Question: please andwer all 10 questions. AG E 342 Homework #2 Rivalry and present value Each part of questions 1-5, Question 6 parts a & b,

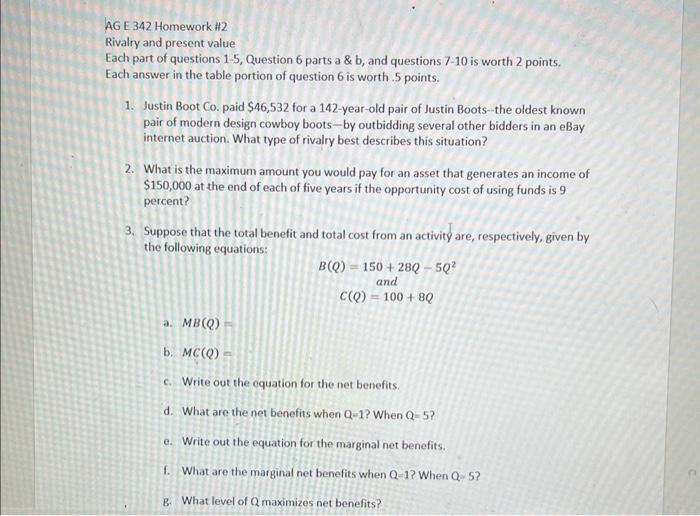

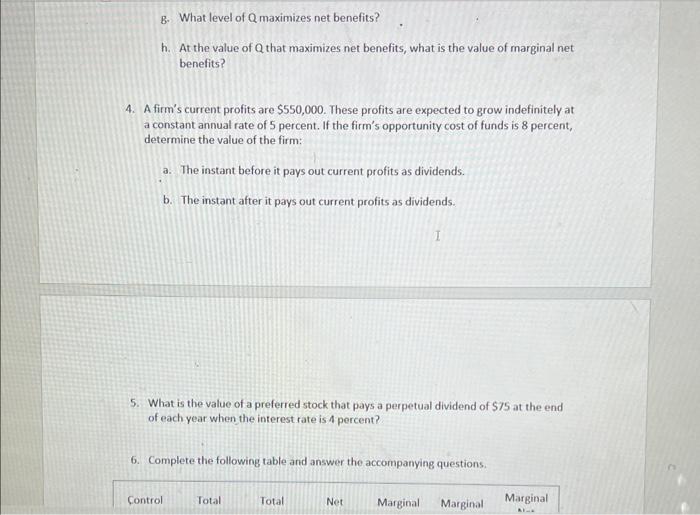

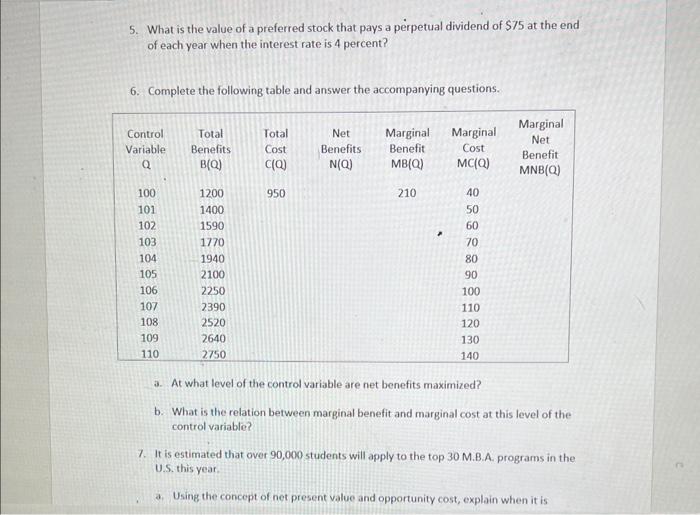

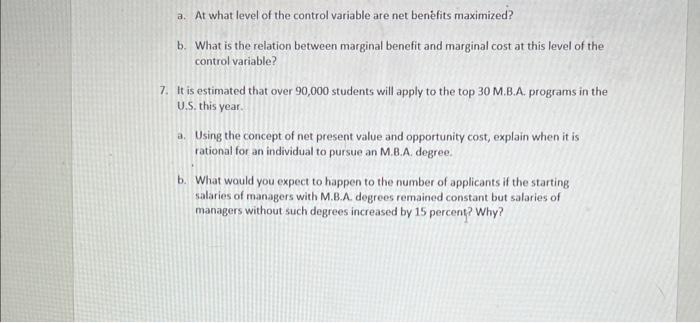

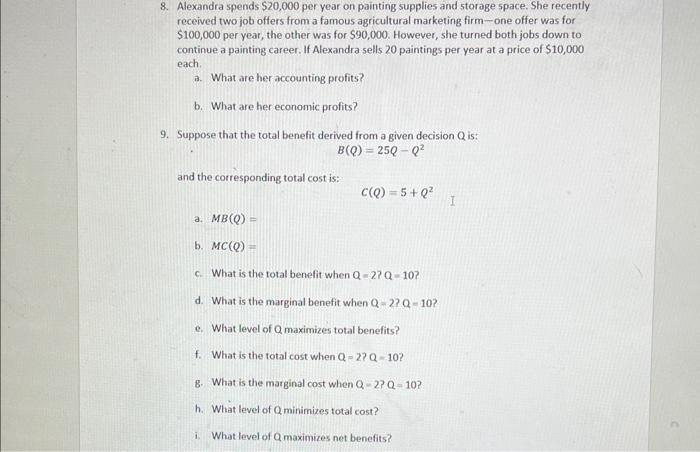

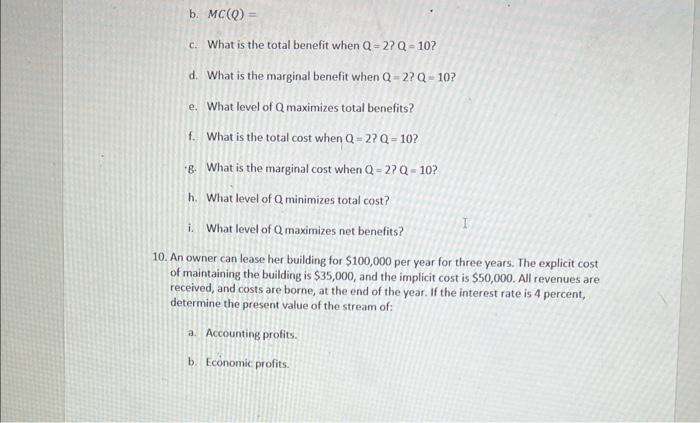

AG E 342 Homework #2 Rivalry and present value Each part of questions 1-5, Question 6 parts a \& b, and questions 7-10 is worth 2 points. Each answer in the table portion of question 6 is worth .5 points. 1. Justin Boot Co. paid $46,532 for a 142-year-old pair of Justin Boots-the oldest known pair of modern design cowboy boots - by outbidding several other bidders in an eBay internet auction. What type of rivalry best describes this situation? 2. What is the maximum amount you would pay for an asset that generates an income of $150,000 at the end of each of five years if the opportunity cost of using funds is 9 percent? 3. Suppose that the total benefit and total cost from an activity are, respectively, given by the following equations: B(Q)=150+28Q5Q2andC(Q)=100+8Q a. MB(Q)= b. MC(Q)= c. Write out the equation for the net benefits. d. What are the net benefits when Q=1 ? When Q=5 ? e. Write out the equation for the marginal net benefits. f. What are the marginal net benefits when Q=1 ? When Q=5 ? B. What level of Q maximizes net benefits? B. What level of Q maximizes net benefits? h. At the value of Q that maximizes net benefits, what is the value of marginal net benefits? 4. A firm's current profits are $550,000. These profits are expected to grow indefinitely at a constant annual rate of 5 percent. If the firm's opportunity cost of funds is 8 percent, determine the value of the firm: a. The instant before it pays out current profits as dividends. b. The instant after it pays out current profits as dividends. 5. What is the value of a preferred stock that pays a perpetual dividend of $75 at the end of each year when the interest rate is 4 percent? 6. Complete the following table and answer the accompanying questions. 5. What is the value of a preferred stock that pays a perpetual dividend of $75 at the end of each year when the interest rate is 4 percent? 6. Complete the following table and answer the accompanying questions. a. At what level of the control variable are net benefits maximized? b. What is the relation between marginal benefit and marginal cost at this level of the control variable? 7. It is estimated that over 90,000 students will apply to the top 30 M.B.A. programs in the U.S. this year. a. Using the concept of net present value and opportunity cost, explain when it is a. At what level of the control variable are net benfits maximized? b. What is the relation between marginal benefit and marginal cost at this level of the control variable? 7. It is estimated that over 90,000 students will apply to the top 30 M.B.A. programs in the U.S. this year. a. Using the concept of net present value and opportunity cost, explain when it is rational for an individual to pursue an M.B.A. degree. b. What would you expect to happen to the number of applicants if the starting salaries of managers with M.B.A. degrees remained constant but salaries of managers without such degrees increased by 15 percent? Why? 8. Alexandra spends $20,000 per year on painting supplies and storage space. She recently received two job offers from a famous agricultural marketing firm-one offer was for $100,000 per year, the other was for $90,000. However, she turned both jobs down to continue a painting career. If Alexandra sells 20 paintings per year at a price of $10,000 each. a. What are her accounting profits? b. What are her economic profits? 9. Suppose that the total benefit derived from a given decision Q is: B(Q)=25QQ2 and the corresponding total cost is: C(Q)=5+Q2 a. MB(Q)= b. MC(Q)= c. What is the total benefit when Q=2?Q=10 ? d. What is the marginal benefit when Q=2?Q=10 ? e. What level of Q maximizes total benefits? f. What is the total cost when Q=2?Q=10 ? 8. What is the matginal cost when Q=2?Q=10 ? h. What level of Q minimizes total cost? i. What level of Q maximizes net benefits? b. MC(Q)= c. What is the total benefit when Q=2 ? Q=10 ? d. What is the marginal benefit when Q=2?Q=10 ? e. What level of Q maximizes total benefits? f. What is the total cost when Q=2?Q=10 ? 'B. What is the marginal cost when Q=2?Q=10 ? h. What level of Q minimizes total cost? i. What level of Q maximizes net benefits? 10. An owner can lease her building for $100,000 per year for three years. The explicit cost of maintaining the building is $35,000, and the implicit cost is $50,000. All revenues are received, and costs are borne, at the end of the year. If the interest rate is 4 percent, determine the present value of the stream of: a. Accounting profits. b. Economic profits. AG E 342 Homework #2 Rivalry and present value Each part of questions 1-5, Question 6 parts a \& b, and questions 7-10 is worth 2 points. Each answer in the table portion of question 6 is worth .5 points. 1. Justin Boot Co. paid $46,532 for a 142-year-old pair of Justin Boots-the oldest known pair of modern design cowboy boots - by outbidding several other bidders in an eBay internet auction. What type of rivalry best describes this situation? 2. What is the maximum amount you would pay for an asset that generates an income of $150,000 at the end of each of five years if the opportunity cost of using funds is 9 percent? 3. Suppose that the total benefit and total cost from an activity are, respectively, given by the following equations: B(Q)=150+28Q5Q2andC(Q)=100+8Q a. MB(Q)= b. MC(Q)= c. Write out the equation for the net benefits. d. What are the net benefits when Q=1 ? When Q=5 ? e. Write out the equation for the marginal net benefits. f. What are the marginal net benefits when Q=1 ? When Q=5 ? B. What level of Q maximizes net benefits? B. What level of Q maximizes net benefits? h. At the value of Q that maximizes net benefits, what is the value of marginal net benefits? 4. A firm's current profits are $550,000. These profits are expected to grow indefinitely at a constant annual rate of 5 percent. If the firm's opportunity cost of funds is 8 percent, determine the value of the firm: a. The instant before it pays out current profits as dividends. b. The instant after it pays out current profits as dividends. 5. What is the value of a preferred stock that pays a perpetual dividend of $75 at the end of each year when the interest rate is 4 percent? 6. Complete the following table and answer the accompanying questions. 5. What is the value of a preferred stock that pays a perpetual dividend of $75 at the end of each year when the interest rate is 4 percent? 6. Complete the following table and answer the accompanying questions. a. At what level of the control variable are net benefits maximized? b. What is the relation between marginal benefit and marginal cost at this level of the control variable? 7. It is estimated that over 90,000 students will apply to the top 30 M.B.A. programs in the U.S. this year. a. Using the concept of net present value and opportunity cost, explain when it is a. At what level of the control variable are net benfits maximized? b. What is the relation between marginal benefit and marginal cost at this level of the control variable? 7. It is estimated that over 90,000 students will apply to the top 30 M.B.A. programs in the U.S. this year. a. Using the concept of net present value and opportunity cost, explain when it is rational for an individual to pursue an M.B.A. degree. b. What would you expect to happen to the number of applicants if the starting salaries of managers with M.B.A. degrees remained constant but salaries of managers without such degrees increased by 15 percent? Why? 8. Alexandra spends $20,000 per year on painting supplies and storage space. She recently received two job offers from a famous agricultural marketing firm-one offer was for $100,000 per year, the other was for $90,000. However, she turned both jobs down to continue a painting career. If Alexandra sells 20 paintings per year at a price of $10,000 each. a. What are her accounting profits? b. What are her economic profits? 9. Suppose that the total benefit derived from a given decision Q is: B(Q)=25QQ2 and the corresponding total cost is: C(Q)=5+Q2 a. MB(Q)= b. MC(Q)= c. What is the total benefit when Q=2?Q=10 ? d. What is the marginal benefit when Q=2?Q=10 ? e. What level of Q maximizes total benefits? f. What is the total cost when Q=2?Q=10 ? 8. What is the matginal cost when Q=2?Q=10 ? h. What level of Q minimizes total cost? i. What level of Q maximizes net benefits? b. MC(Q)= c. What is the total benefit when Q=2 ? Q=10 ? d. What is the marginal benefit when Q=2?Q=10 ? e. What level of Q maximizes total benefits? f. What is the total cost when Q=2?Q=10 ? 'B. What is the marginal cost when Q=2?Q=10 ? h. What level of Q minimizes total cost? i. What level of Q maximizes net benefits? 10. An owner can lease her building for $100,000 per year for three years. The explicit cost of maintaining the building is $35,000, and the implicit cost is $50,000. All revenues are received, and costs are borne, at the end of the year. If the interest rate is 4 percent, determine the present value of the stream of: a. Accounting profits. b. Economic profits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts