that sends them a geared toward helping new parents. She provided their names, address and phone numbers so that they will not miss any of the activities provided in the package

a. O Cara did not protect her clients' privacy when she shared their personal information with the baby registry.

b.O

Cara should not make this a regular practice. Her clients will begin to expect gifts and she will not be able to sustain this.

c.O

Cara should have set up an appointment to re-evaluate her clients' needs now that they have had a baby.

d. O Cara's gift is very thoughtful and will help to build a relationship with her clients.

15. Carol shares an office with an accountant. They want to make sure that their clients have privacy while discussing their finances, and so they alternate days and times and are never there at the same time. They both keep their files abeled cabinets and the office has a locked door to ensure their client files remain confidential Carol and the accountant also have a referral agreement when their dients need each other's services. What should Carol be concerned al

a. O By sharing offices, she is not maintaining diligence or reliability. Advisors need to have their own offices to speak with clients.

b.O By referring clients to the accountant, she is not maintaining their confidentiality.

c. O She should not be sharing an office with anyone outside of the insurance industry.

d. O She is not protecting her clients' confidentially by locking their files in a secure location.

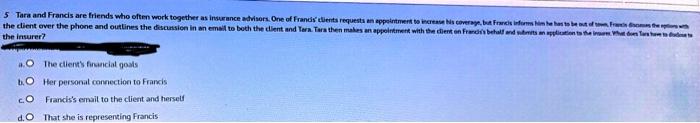

16. 5 Tara and Francis are friends who often work together as insurance advisors. One of Francis' clients requests an appointment to increase his coverage, but Francis informs him he has to be out af town. Francis discusses the eptiers with the client over the phone and outlines the discussion in an email to both the client and Tara. Tara then makes an appointment with the client on Francis's behalf and submits an application to the insurer. What does Tara have to disclose to the insurer?

a. O The client's financial goals

b.O Her personal connection to Francis

c. O Francis's email to the client and herself

d.O That she is representing Francis

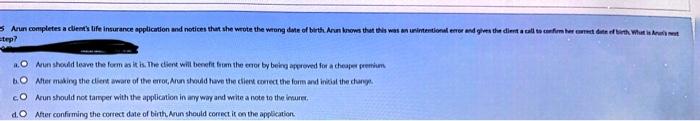

17. Arun completes a client's life insurance application and notices that she wrote the wrong date of birth. Arun knows that this was an unintentional error and give the client a call to confirm her actual birth date. What is aruns nest step?

a.O Arun should leave the form as it is. The client will benefit from the error by being approved for a cheaper premium.

b. After making the client aware of the error, Arun should have the client correct the form and initial the change.

cO Arun should not tamper with the application in any way and write a note to the insurer. dO After confirming the correct date of birth, Arun should correct it on the application.

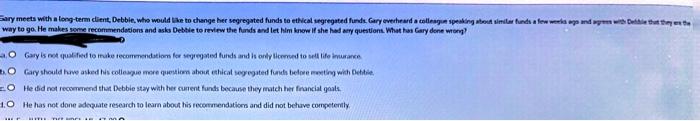

18. Sary meets with a long-term client, Debbie, who would like to change her segregated funds to ethical segregated funds. Gary overheard a colleague speaking about similar funds a few weeks ago and agrees with Debbie that they are the way to go. He makes some recommendations and asks Debbie to review the funds and let him know if she had any questions. What has Gary done wrong?

a. Gary is not qualified to make recommendations for segregated funds and is only licensed to sell life insurance.

b.O Gary should have asked his colleague more questions about ethical segregated funds before meeting with Debbie.

C. O He did not recommend that Debbie stay with her current funds because they match her financial goals.

D. O He has not done adequate research to learn about his recommendations and did not behave competently.

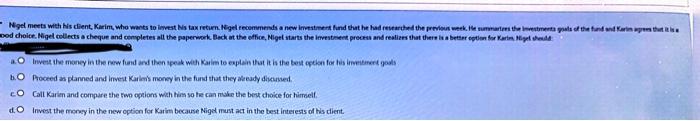

19. Nigel meets with his client, Karim, who wants to invest his tax return. Nigel recommends a new investment fund that he had researched the previous week. He summarizes the investments goals of the fund and Karim agrees that it is a good choice. Nigel collects a cheque and completes all the paperwork. Back at the office, Nigel starts the investment process and realizes that there is a better option for Karim. Nigel should:

a. O Invest the money in the new fund and then speak with Karim to explain that it is the best option for his investment goals

b.O Proceed as planned and invest Karim's money in the fund that they already discussed.

c.O Call Karim and compare the two options with him so he can make the best choice for himself.

d. O Invest the money in the new option for Karim because Nigel must act in the best interests of his client.

20. Daru meets with Saniya, a new business owner, who is worried about expenses. Daru presents her with two options that meet her needs, one with a slightly higher commission for himself. Daru recommends the more expensive policy and says to Saniya that while it might be more costly now, it will be worth it in the long run. How should Daru's actions be assessed?

a. O Daru is helping his client and building a relationship with her.

b. O Daru is giving Saniya objective advice by encouraging her to get a policy that meets her needs in the long run.

c. O Daru should not encourage Saniya to buy a policy just because it gives him a higher commission.

d. O Daru is not recommending the best policy for Saniya because it does not meet her needs.

21. Adisa hears that Cayman, another insurance advisor, has been upselling his clients on their insurance policies. She does not feel comfortable with this practice. When she meets with clients who know Cayman, she decides to tell them about the upselling. Based on Adisa's actions, the regulator will:

a. O Agree she should warn clients that other advisors are acting unethically.

b. O Request a formal complaint from Adisa, with proof of Cayman's behaviour.

cO Tell her not to discredit another advisor.

DO Ask her to take over Cayman's clients.

22. Saran meets with his insurance advisor and purchases a policy that he feels is a very good investment. He immediately calls his brother and sister to explain the details of the policy and suggests they call his advisor to set up the same policy for themselves. Both siblings call and follow Saran's advice. Will Saran receive a referral fee for his brother and sister?

a. O No. Saran discussed the benefits of the product and made a recommendation.

b.O Yes. As long as his advisor explains Saran will receive a referral fee before their purchase.

cO No. Saran's advisor did not explain the referral fee rules.

d. O Yes. Saran followed the referral fee rules.

23.Samuel is starting a new insurance practice and recently sent flyers to the local community. He is excited because many people in the community are underinsured and he will be able to make a lot of sales How can Samuel maintain his objectivity?

a. O Samuel must list all the services he provides, not just the ones that he prefers, so that his clients understand what is available to them.

b. O Samuel must disclose his services and qualifications as a financial planner and insurance agent.

cO Samuel needs to make sure that his clients are not at a disadvantage due to their inexperience with insurance.

dO Samuel needs to make sure that his new practice has a secure place to keep his clients information confidential

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started