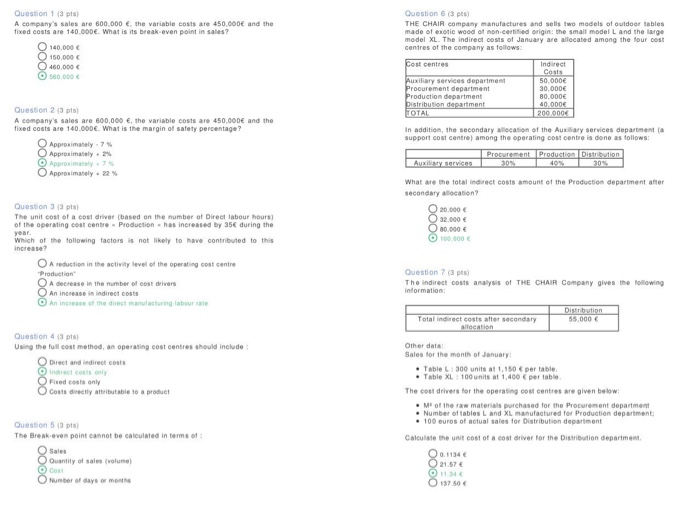

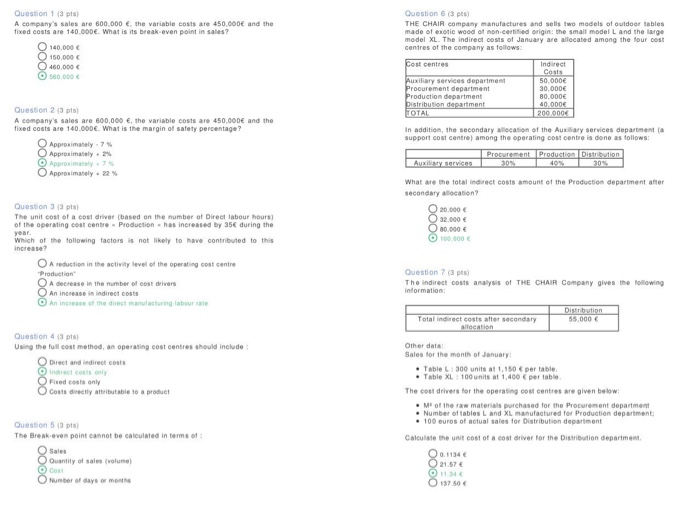

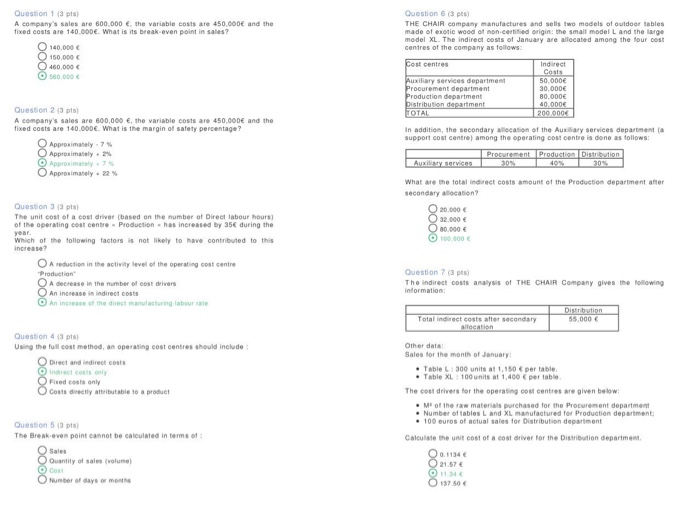

please advise how to caculate question 1,6,7

Question 13 pts A company's sales are 600.000 the variable costs are 450.000 and the fixed costs are 140.000. What is its break-even point in sales? 140.000 460 000 580,000 Question 6 (3 pts THE CHAIR company manufactures and sells two models of outdoor tables made of exotic wood of non-certified origin: the small model L and the large model XL. The indirect costs of January are allocated among the four cost centres of the company as follows: Cost centres Indirect Costs Auxiliary services department 50.000 Procurement department 30.000 Production department 80.000 Distribution department 40.000 TOTAL 200.000 In addition, the secondary allocation of the Auxiliary services department (a support cost centre) among the operating cost centre is done as follows: Procurement Production Distribution Auxiliary services Question 2 (3 pts A company's sales are 600.000 , the variable costs are 450.000 and the fixed costs are 140.000. What is the margin of safety percentage? Approximately Approximately Approximately 75 Approximately 22 What are the total indirect costs amount of the Production department after secondary allocation? 20.000 32.000 30.000 100.000 Question 3 (3 pts) The unit cost of a cost driver (based on the number of Direct labour hours) of the operating cost centre - Production has increased by 35 during the year Which of the following factors is not likely to have contributed to this Increase? A reduction in the activity level of the operating cost centre Production O A decrease in the number of cost drivers An increase in indirect costs An increase of the direct manufacturing labour tale Question 73 The indirect costs analysis of THE CHAIR Company gives the following information: Total indirect costs after secondary allocation Distribution 55,000 Question 4 (3 pts Using the full cost method, an operating cost centres should include: Direct and indirect costs Fixed costs only Corts directly attributable to a product Other data Sales for the month of January Table L: 300 units at 1.150 per table Table XL: 100 units at 1,400 per table The cost drivers for the operating cost centres are given below M' of the raw materials purchased for the Procurement department Number of tables L and XL manufactured for Production department 100 euros of actual sales for Distribution department Calculate the unit cost of a cost driver for the Distribution department 0.1134 Question 5 (3 pts The Break-even point cannot be calculated in terms of Sales Quantity of sales volume) Cost Number of days or mon 8 13750