Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please also show all calculations and how you got to the solution and why you used the numbers you used. Exercise 4-11 On January 1,

Please also show all calculations and how you got to the solution and why you used the numbers you used.

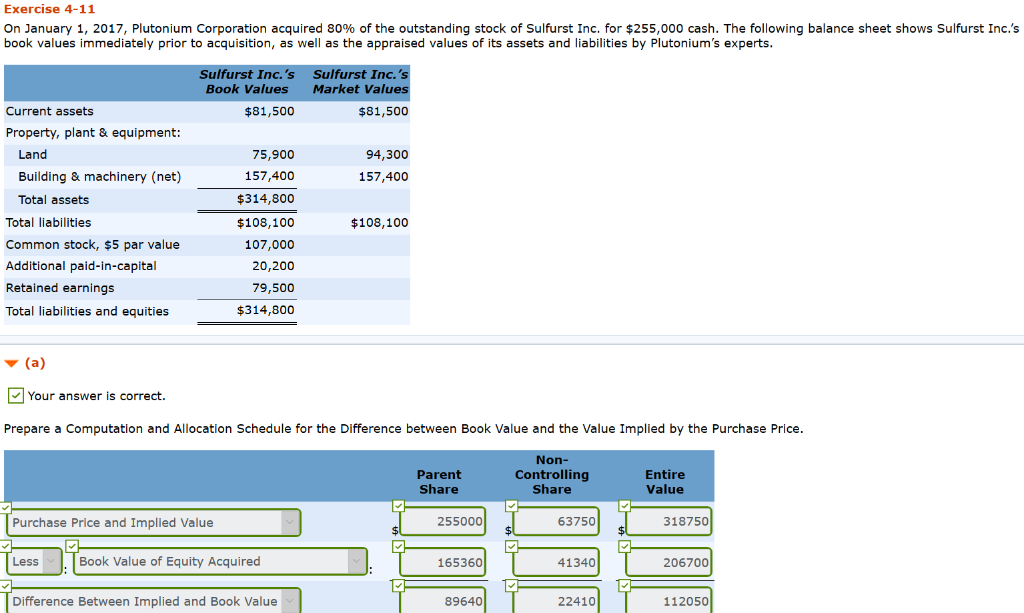

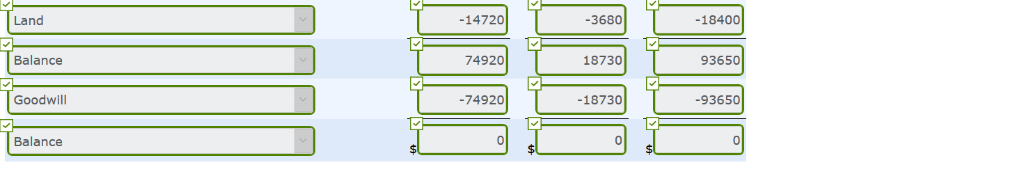

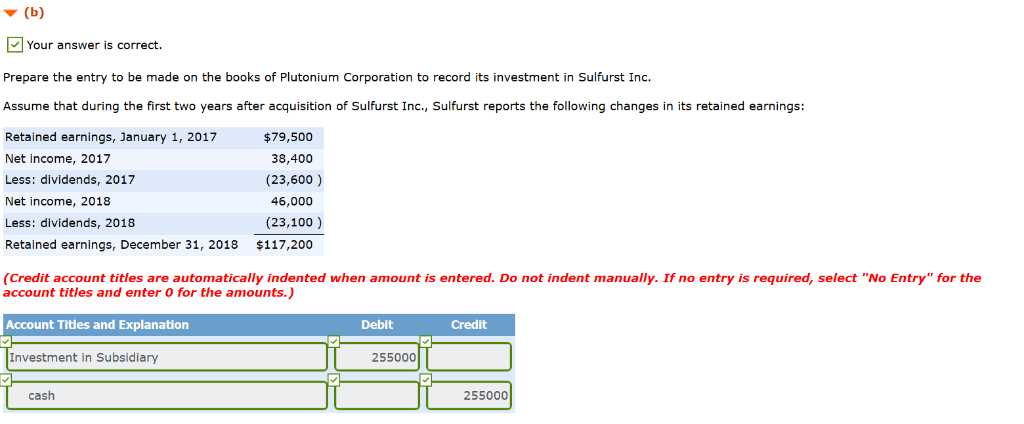

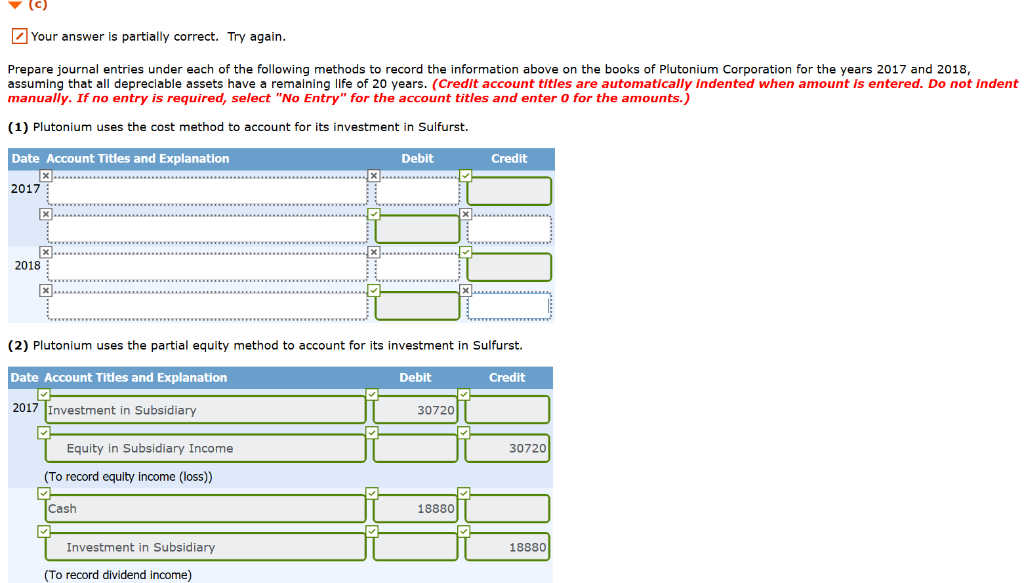

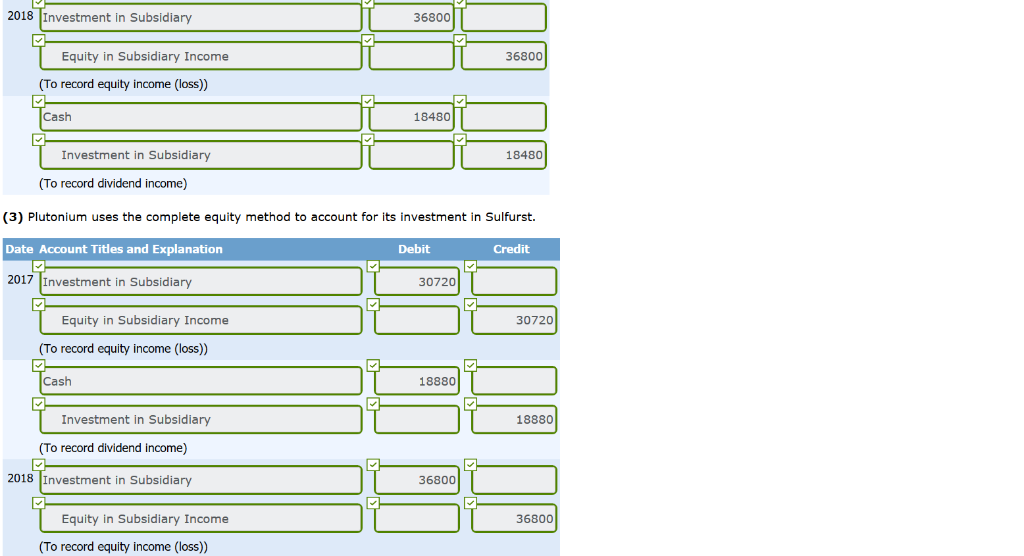

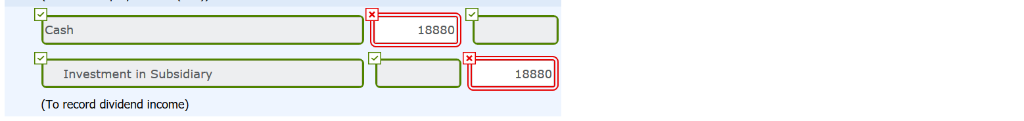

Exercise 4-11 On January 1, 2017, Plutonium Corporation acquired 80% of the outstanding stock of Sulfurst Inc. for $255,000 cash. The following balance sheet shows Sulfurst Inc.'s book values immediately prior to acquisition, as well as the appraised values of its assets and liabilities by Plutonium's experts Sulfurst Inc. 's Sulfurst Inc Book ValuesMarket Values Current assets $81,500 $81,500 Property, plant & equipment: 75,900 157,400 $314,800 $108,100 107,000 20,200 79,500 $314,800 Land 94,300 157,400 Building & machinery (net) Total assets Total liabilities Common stock, $5 par value Additional paid-in-capital Retained earnings Total liabilities and equities $108,100 (a) Your answer is correct. Prepare a Computation and Allocation Schedule for the Difference between Book Value and the Value Implied by the Purchase Price Parent Share Non- Controlling Share Entire Value Purchase Price and Implied Value 255000 63750 318750 Less Book Value of Equity Acquired 165360 41340 206700 Difference Between Implied and Book Value 89640 22410 112050 Land -14720 -3680 -18400 Balance 74920 18730 93650 Goodwill -74920 -18730 -93650 Balance 0 0 0 Your answer is correct. Prepare the entry to be made on the books of Plutonium Corporation to record its investment in Sulfurst Inc. Assume that during the first two years after acquisition of Sulfurst Inc., Sulfurst reports the following changes in its retained earnings: Retained earnings, January 1, 2017 Net income, 2017 Less: dividends, 2017 Net income, 2018 Less: dividends, 2018 Retained earnings, December 31, 2018 $117,200 $79,500 38,400 (23,600) 46,000 (23,100 ) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Investment in Subsidiary Debit Credit 255000 cash 255000 Your answer is partially correct. Try again Prepare journal entries under each of the following methods to record the information above on the books of Plutonium Corporation for the years 2017 and 2018 assuming that all depreclable assets have a remaining life of 20 years. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (1) Plutonium uses the cost method to account for its investment in Sulfurst. Date Account Titles and Explanation 2017 Debit Credit 2018 (2) Plutonium uses the partial equity method to account for its investment in Sulfurst. Date Account Titles and Explanation 2017 Investment in Subsidiary Debit Credit 30720 Equity in Subsidiary Income (To record equity income (loss)) Cash 30720 18880 Investment in Subsidiary 18880 (To record dividend income) 2018 Investment in Subsidiary 36800 Equity in Subsidiary Income (To record equity income (loss)) Cash 36800 18480 Investment in Subsidiary 18480 (To record dividend income) (3) Plutonium uses the complete equity method to account for its investment in Sulfurst. Date Account Titles and Explanation 2017 Investment in Subsidiary Debit Credit 30720 Equity in Subsidiary Income (To record equity income (loss)) Cash 30720 18880 Investment in Subsidiary 18880 (To record dividend income) 2018 Investment in Subsidiary 36800 Equity in Subsidiary Income 36800 (To record equity income (loss)) Cash 18880 Investment in Subsidiary 18880 (To record dividend income) Exercise 4-11 On January 1, 2017, Plutonium Corporation acquired 80% of the outstanding stock of Sulfurst Inc. for $255,000 cash. The following balance sheet shows Sulfurst Inc.'s book values immediately prior to acquisition, as well as the appraised values of its assets and liabilities by Plutonium's experts Sulfurst Inc. 's Sulfurst Inc Book ValuesMarket Values Current assets $81,500 $81,500 Property, plant & equipment: 75,900 157,400 $314,800 $108,100 107,000 20,200 79,500 $314,800 Land 94,300 157,400 Building & machinery (net) Total assets Total liabilities Common stock, $5 par value Additional paid-in-capital Retained earnings Total liabilities and equities $108,100 (a) Your answer is correct. Prepare a Computation and Allocation Schedule for the Difference between Book Value and the Value Implied by the Purchase Price Parent Share Non- Controlling Share Entire Value Purchase Price and Implied Value 255000 63750 318750 Less Book Value of Equity Acquired 165360 41340 206700 Difference Between Implied and Book Value 89640 22410 112050 Land -14720 -3680 -18400 Balance 74920 18730 93650 Goodwill -74920 -18730 -93650 Balance 0 0 0 Your answer is correct. Prepare the entry to be made on the books of Plutonium Corporation to record its investment in Sulfurst Inc. Assume that during the first two years after acquisition of Sulfurst Inc., Sulfurst reports the following changes in its retained earnings: Retained earnings, January 1, 2017 Net income, 2017 Less: dividends, 2017 Net income, 2018 Less: dividends, 2018 Retained earnings, December 31, 2018 $117,200 $79,500 38,400 (23,600) 46,000 (23,100 ) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Investment in Subsidiary Debit Credit 255000 cash 255000 Your answer is partially correct. Try again Prepare journal entries under each of the following methods to record the information above on the books of Plutonium Corporation for the years 2017 and 2018 assuming that all depreclable assets have a remaining life of 20 years. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (1) Plutonium uses the cost method to account for its investment in Sulfurst. Date Account Titles and Explanation 2017 Debit Credit 2018 (2) Plutonium uses the partial equity method to account for its investment in Sulfurst. Date Account Titles and Explanation 2017 Investment in Subsidiary Debit Credit 30720 Equity in Subsidiary Income (To record equity income (loss)) Cash 30720 18880 Investment in Subsidiary 18880 (To record dividend income) 2018 Investment in Subsidiary 36800 Equity in Subsidiary Income (To record equity income (loss)) Cash 36800 18480 Investment in Subsidiary 18480 (To record dividend income) (3) Plutonium uses the complete equity method to account for its investment in Sulfurst. Date Account Titles and Explanation 2017 Investment in Subsidiary Debit Credit 30720 Equity in Subsidiary Income (To record equity income (loss)) Cash 30720 18880 Investment in Subsidiary 18880 (To record dividend income) 2018 Investment in Subsidiary 36800 Equity in Subsidiary Income 36800 (To record equity income (loss)) Cash 18880 Investment in Subsidiary 18880 (To record dividend income)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started