Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please andwer all questions Compared to the valuations of debt and preferred stock, the valuation of common stock suffers most from information asymmetry problem due

please andwer all questions

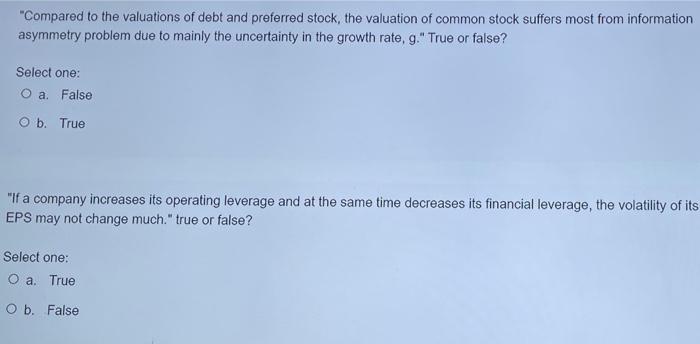

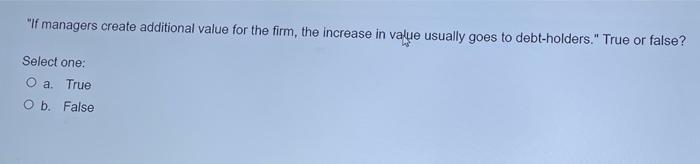

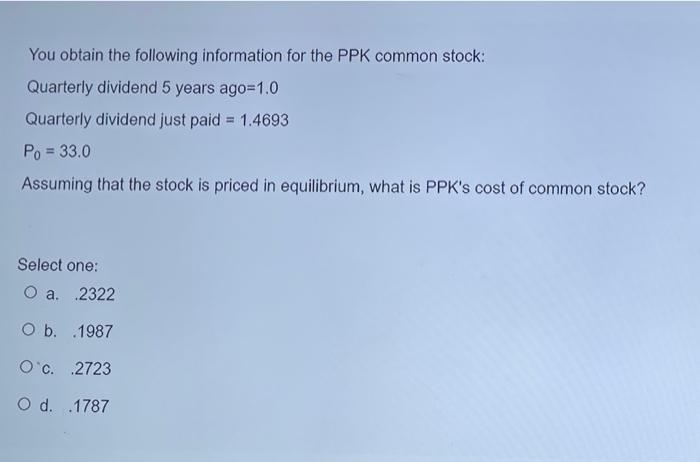

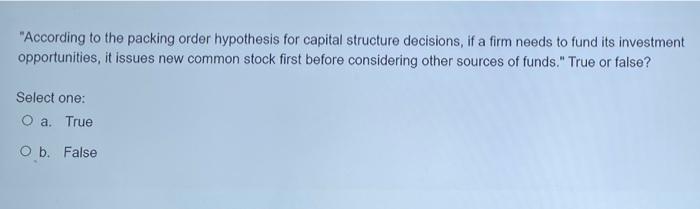

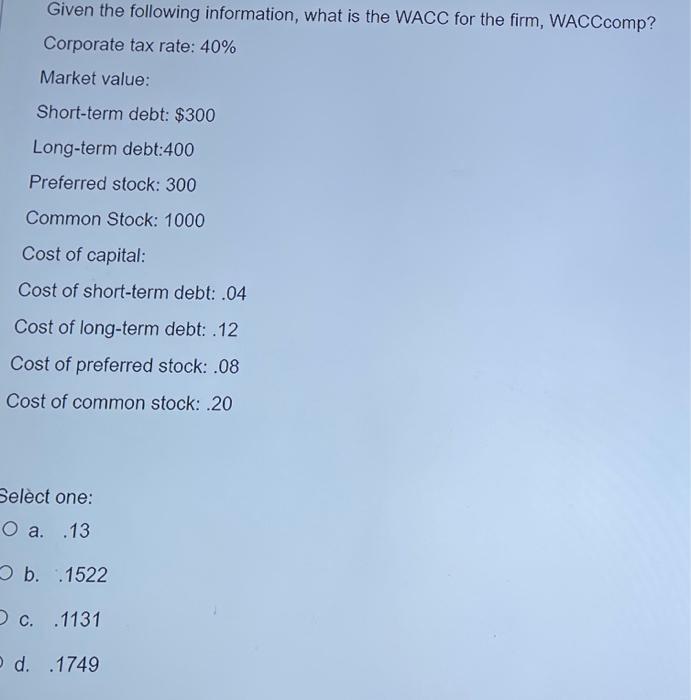

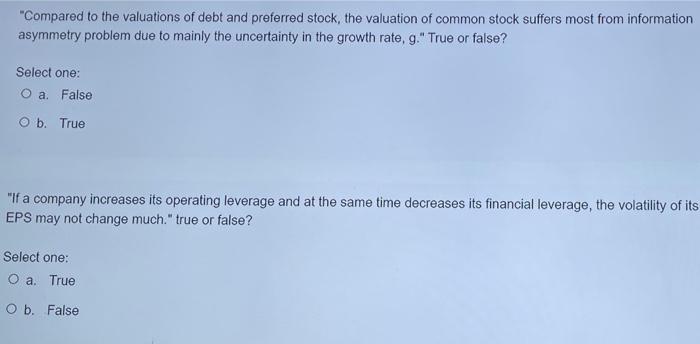

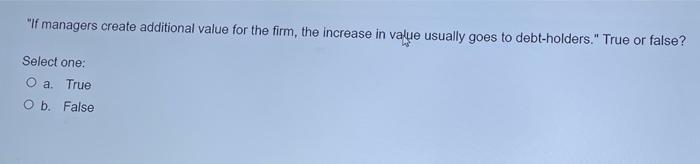

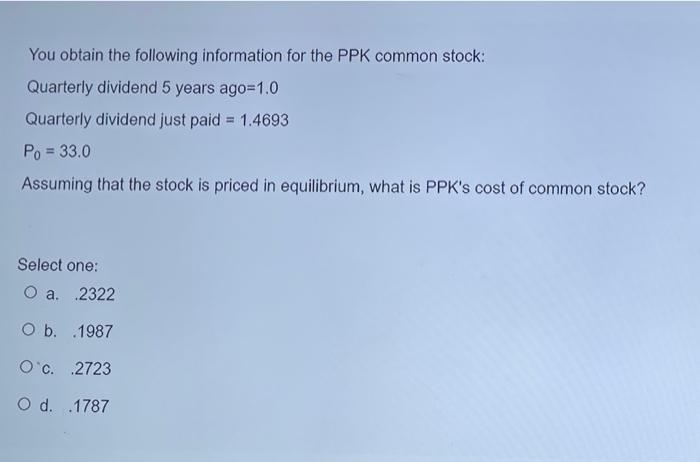

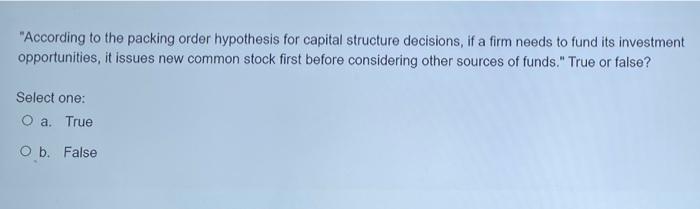

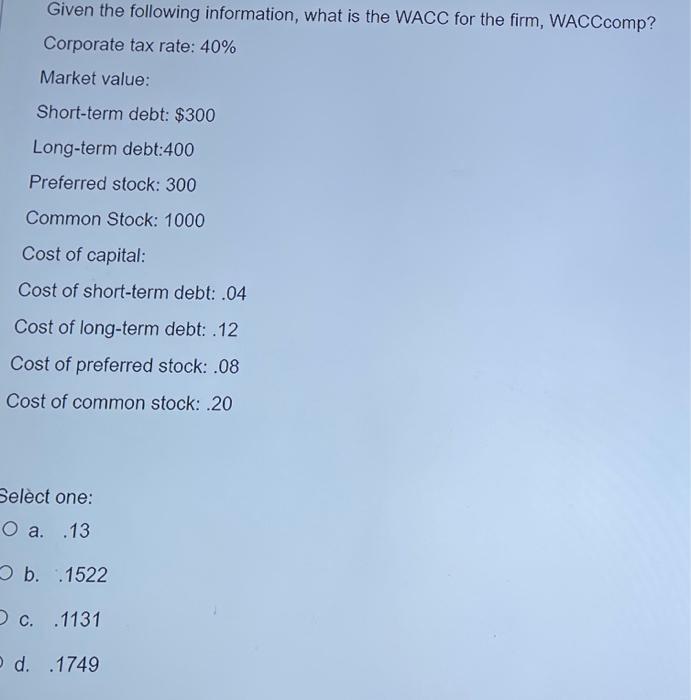

"Compared to the valuations of debt and preferred stock, the valuation of common stock suffers most from information asymmetry problem due to mainly the uncertainty in the growth rate, g." True or false? Select one: O a False O b. True "If a company increases its operating leverage and at the same time decreases its financial leverage, the volatility of its EPS may not change much." true or false? Select one: O a. True O b. False "If managers create additional value for the firm, the increase in value usually goes to debt-holders." True or false? Select one: O a. True O b. False You obtain the following information for the PPK common stock: Quarterly dividend 5 years ago=1.0 Quarterly dividend just paid = 1.4693 Po = 33.0 Assuming that the stock is priced in equilibrium, what is PPK's cost of common stock? Select one: O a. 2322 Ob. 1987 O c. 2723 O d. 1787 "According to the packing order hypothesis for capital structure decisions, if a firm needs to fund its investment opportunities, it issues new common stock first before considering other sources of funds." True or false? Select one: O a. True Ob. False Given the following information, what is the WACC for the firm, WACCcomp? Corporate tax rate: 40% Market value: Short-term debt: $300 Long-term debt:400 Preferred stock: 300 Common Stock: 1000 Cost of capital: Cost of short-term debt: .04 Cost of long-term debt: .12 Cost of preferred stock: .08 Cost of common stock: .20 Select one: O a..13 b. 1522 c. 1131 d. 1749

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started