Please ADD to the solutions given

THESE ARE THE SOLUTIONS TO AR9 THAT NEED TO BE ADJUSTED WITH THE NEW INFORMATION

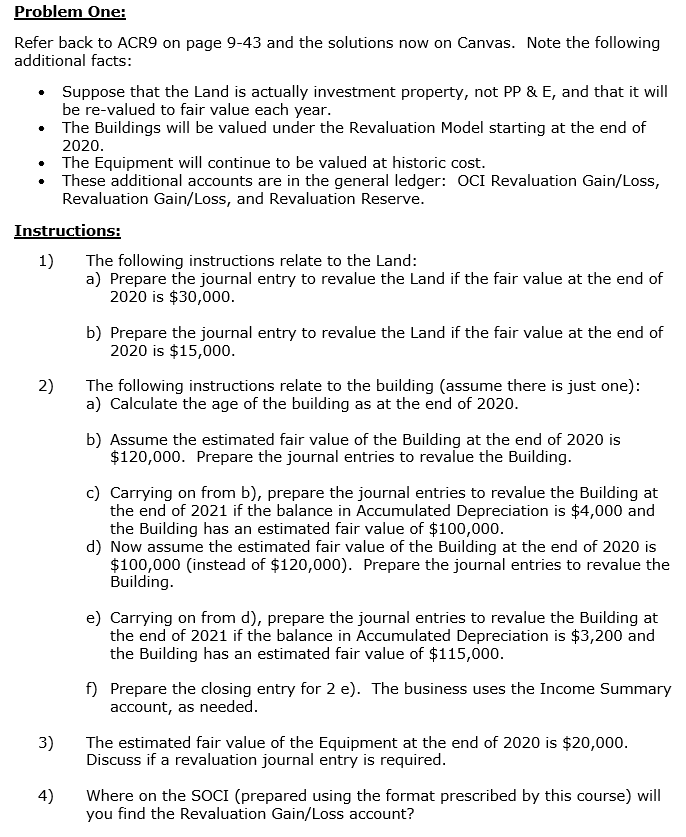

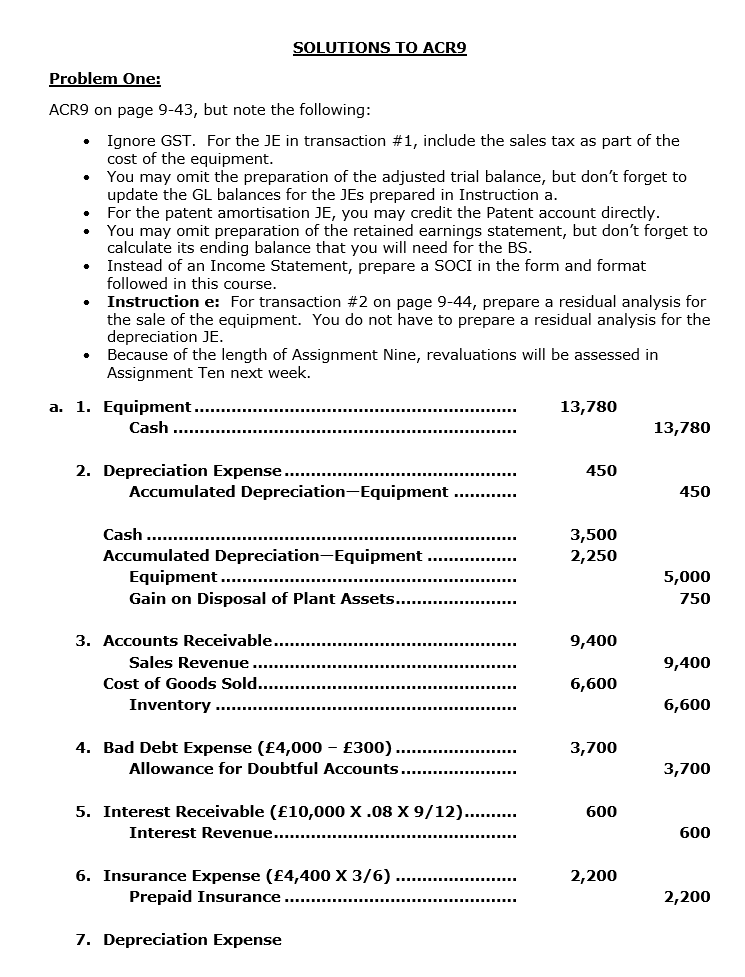

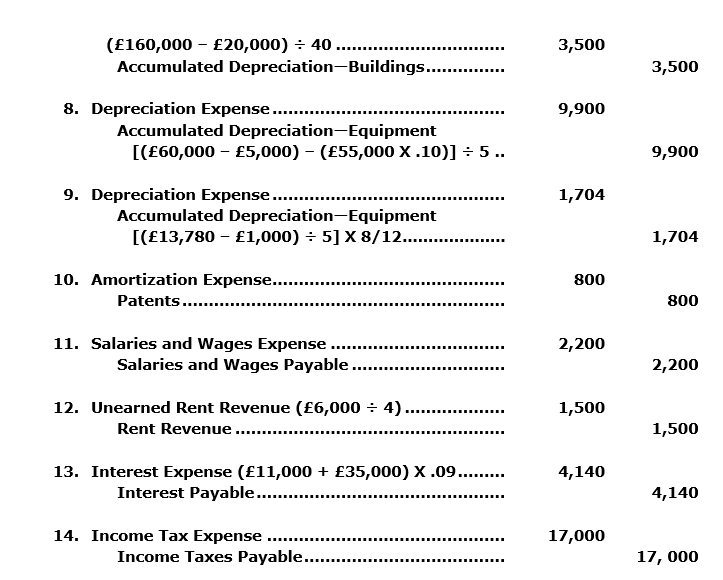

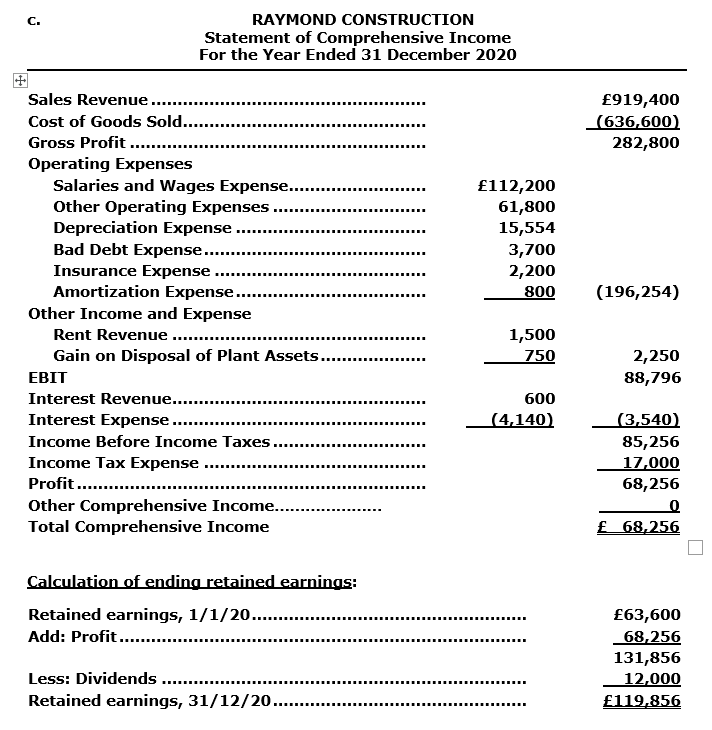

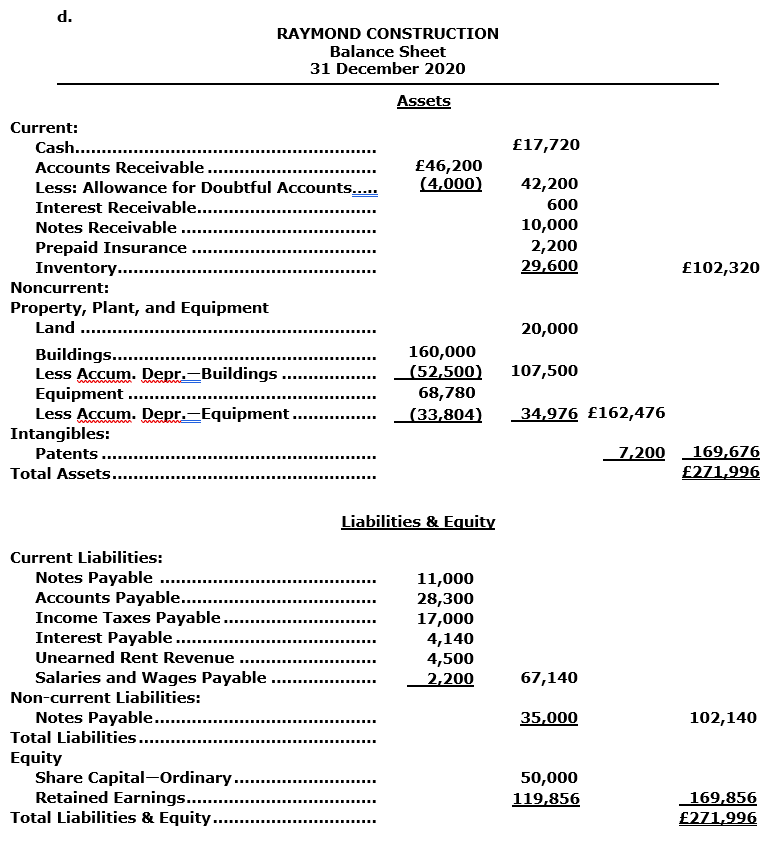

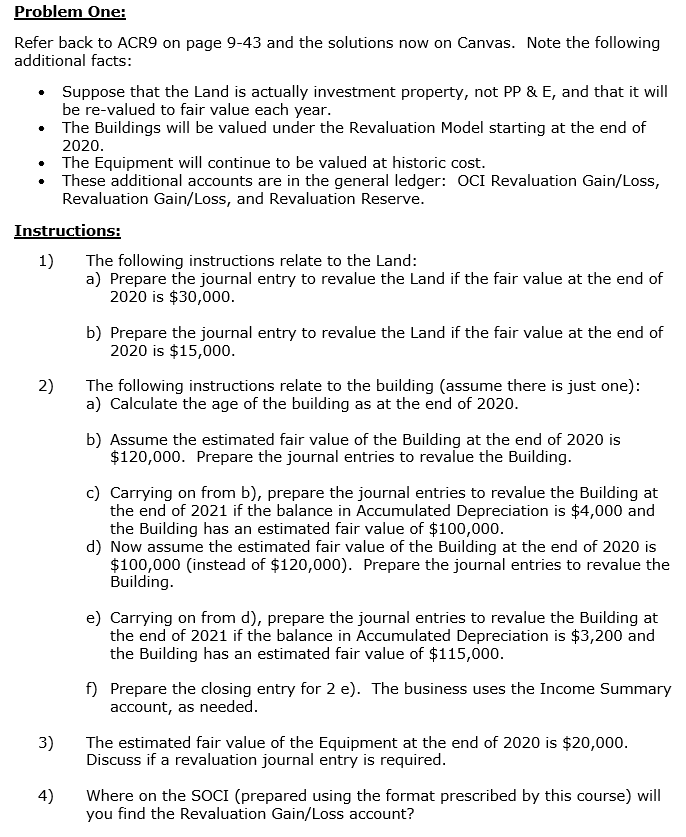

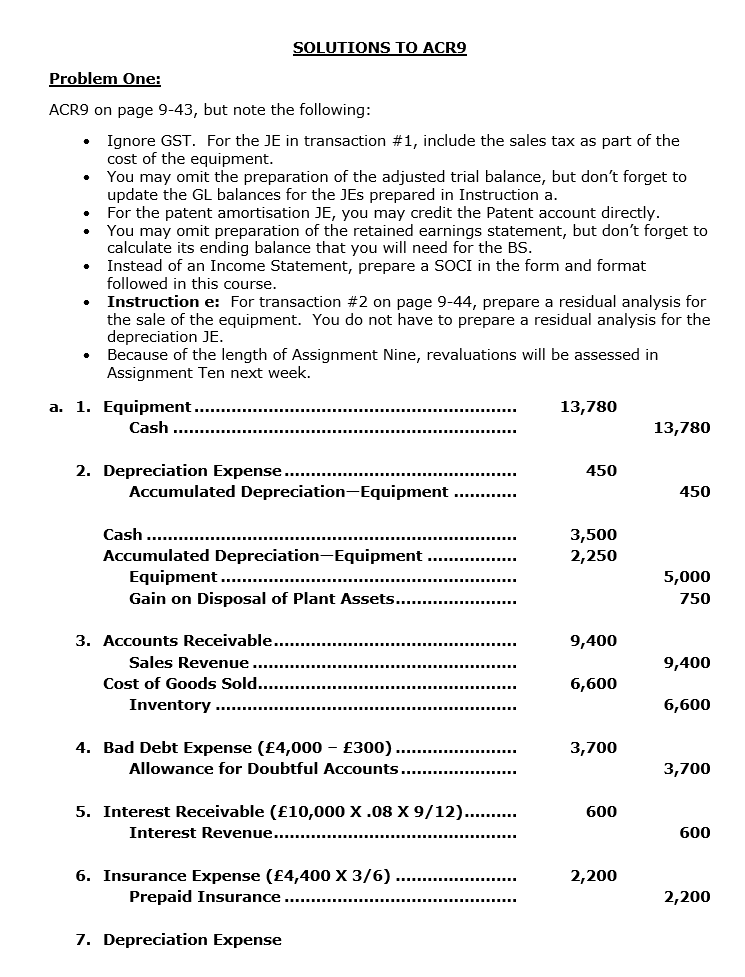

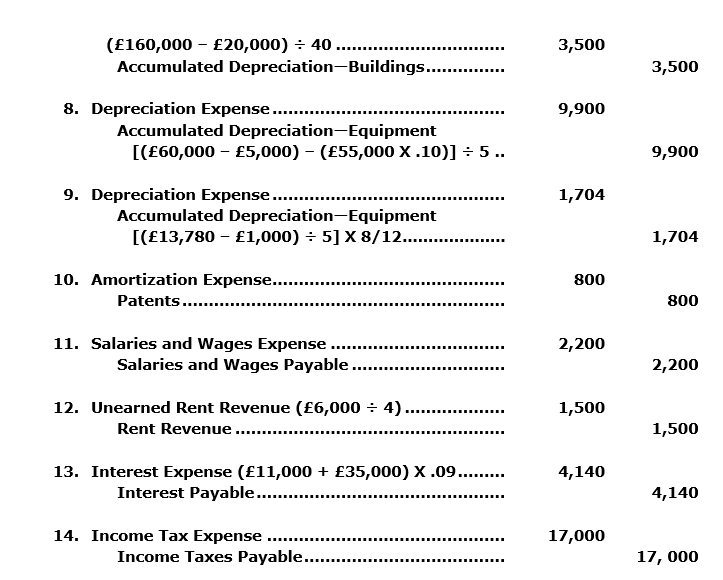

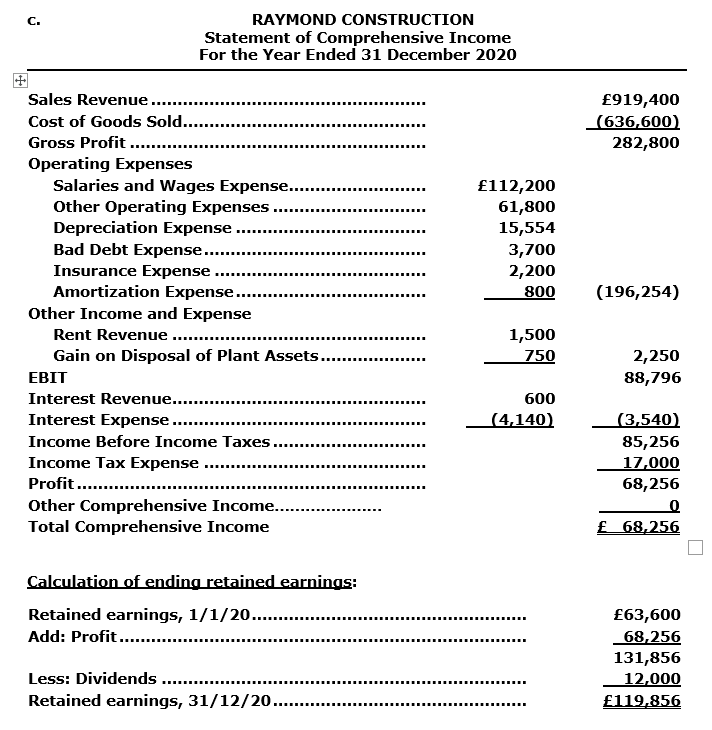

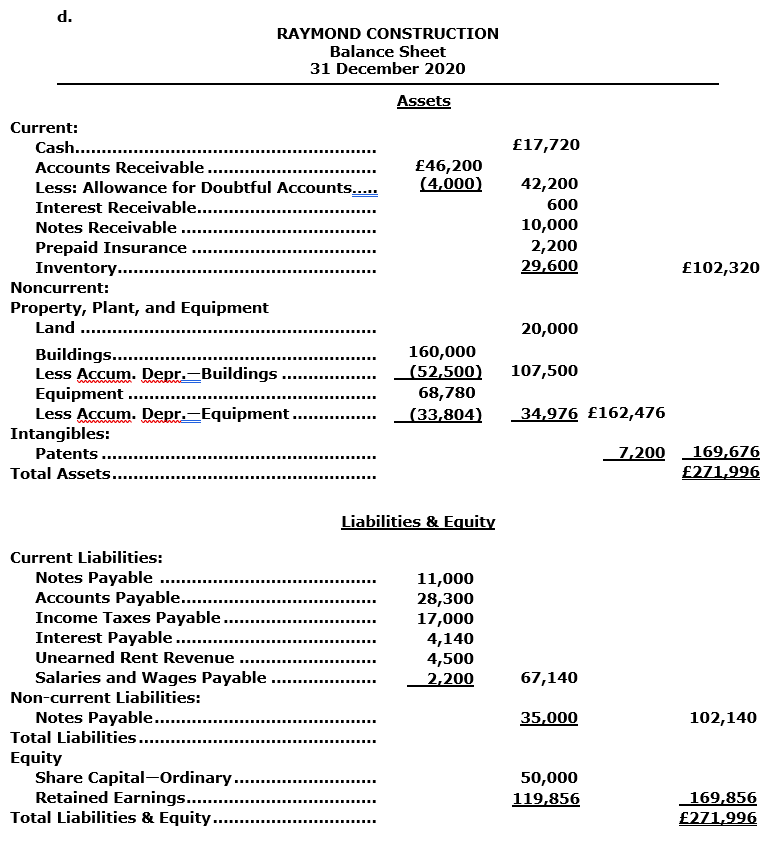

Problem One: Refer back to ACR9 on page 9-43 and the solutions now on Canvas. Note the following additional facts: Suppose that the Land is actually investment property, not PP & E, and that it will be re-valued to fair value each year. The Buildings will be valued under the Revaluation Model starting at the end of 2020. The Equipment will continue to be valued at historic cost. These additional accounts are in the general ledger: OCI Revaluation Gain/Loss, Revaluation Gain/Loss, and Revaluation Reserve. Instructions: 1) The following instructions relate to the Land: a) Prepare the journal entry to revalue the Land if the fair value at the end of 2020 is $30,000. b) Prepare the journal entry to revalue the Land if the fair value at the end of 2020 is $15,000. 2) The following instructions relate to the building (assume there is just one): a) Calculate the age of the building as at the end of 2020. b) Assume the estimated fair value of the Building at the end of 2020 is $120,000. Prepare the journal entries to revalue the Building. c) Carrying on from b), prepare the journal entries to revalue the Building at the end of 2021 if the balance in Accumulated Depreciation is $4,000 and the Building has an estimated fair value of $100,000. d) Now assume the estimated fair value of the Building at the end of 2020 is $100,000 (instead of $120,000). Prepare the journal entries to revalue the Building. e) Carrying on from d), prepare the journal entries to revalue the Building at the end of 2021 if the balance in Accumulated Depreciation is $3,200 and the Building has an estimated fair value of $115,000. f) Prepare the closing entry for 2 e). The business uses the Income Summary account, as needed. The estimated fair value of the Equipment at the end of 2020 is $20,000. Discuss if a revaluation journal entry is required. Where on the SOCI (prepared using the format prescribed by this course) will you find the Revaluation Gain/Loss account? 3) 4) SOLUTIONS TO ACR9 Problem One: ACR9 on page 9-43, but note the following: Ignore GST. For the JE in transaction #1, include the sales tax as part of the cost of the equipment. You may omit the preparation of the adjusted trial balance, but don't forget to update the GL balances for the JEs prepared in Instruction a. For the patent amortisation JE, you may credit the Patent account directly. You may omit preparation of the retained earnings statement, but don't forget to calculate its ending balance that you will need for the BS. Instead of an Income Statement, prepare a SOCI in the form and format followed in this course. Instruction e: For transaction #2 on page 9-44, prepare a residual analysis for the sale of the equipment. You do not have to prepare a residual analysis for the depreciation JE. Because of the length of Assignment Nine, revaluations will be assessed in Assignment Ten next week. a. 1. Equipment. Cash 13,780 13,780 450 2. Depreciation Expense.... Accumulated Depreciation Equipment 450 3,500 2,250 Cash ..... Accumulated Depreciation Equipment Equipment... Gain on Disposal of Plant Assets. 5,000 750 9,400 9,400 3. Accounts Receivable. Sales Revenue Cost of Goods Sold. Inventory 6,600 6,600 4. Bad Debt Expense (4,000 300). Allowance for Doubtful Accounts 3,700 3,700 600 5. Interest Receivable (10,000 X.08 X 9/12)... Interest Revenue...... 600 2,200 6. Insurance Expense (4,400 X 3/6) Prepaid Insurance 2,200 7. Depreciation Expense 3,500 (160,000 20,000) = 40 ..... Accumulated Depreciation-Buildings.... 3,500 9,900 8. Depreciation Expense... Accumulated Depreciation Equipment [(60,000 5,000) - (55,000 X.10)] = 5.. 9,900 1,704 9. Depreciation Expense.... Accumulated Depreciation Equipment [(13,780 1,000) = 5] X 8/12......... 1,704 800 10. Amortization Expense..... Patents. 800 2,200 11. Salaries and Wages Expense .... Salaries and Wages Payable... 2,200 12. Unearned Rent Revenue (6,000 = 4). Rent Revenue... 1,500 1,500 4,140 13. Interest Expense (11,000 + 35,000) X.09..... Interest Payable.... 4,140 17,000 14. Income Tax Expense ..... Income Taxes Payable.... 17,000 C. RAYMOND CONSTRUCTION Statement of Comprehensive Income For the Year Ended 31 December 2020 919,400 (636,600) 282,800 112,200 61,800 15,554 3,700 2,200 800 (196,254) Sales Revenue ... Cost of Goods Sold... Gross Profit .... Operating Expenses Salaries and Wages Expense..... Other Operating Expenses Depreciation Expense Bad Debt Expense. Insurance Expense Amortization Expense.... Other Income and Expense Rent Revenue ....... Gain on Disposal of Plant Assets.... EBIT Interest Revenue... Interest Expense..... Income Before Income Taxes .... Income Tax Expense Profit ... Other Comprehensive Income.... Total Comprehensive Income 1,500 750 2,250 88,796 600 (4,140) (3,540) 85,256 17,000 68,256 O 68,256 Calculation of ending retained earnings: Retained earnings, 1/1/20...... Add: Profit....... 63,600 68,256 131,856 12,000 119.856 Less: Dividends ...... Retained earnings, 31/12/20...... 17,720 d. RAYMOND CONSTRUCTION Balance Sheet 31 December 2020 Assets Current: Cash............ Accounts Receivable ....... 46,200 Less: Allowance for Doubtful Accounts..... (4,000) Interest Receivable........ Notes Receivable ...... Prepaid Insurance Inventory..... Noncurrent: Property, Plant, and Equipment Land ...... Buildings..... 160,000 Less Accum. Depr.Buildings (52,500) Equipment .... 68,780 Less Accum. Depr.-Equipment (33,804) Intangibles: Patents .... Total Assets...... 42,200 600 10,000 2,200 29,600 102,320 20,000 107,500 34,976 162,476 7,200 169,676 271,996 Liabilities & Equity 11,000 28,300 17,000 4,140 4,500 2,200 Current Liabilities: Notes Payable ...... Accounts Payable......... Income Taxes Payable... Interest Payable .... Unearned Rent Revenue ... Salaries and Wages Payable Non-current Liabilities: Notes Payable..... Total Liabilities... Equity Share Capital-Ordinary.. Retained Earnings.. Total Liabilities & Equity ... 67,140 35,000 102,140 50,000 119,856 169,856 271,996 Problem One: Refer back to ACR9 on page 9-43 and the solutions now on Canvas. Note the following additional facts: Suppose that the Land is actually investment property, not PP & E, and that it will be re-valued to fair value each year. The Buildings will be valued under the Revaluation Model starting at the end of 2020. The Equipment will continue to be valued at historic cost. These additional accounts are in the general ledger: OCI Revaluation Gain/Loss, Revaluation Gain/Loss, and Revaluation Reserve. Instructions: 1) The following instructions relate to the Land: a) Prepare the journal entry to revalue the Land if the fair value at the end of 2020 is $30,000. b) Prepare the journal entry to revalue the Land if the fair value at the end of 2020 is $15,000. 2) The following instructions relate to the building (assume there is just one): a) Calculate the age of the building as at the end of 2020. b) Assume the estimated fair value of the Building at the end of 2020 is $120,000. Prepare the journal entries to revalue the Building. c) Carrying on from b), prepare the journal entries to revalue the Building at the end of 2021 if the balance in Accumulated Depreciation is $4,000 and the Building has an estimated fair value of $100,000. d) Now assume the estimated fair value of the Building at the end of 2020 is $100,000 (instead of $120,000). Prepare the journal entries to revalue the Building. e) Carrying on from d), prepare the journal entries to revalue the Building at the end of 2021 if the balance in Accumulated Depreciation is $3,200 and the Building has an estimated fair value of $115,000. f) Prepare the closing entry for 2 e). The business uses the Income Summary account, as needed. The estimated fair value of the Equipment at the end of 2020 is $20,000. Discuss if a revaluation journal entry is required. Where on the SOCI (prepared using the format prescribed by this course) will you find the Revaluation Gain/Loss account? 3) 4) SOLUTIONS TO ACR9 Problem One: ACR9 on page 9-43, but note the following: Ignore GST. For the JE in transaction #1, include the sales tax as part of the cost of the equipment. You may omit the preparation of the adjusted trial balance, but don't forget to update the GL balances for the JEs prepared in Instruction a. For the patent amortisation JE, you may credit the Patent account directly. You may omit preparation of the retained earnings statement, but don't forget to calculate its ending balance that you will need for the BS. Instead of an Income Statement, prepare a SOCI in the form and format followed in this course. Instruction e: For transaction #2 on page 9-44, prepare a residual analysis for the sale of the equipment. You do not have to prepare a residual analysis for the depreciation JE. Because of the length of Assignment Nine, revaluations will be assessed in Assignment Ten next week. a. 1. Equipment. Cash 13,780 13,780 450 2. Depreciation Expense.... Accumulated Depreciation Equipment 450 3,500 2,250 Cash ..... Accumulated Depreciation Equipment Equipment... Gain on Disposal of Plant Assets. 5,000 750 9,400 9,400 3. Accounts Receivable. Sales Revenue Cost of Goods Sold. Inventory 6,600 6,600 4. Bad Debt Expense (4,000 300). Allowance for Doubtful Accounts 3,700 3,700 600 5. Interest Receivable (10,000 X.08 X 9/12)... Interest Revenue...... 600 2,200 6. Insurance Expense (4,400 X 3/6) Prepaid Insurance 2,200 7. Depreciation Expense 3,500 (160,000 20,000) = 40 ..... Accumulated Depreciation-Buildings.... 3,500 9,900 8. Depreciation Expense... Accumulated Depreciation Equipment [(60,000 5,000) - (55,000 X.10)] = 5.. 9,900 1,704 9. Depreciation Expense.... Accumulated Depreciation Equipment [(13,780 1,000) = 5] X 8/12......... 1,704 800 10. Amortization Expense..... Patents. 800 2,200 11. Salaries and Wages Expense .... Salaries and Wages Payable... 2,200 12. Unearned Rent Revenue (6,000 = 4). Rent Revenue... 1,500 1,500 4,140 13. Interest Expense (11,000 + 35,000) X.09..... Interest Payable.... 4,140 17,000 14. Income Tax Expense ..... Income Taxes Payable.... 17,000 C. RAYMOND CONSTRUCTION Statement of Comprehensive Income For the Year Ended 31 December 2020 919,400 (636,600) 282,800 112,200 61,800 15,554 3,700 2,200 800 (196,254) Sales Revenue ... Cost of Goods Sold... Gross Profit .... Operating Expenses Salaries and Wages Expense..... Other Operating Expenses Depreciation Expense Bad Debt Expense. Insurance Expense Amortization Expense.... Other Income and Expense Rent Revenue ....... Gain on Disposal of Plant Assets.... EBIT Interest Revenue... Interest Expense..... Income Before Income Taxes .... Income Tax Expense Profit ... Other Comprehensive Income.... Total Comprehensive Income 1,500 750 2,250 88,796 600 (4,140) (3,540) 85,256 17,000 68,256 O 68,256 Calculation of ending retained earnings: Retained earnings, 1/1/20...... Add: Profit....... 63,600 68,256 131,856 12,000 119.856 Less: Dividends ...... Retained earnings, 31/12/20...... 17,720 d. RAYMOND CONSTRUCTION Balance Sheet 31 December 2020 Assets Current: Cash............ Accounts Receivable ....... 46,200 Less: Allowance for Doubtful Accounts..... (4,000) Interest Receivable........ Notes Receivable ...... Prepaid Insurance Inventory..... Noncurrent: Property, Plant, and Equipment Land ...... Buildings..... 160,000 Less Accum. Depr.Buildings (52,500) Equipment .... 68,780 Less Accum. Depr.-Equipment (33,804) Intangibles: Patents .... Total Assets...... 42,200 600 10,000 2,200 29,600 102,320 20,000 107,500 34,976 162,476 7,200 169,676 271,996 Liabilities & Equity 11,000 28,300 17,000 4,140 4,500 2,200 Current Liabilities: Notes Payable ...... Accounts Payable......... Income Taxes Payable... Interest Payable .... Unearned Rent Revenue ... Salaries and Wages Payable Non-current Liabilities: Notes Payable..... Total Liabilities... Equity Share Capital-Ordinary.. Retained Earnings.. Total Liabilities & Equity ... 67,140 35,000 102,140 50,000 119,856 169,856 271,996