Answered step by step

Verified Expert Solution

Question

1 Approved Answer

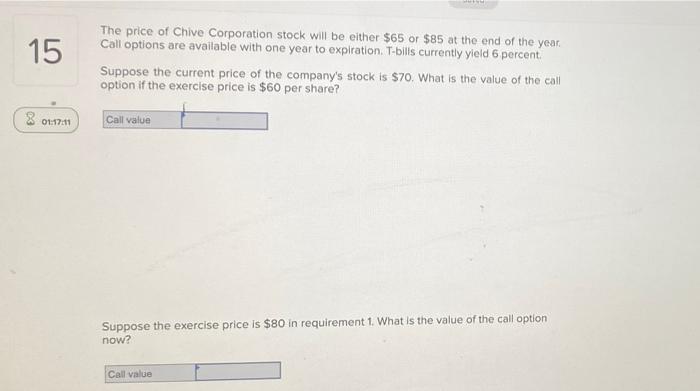

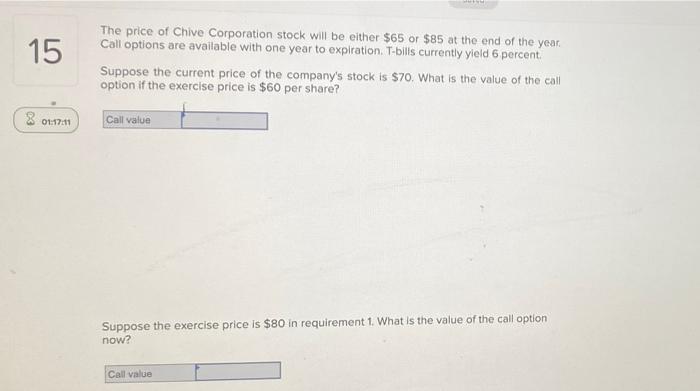

please anawe all question thank you 15 The price of Chive Corporation stock will be either $65 or $85 at the end of the year.

please anawe all question

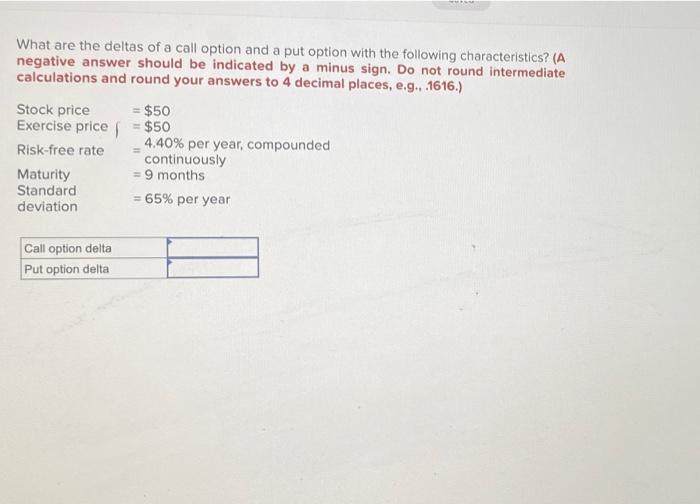

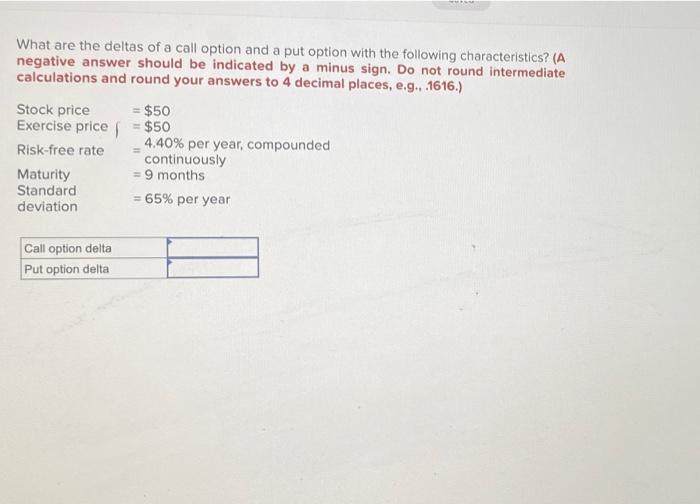

15 The price of Chive Corporation stock will be either $65 or $85 at the end of the year. Call options are available with one year to explration. Tbilis currently yield 6 percent. Suppose the current price of the company's stock is $70. What is the value of the call option if the exercise price is $60 per share? 8 011711 Call value Suppose the exercise price is $80 in requirement 1. What is the value of the call option now? Call value What are the deltas of a call option and a put option with the following characteristics? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 4 decimal places, e.g. 1616.) Stock price = $50 Exercise price = $50 Risk-free rate 4.40% per year, compounded continuously Maturity = 9 months Standard = 65% per year deviation Call option delta Put option delta thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started