Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please also provide explanation XYZ stock is currently trading at $50 per share. We ask our favourite trading desk to price a bunch of 6-month

Please also provide explanation

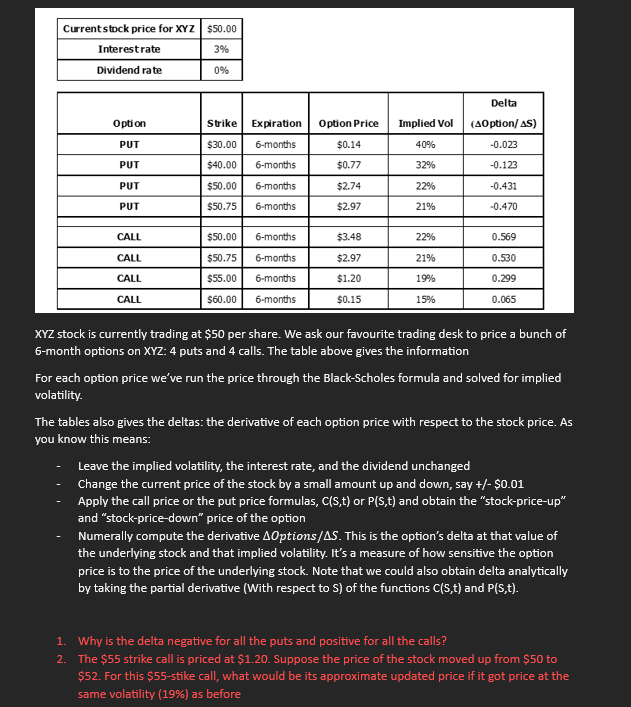

XYZ stock is currently trading at $50 per share. We ask our favourite trading desk to price a bunch of 6-month options on XYZ: 4 puts and 4 calls. The table above gives the information For each option price we've run the price through the Black-Scholes formula and solved for implied volatility. The tables also gives the deltas: the derivative of each option price with respect to the stock price. As you know this means: - Leave the implied volatility, the interest rate, and the dividend unchanged - Change the current price of the stock by a small amount up and down, say +/- $0.01 - Apply the call price or the put price formulas, C(S,t) or P(S,t) and obtain the "stock-price-up" and "stock-price-down" price of the option - Numerally compute the derivative O ptions/ S. This is the option's delta at that value of the underlying stock and that implied volatility. It's a measure of how sensitive the option price is to the price of the underlying stock. Note that we could also obtain delta analytically by taking the partial derivative (With respect to S ) of the functions C(S,t) and P(S,t). 1. Why is the delta negative for all the puts and positive for all the calls? 2. The $55 strike call is priced at $1.20. Suppose the price of the stock moved up from $50 to $52. For this $55-stike call, what would be its approximate updated price if it got price at the same volatility (19%) as beforeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started