please ans all mcq. no need to explain. just answer with A,B,C or D

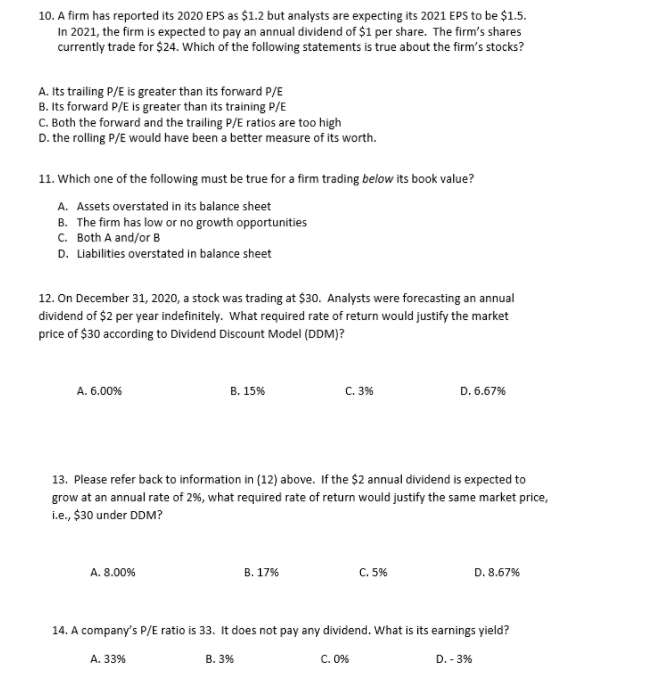

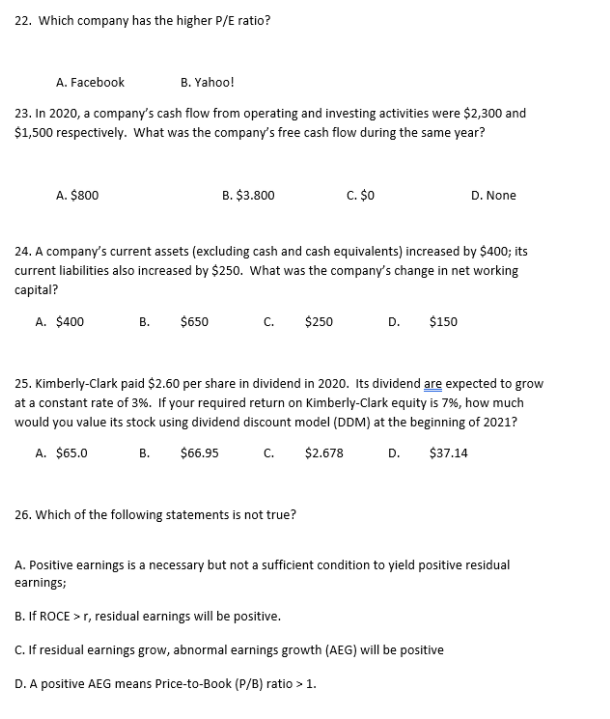

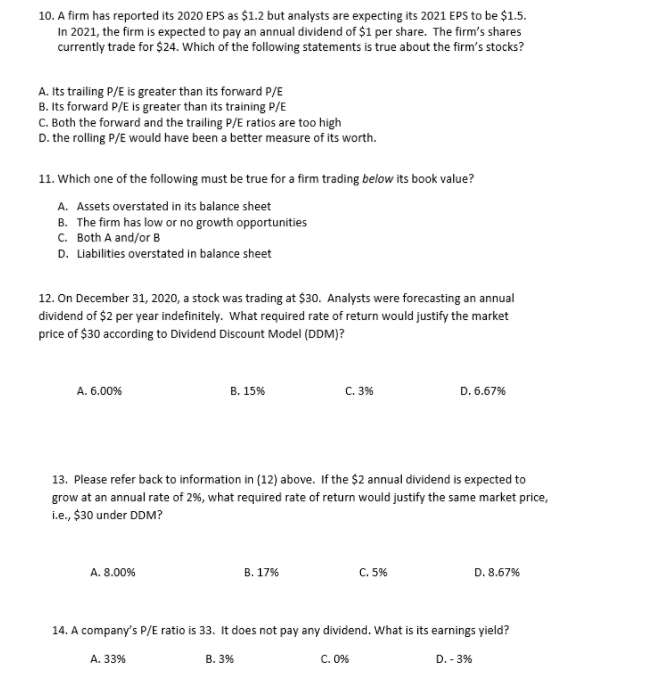

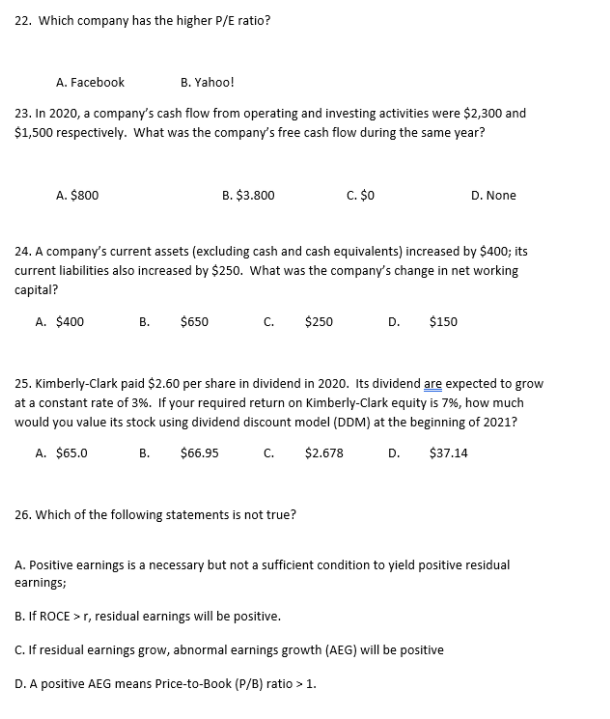

10. A firm has reported its 2020 EPS as $1.2 but analysts are expecting its 2021 EPS to be $1.5. In 2021, the firm is expected to pay an annual dividend of $1 per share. The firm's shares currently trade for $24. Which of the following statements is true about the firm's stocks? A. Its trailing P/E is greater than its forward P/E B. Its forward P/E is greater than its training P/E C. Both the forward and the trailing P/E ratios are too high D. the rolling P/E would have been a better measure of its worth. 11. Which one of the following must be true for a firm trading below its book value? A. Assets overstated in its balance sheet B. The firm has low or no growth opportunities C. Both A and/or B D. Liabilities overstated in balance sheet 12. On December 31, 2020, a stock was trading at $30. Analysts were forecasting an annual dividend of $2 per year indefinitely. What required rate of return would justify the market price of $30 according to Dividend Discount Model (DDM)? A. 6.00% B. 15% C. 3% D. 6.67% 13. Please refer back to information in (12) above. If the $2 annual dividend is expected to grow at an annual rate of 2%, what required rate of return would justify the same market price, i.e., $30 under DDM? A. 8.00% B. 17% C. 5% D. 8.67% 14. A company's P/E ratio is 33. It does not pay any dividend. What is its earnings yield? C.0% D. - 3% A. 3396 B. 396 22. Which company has the higher P/E ratio? A. Facebook B. Yahoo! 23. In 2020, a company's cash flow from operating and investing activities were $2,300 and $1,500 respectively. What was the company's free cash flow during the same year? A. $800 B. $3.800 C. $0 D. None 24. A company's current assets (excluding cash and cash equivalents) increased by $400; its current liabilities also increased by $250. What was the company's change in net working capital? A. $400 B. $650 C. $250 D. $150 25. Kimberly-Clark paid $2.60 per share in dividend in 2020. Its dividend are expected to grow at a constant rate of 3%. If your required return on Kimberly-Clark equity is 7%, how much would you value its stock using dividend discount model (DDM) at the beginning of 2021? A. $65.0 B. $66.95 C. $2.678 D. $37.14 26. Which of the following statements is not true? A. Positive earnings is a necessary but not a sufficient condition to yield positive residual earnings; B. If ROCE >r, residual earnings will be positive. C. If residual earnings grow, abnormal earnings growth (AEG) will be positive D. A positive AEG means Price-to-Book (P/B) ratio > 1