Answered step by step

Verified Expert Solution

Question

1 Approved Answer

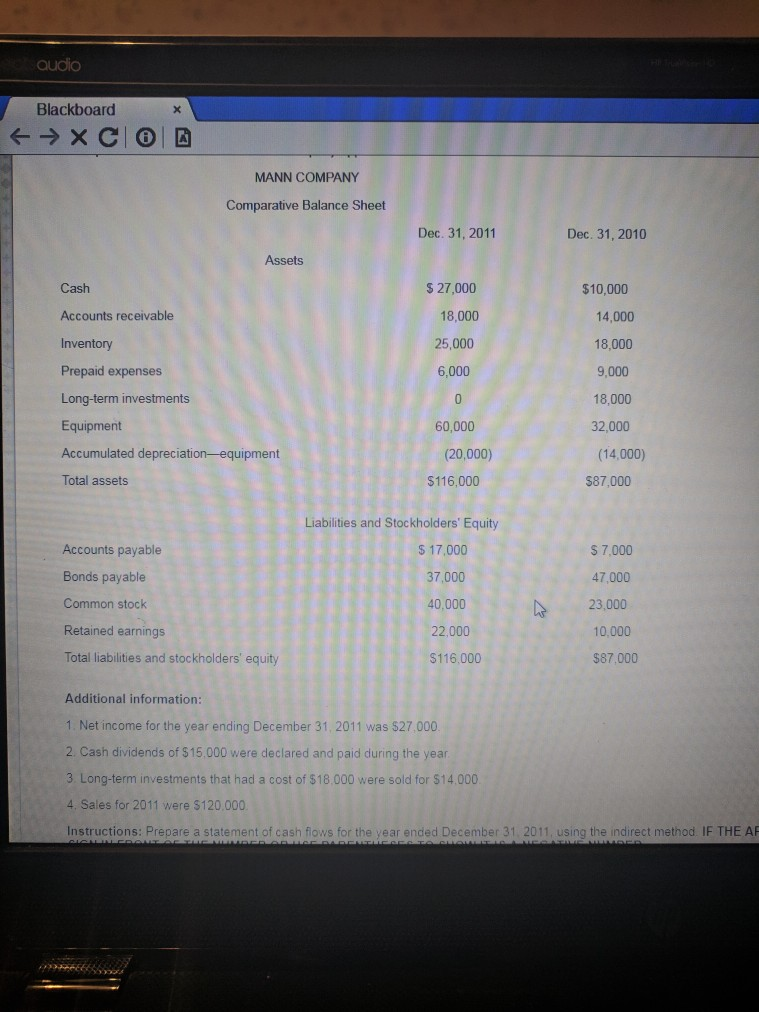

please and thank you! Blackboard MANN COMPANY Comparative Balance Sheet Dec. 31, 2011 Dec. 31, 2010 Assets Cash Accounts receivable Inventory Prepaid expenses Long-term investments

please and thank you!

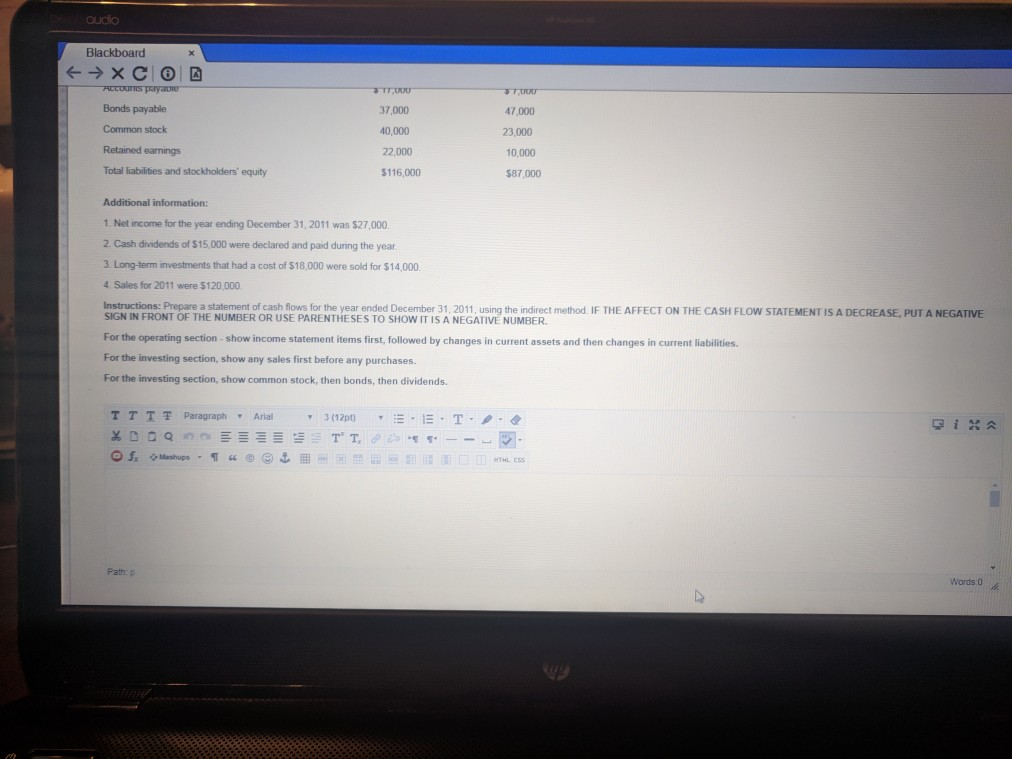

Blackboard MANN COMPANY Comparative Balance Sheet Dec. 31, 2011 Dec. 31, 2010 Assets Cash Accounts receivable Inventory Prepaid expenses Long-term investments Equipment Accumulated depreciation-equipment Total assets $ 27,000 $10,000 18,000 25,000 6,000 14,000 18,000 9,000 18,000 32,000 60,000 (20,000) (14,000) $116,000 587,000 Liabilities and Stockholders' Equity Accounts payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity $ 17.000 37,000 40,000 22,000 S116,000 S 7,000 47,000 23,000 10,000 $87,000 Additional information 1. Net income for the year ending December 31, 2011 was $27,000 2 Cash dividends of $15,000 were declared and paid during the year 3 Long-term investments that had a cost of $18,000 were sold for $14.000 4. Sales for 2011 were $120,000 Instructions: Prepare a statement of cash flows for the year ended December 31 2011, using the indirect method IF THE A oudio Blackboard Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity Additional information: 1. Net income for the year ending December 31, 2011 was $27,000 2 Cash dividends of $15,000 were declared and paid during the year 3 Long-term investments that had a cost of $18,000 were sold for $14,000 4. Sales for 2011 were $120,000 Instructions: Prepare a statement of cash flows for the year ended December 31, 2011, using the indirect method IF THE AFFECT ON THE CASH FLOW STATEMENT IS A DECREASE, PUT A NEGATIVE 37,000 40,000 22,000 $116,000 47,000 23,000 0,000 $87,000 SIGN IN FRONT OF THE NUMBER OR USE PARENTHESES TO SHOW IT IS A NEGATIVE NUMBER. For the operating section - show income statement items first, followed by changes in current assets and then changes in current liabilities. For the investing section, show any sales first before any purchases. For the investing section, show common stock, then bonds, then dividends. TTT Paragraph Arial Path: p Words:0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started