Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please ans q4 fasttt please answer fast if can Question 3 (20 marks) Professional Ltd has a tax rate of 25%. It has 36,000 shares

please ans q4 fasttt

please ans q4 fasttt

please answer fast if can

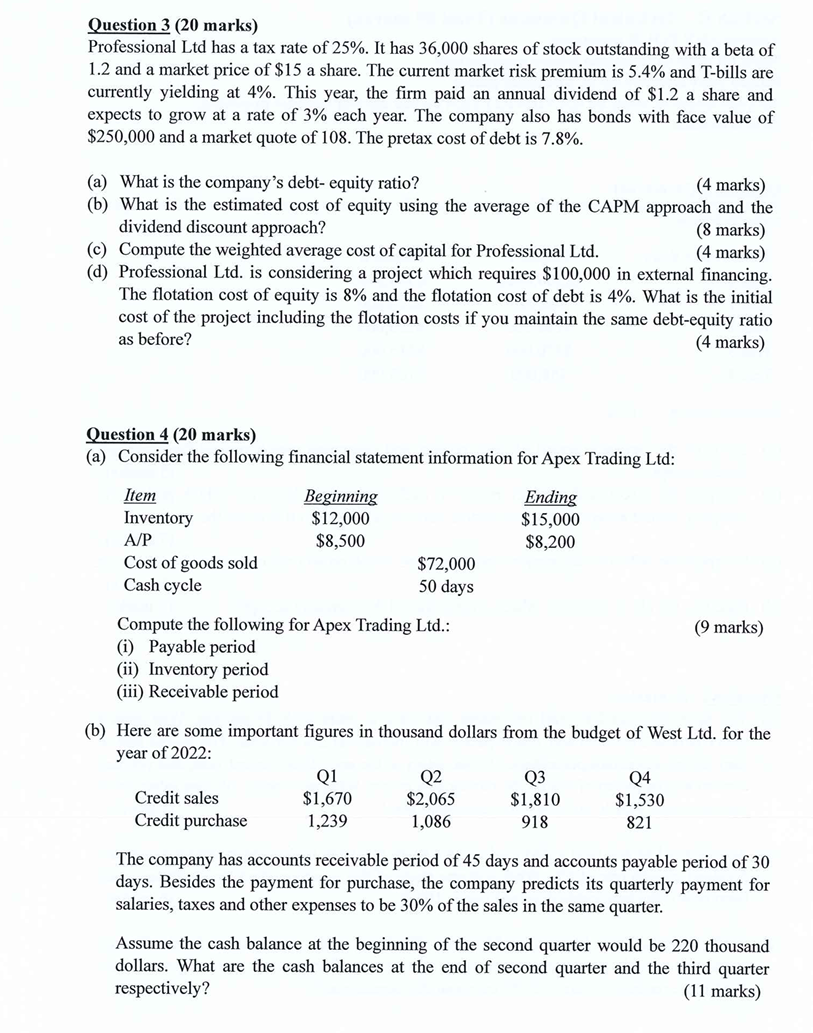

Question 3 (20 marks) Professional Ltd has a tax rate of 25%. It has 36,000 shares of stock outstanding with a beta of 1.2 and a market price of $15 a share. The current market risk premium is 5.4% and T-bills are currently yielding at 4%. This year, the firm paid an annual dividend of $1.2 a share and expects to grow at a rate of 3% each year. The company also has bonds with face value of $250,000 and a market quote of 108. The pretax cost of debt is 7.8%. (a) What is the company's debt- equity ratio? (4 marks) (b) What is the estimated cost of equity using the average of the CAPM approach and the dividend discount approach? (8 marks) (c) Compute the weighted average cost of capital for Professional Ltd. (4 marks) (d) Professional Ltd. is considering a project which requires $100,000 in external financing. The flotation cost of equity is 8% and the flotation cost of debt is 4%. What is the initial cost of the project including the flotation costs if you maintain the same debt-equity ratio as before? (4 marks) Question 4 (20 marks) (a) Consider the following financial statement information for Apex Trading Ltd: Item Inventory Beginning $12,000 $8,500 Ending $15,000 $8,200 A/P Cost of goods sold Cash cycle $72,000 50 days (9 marks) Compute the following for Apex Trading Ltd.: (i) Payable period (ii) Inventory period (iii) Receivable period (b) Here are some important figures in thousand dollars from the budget of West Ltd. for the year of 2022: Q1 Q2 Q3 04 Credit sales $1,670 $2,065 $1,810 $1,530 Credit purchase 1,239 1,086 918 821 The company has accounts receivable period of 45 days and accounts payable period of 30 days. Besides the payment for purchase, the company predicts its quarterly payment for salaries, taxes and other expenses to be 30% of the sales in the same quarter. Assume the cash balance at the beginning of the second quarter would be 220 thousand dollars. What are the cash balances at the end of second quarter and the third quarter respectively? (11 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started