Answered step by step

Verified Expert Solution

Question

1 Approved Answer

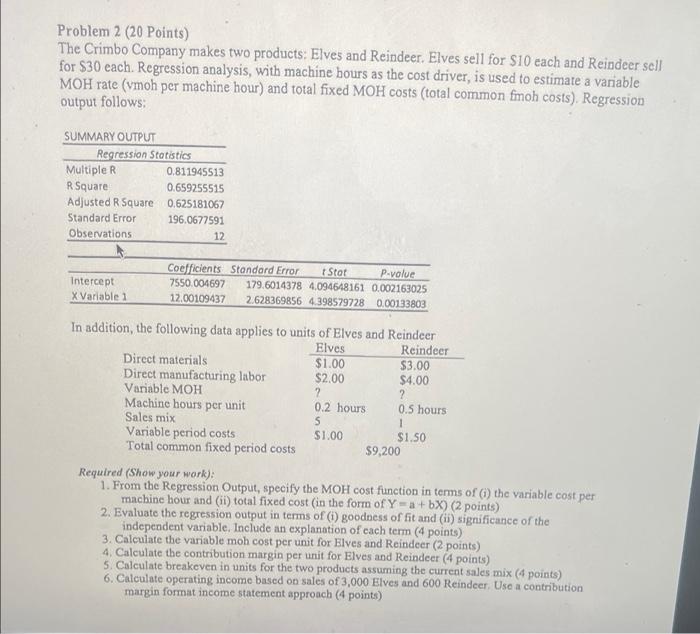

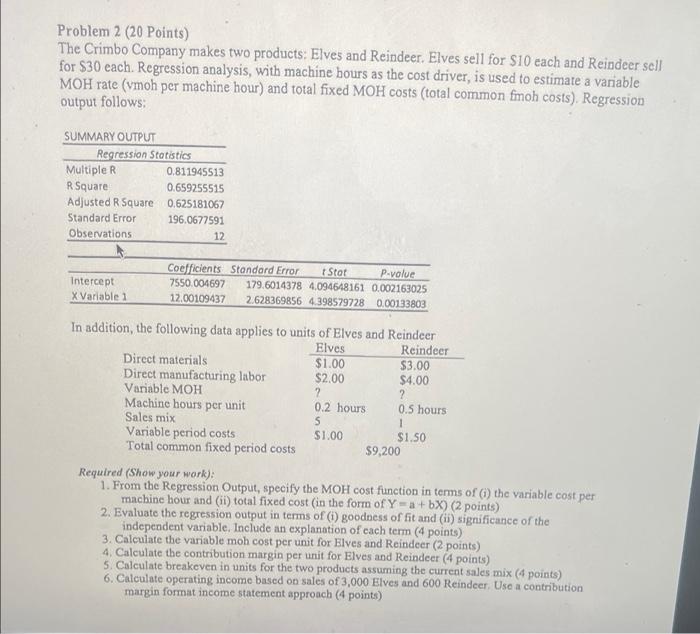

please amswer all. thanks Problem 2 (20 Points) The Crimbo Company makes two products: Elves and Reindeer. Elves sell for $10 each and Reindeer sell

please amswer all. thanks

Problem 2 (20 Points) The Crimbo Company makes two products: Elves and Reindeer. Elves sell for $10 each and Reindeer sell for $30 each. Regression analysis, with machine hours as the cost driver, is used to estimate a variable MOH rate (vmoh per machine hour) and total fixed MOH costs (total common fmoh costs). Regression output follows: SUMMARY OUTPUT Regression Statistics Multiple R 0.811945513 R Square 0.659255515 Adjusted R Square 0.625181067 Standard Error 196.0677591 Observations 12 Intercept X Variable Coefficients Standard Error Star P-value 7550.004697 179.6014378 4,094648161 0.002163025 12.00109437 2628369856 4.398579728 0.00133803 In addition, the following data applies to units of Elves and Reindeer Elves Reindeer Direct materials $1.00 $3.00 Direct manufacturing labor $2.00 $4.00 Variable MOH 2 ? Machine hours per unit 0.2 hours 0.5 hours Sales mix 5 1 Variable period costs $1.00 $1.50 Total common fixed period costs $9,200 Required (Show your work). 1. From the Regression Output, specify the MOH cost function in terms of (1) the variable cost per machine hour and (ii) total fixed cost in the form of Y=a+bX) (2 points) 2. Evaluate the regression output in terms of (1) goodness of fit and (ii) significance of the independent variable. Include an explanation of each term (4 points) 3. Calculate the variable moh cost per unit for Elves and Reindeer (2 points) 4. Calculate the contribution margin per unit for Elves and Reindeer (4 points) 5. Calculate breakeven in units for the two products assuming the current sales mix (4 points) 6. Calculate operating income based on sales of 3,000 Elves and 600 Reindeer. Use a contribution margin format income statement approach (4 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started