Answered step by step

Verified Expert Solution

Question

1 Approved Answer

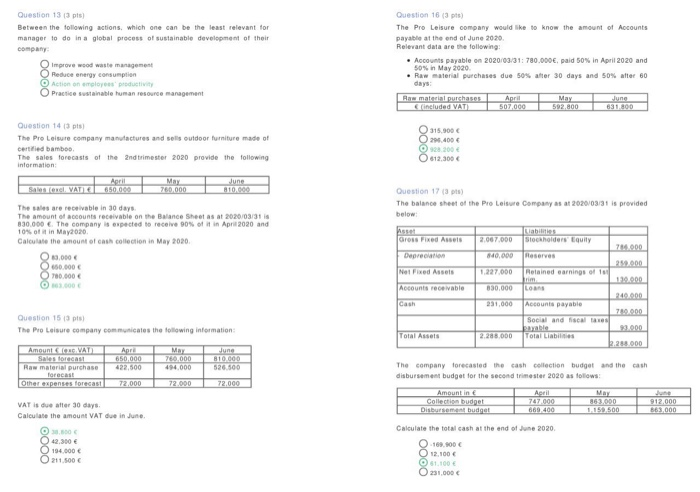

Please advise how to do 15,16,17,18 how to calculate to fet right answers Question 133 pts) Between the following actions, which one can be the

Please advise how to do

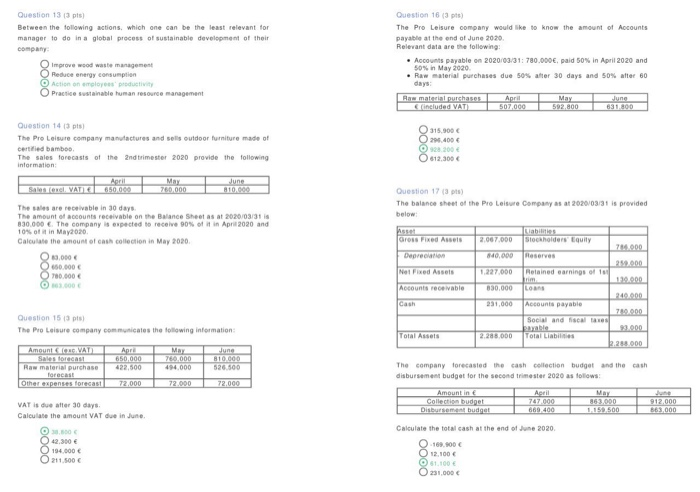

Question 133 pts) Between the following actions, which one can be the least relevant for manager to do in a global process of sustainable development of their company waste Reduce energy consumption Action on els productivity Practice sustainable human resource management Question 16 (3 pts) The Pro Leisure company would like to know the amount of Accounts payable at the end of June 2020 Relevant data are the following Accounts payable on 2020/09:31: 780.000, paid 50% in April 2020 and 50% in May 2020 Raw material purchases due 50% after 30 days and 50% after 60 days: Bw matenpurchases April May June (included VAT 507.000 592,800 Question 14 The Pro Leisure company manufactures and sells outdoor furniture made of certified bamboo The sales forecasts of the 2nd trimester 2020 provide the following information 315.900 206.400 928.200 612.300 April Salon VATIKE 650.000 MAY 760.000 Question 17 (3) The balance sheet of the Pro Leisure Company as at 2020/03/31 is provided below The sales are receivable in 30 days The amount of accounts receivable on the Balance Sheet as at 2020/03/31 is 330.000 The company expected to receive 90% of it in April 2020 and 10% of it in May2020 Calculate the amount of cash collection in May 2020 19.000 Cross Fixed Assets 2.007.000 Stockholders Equity 840,000 Reserves Depreca Not Fixed Assets 259.000 700.000 1.227.000 Retained earnings of Accounts receivable 830,000 LO Cash 231,000 Accounts payable 710.000 Social and fiscales Question 15 (3) The Pro Leisure company communicates the following information: Total Assets 2.285.000 Total Liabilities 1.288.000 MBY Amount Sales forecast Raw material purchase forecast Other expenses forecast And 650,000 422,500 494,000 526.500 The company forecasted the cash collection budget and the cash disbursement budget for the second trimester 2020 as follows: 72.000 72000 72.000 VAT is due after 30 days Calculate the amount VAT due in June Amount in Collection budget Disbursement budget April 747000 669.400 MAY 863.000 1.150.500 912,000 863.000 Calculate the total cash at the end of June 2020 42.300 194.000 211.500 OOOO 169.00 12.100 1.100 231.000 15,16,17,18 how to calculate to fet right answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started