please also help me figure out tbe partially wring questions, i will like

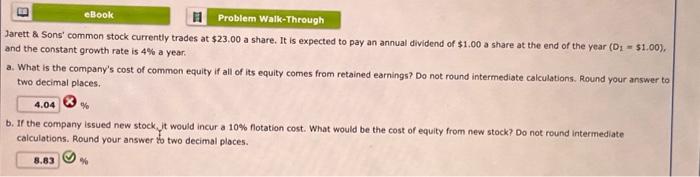

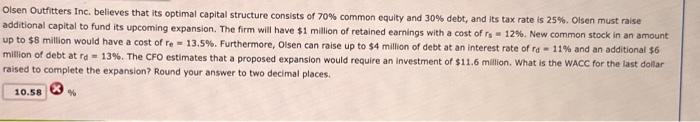

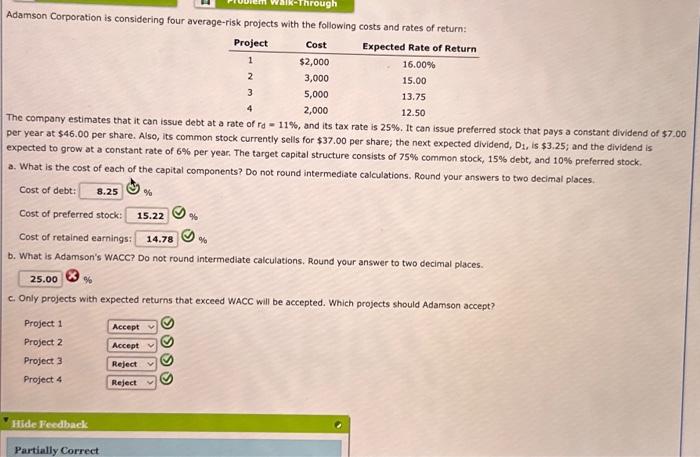

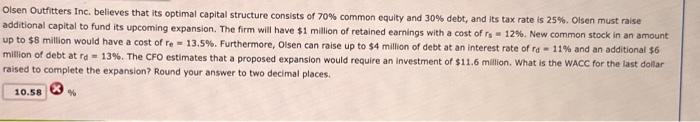

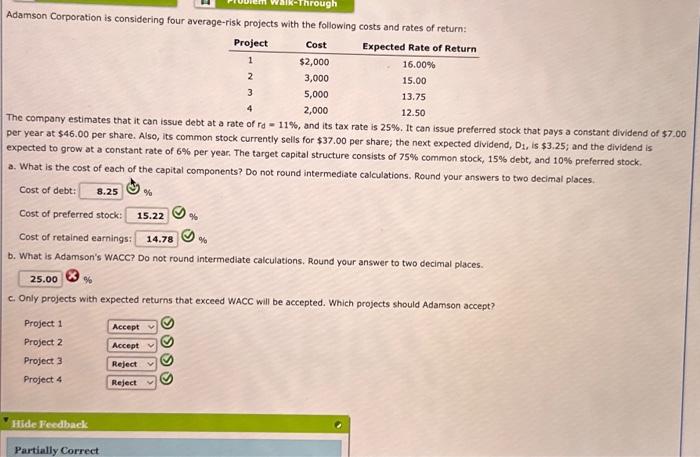

Jarett \& Sons' common stock currently trades at $23,00 a share. It is expected to pay an annual dividend of $1,00 a share at the end of the year (0,$1,00). and the constant growth rate is 4% a year. a. What is the company's cost of common equity if all of its equity comes from retained earnings? Do not round intermediate calculations. Round your answer to two decimal places. b. If the company issued new stock, it would incur a 10% flotation cost. What would be the cost of equity from new stock? Do not round intermediate calculations. Round your answer to two decimal places. Olsen Outfitters Inc. believes that its optimal capital structure consists of 70% common cquity and 30% debt, and its tax rate is 25%. Olsen must rise additional capital to fund its upcoming expansion. The firm will have $1 million of retained earnings with a cost of rs=12%. New common stock in an amount up to $8 million would have a cost of re=13.5%. Furthermore, Olsen can raise up to $4 million of debt at an interest rate of rd=11% and an additional $6 million of debt at rd=13%. The CFO estimates that a proposed expansion would require an investment of $11.6mlllion. What is the wacc for the last dollar raised to complete the expansion? Round your answer to two decimal places. Adamson Corporation is considering four average-risk projects with the following costs and rates of return: The company estimates that it can issue debt at a rate of rd = 11%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $7.00 per year at $46.00 per share. Also, its common stock currently sells for $37.00 per share; the next expected dividend, Di, is $3.25; and the dividend is expected to grow at a constant rate of 6% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. a. What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: Cost of preferred stock: Cost of retained earnings: b. What is Adamson's WACC? Do not round intermediate calculations. Round your answer to two decimal places. c. Only projects with expected returns that exceed WACC will be accepted. Which projects should Adamson accept? Project 1 Project 2 Project 3 Project 4