***Please analysis the specific outcome and write an analysis directed towards the management team describing what the below numbers means and how they relate to the business.

--------------------------------------------------------------------------------------------------------------------------------------

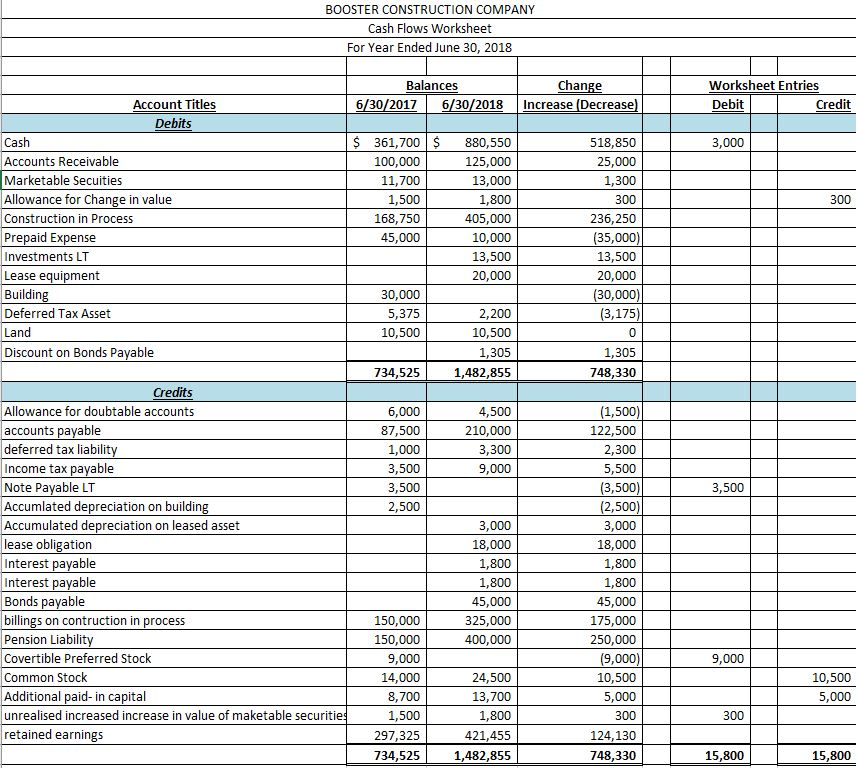

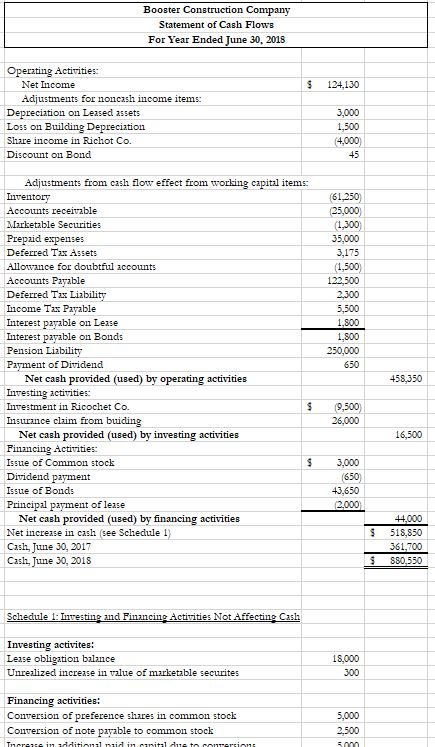

BOOSTER CONSTRUCTION COMPANY Cash Flows Worksheet For Year Ended June 30, 2018 Balances 6/30/2017 6/30/2018 Change Increase Decrease) Worksheet Entries Debit Credit $ 3,000 Account Titles Debits Cash Accounts Receivable Marketable Secuities Allowance for Change in value Construction in Process Prepaid Expense Investments LT Lease equipment Building Deferred Tax Asset Land Discount on Bonds Payable 361,700 $ 100,000 11,700 1,500 168,750 45,000 300 880,550 125,000 13,000 1,800 405,000 10,000 13,500 20,000 518,850 25,000 1,300 300 236,250 (35,000) 13,500 20,000 (30,000) (3,175) 30,000 5,375 10,500 2,200 10,500 1,305 1,482,855 1,305 748,330 734,525 A 50 6,000 87,500 1,000 3,500 3,500 2,500 4,500 210,000 3,300 9,000 3,500 Credits Allowance for doubtable accounts accounts payable deferred tax liability Income tax payable Note Payable LT Accumlated depreciation on building Accumulated depreciation on leased asset lease obligation Interest payable Interest payable Bonds payable billings on contruction in process Pension Liability Covertible Preferred Stock Common Stock Additional paid- in capital unrealised increased increase in value of maketable securities retained earnings 3,000 18,000 1,800 1,800 45,000 325,000 400,000 (1,500) 122,500 2,300 5,500 (3,500) (2,500) 3,000 18.000 1,800 1,800 45,000 175,000 250,000 (9,000) 10,500 5,000 300 124,130 748,330 9,000 150,000 150,000 9,000 14,000 8,700 1,500 297,325 734,525 10,500 5,000 24,500 13,700 1,800 421,455 1,482,855 300 15,800 15,800 Booster Construction Company Statement of Cash Flows For Year Ended June 30, 2018 $ 124,130 Operating Activities: Net Income Adjustments for noncash income items Depreciation on Leased assets Loss on Building Depreciation Share income in Richot Co. Discount on Bond 3,000 1,500 (4,000 61.250 25,000 (1,300 35,000 3.175 1,500) 122,500 2,300 5,500 1.800 1,800 250,000 650 Adjustments from cash flow effect from working capital items: Inventory Accounts receivable Marketable Securities Prepaid expenses Deferred Tax Assets Allowance for doubtful accounts Accounts Payable Deferred Tax Liability Income Tax Payable Interest payable on Lease Interest payable on Bonds Pension Liability Payment of Dividend Net cash provided (used) by operating activities Investing activities Investment in Ricochet Co. $ Insurance claim from buiding Net cash provided (used) by investing activities Financing Activities: Issue of common stock Dividend payment Issue of Bonds Principal payment of lease Net cash provided (used) by financing activities Net increase in cash see Schedule 1) Cash, June 30, 2017 Cash, June 30, 2018 458,350 9,500 26,000 16,500 3,000 650 43,650 2.000 44000 518,850 361.700 SSO,550 Schedule 1 Instesting and Financing Activities Not Affecting Cash Investing activites: Lease obligation balance Unrealized increase in value of marketable securites 18,000 300 Financing activities: Conversion of preference shares in common stock Conversion of note payable to common stock 5,000 2,500 TPV vitin id in carital de to SRP BOOSTER CONSTRUCTION COMPANY Cash Flows Worksheet For Year Ended June 30, 2018 Balances 6/30/2017 6/30/2018 Change Increase Decrease) Worksheet Entries Debit Credit $ 3,000 Account Titles Debits Cash Accounts Receivable Marketable Secuities Allowance for Change in value Construction in Process Prepaid Expense Investments LT Lease equipment Building Deferred Tax Asset Land Discount on Bonds Payable 361,700 $ 100,000 11,700 1,500 168,750 45,000 300 880,550 125,000 13,000 1,800 405,000 10,000 13,500 20,000 518,850 25,000 1,300 300 236,250 (35,000) 13,500 20,000 (30,000) (3,175) 30,000 5,375 10,500 2,200 10,500 1,305 1,482,855 1,305 748,330 734,525 A 50 6,000 87,500 1,000 3,500 3,500 2,500 4,500 210,000 3,300 9,000 3,500 Credits Allowance for doubtable accounts accounts payable deferred tax liability Income tax payable Note Payable LT Accumlated depreciation on building Accumulated depreciation on leased asset lease obligation Interest payable Interest payable Bonds payable billings on contruction in process Pension Liability Covertible Preferred Stock Common Stock Additional paid- in capital unrealised increased increase in value of maketable securities retained earnings 3,000 18,000 1,800 1,800 45,000 325,000 400,000 (1,500) 122,500 2,300 5,500 (3,500) (2,500) 3,000 18.000 1,800 1,800 45,000 175,000 250,000 (9,000) 10,500 5,000 300 124,130 748,330 9,000 150,000 150,000 9,000 14,000 8,700 1,500 297,325 734,525 10,500 5,000 24,500 13,700 1,800 421,455 1,482,855 300 15,800 15,800 Booster Construction Company Statement of Cash Flows For Year Ended June 30, 2018 $ 124,130 Operating Activities: Net Income Adjustments for noncash income items Depreciation on Leased assets Loss on Building Depreciation Share income in Richot Co. Discount on Bond 3,000 1,500 (4,000 61.250 25,000 (1,300 35,000 3.175 1,500) 122,500 2,300 5,500 1.800 1,800 250,000 650 Adjustments from cash flow effect from working capital items: Inventory Accounts receivable Marketable Securities Prepaid expenses Deferred Tax Assets Allowance for doubtful accounts Accounts Payable Deferred Tax Liability Income Tax Payable Interest payable on Lease Interest payable on Bonds Pension Liability Payment of Dividend Net cash provided (used) by operating activities Investing activities Investment in Ricochet Co. $ Insurance claim from buiding Net cash provided (used) by investing activities Financing Activities: Issue of common stock Dividend payment Issue of Bonds Principal payment of lease Net cash provided (used) by financing activities Net increase in cash see Schedule 1) Cash, June 30, 2017 Cash, June 30, 2018 458,350 9,500 26,000 16,500 3,000 650 43,650 2.000 44000 518,850 361.700 SSO,550 Schedule 1 Instesting and Financing Activities Not Affecting Cash Investing activites: Lease obligation balance Unrealized increase in value of marketable securites 18,000 300 Financing activities: Conversion of preference shares in common stock Conversion of note payable to common stock 5,000 2,500 TPV vitin id in carital de to SRP