Answered step by step

Verified Expert Solution

Question

1 Approved Answer

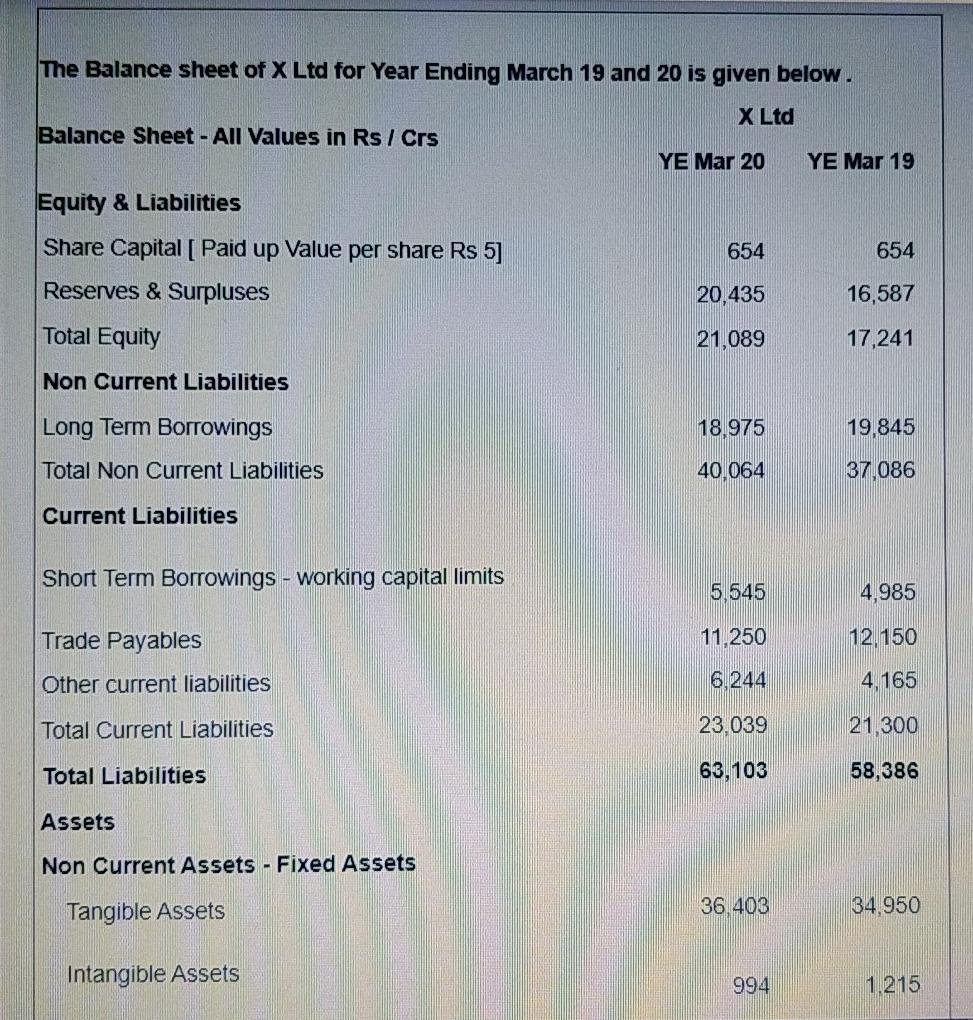

Please ans this in 10 minutes The Balance sheet of X Ltd for Year Ending March 19 and 20 is given below. X Ltd Balance

Please ans this in 10 minutes

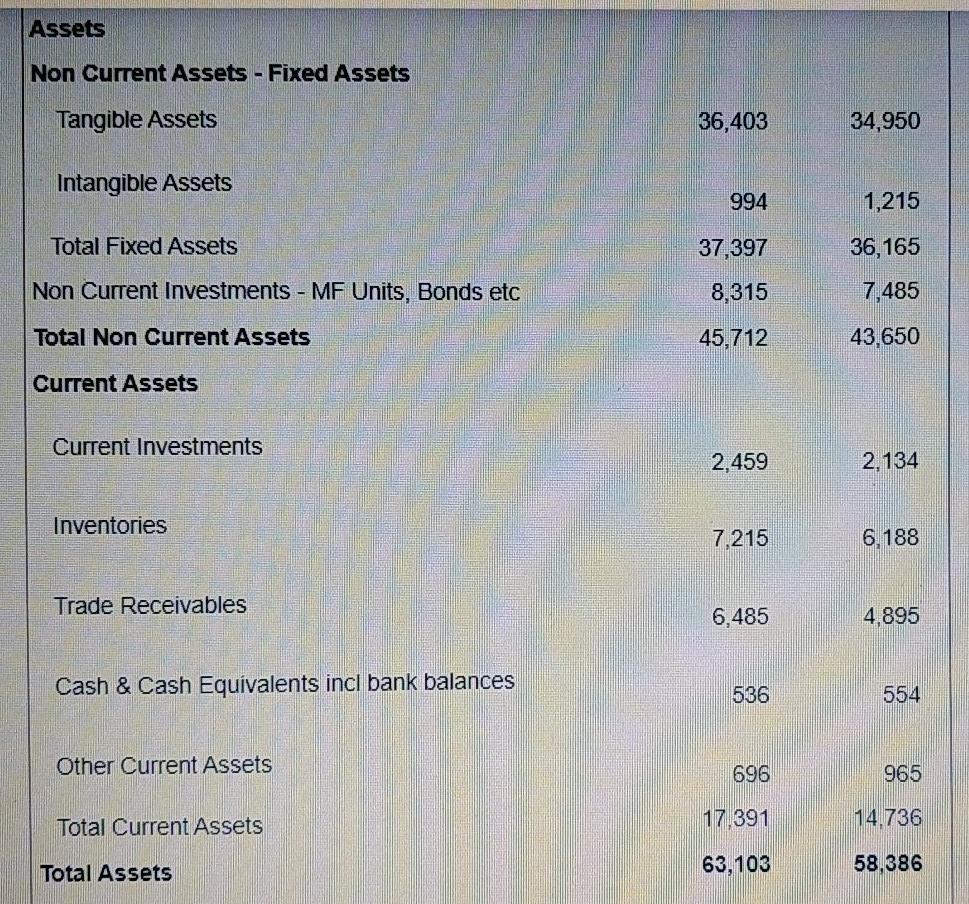

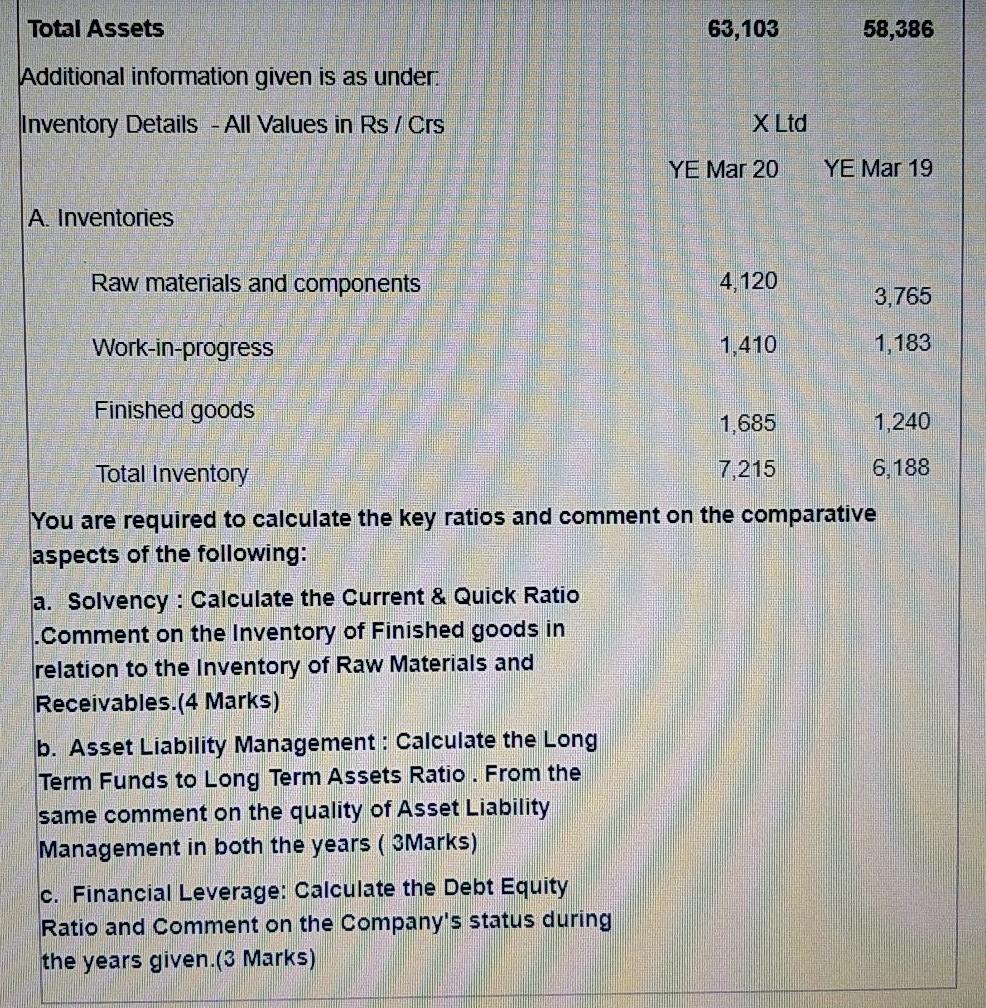

The Balance sheet of X Ltd for Year Ending March 19 and 20 is given below. X Ltd Balance Sheet - All Values in Rs / Crs YE Mar 20 YE Mar 19 654 654 Equity & Liabilities Share Capital [ Paid up Value per share Rs 5] Reserves & Surpluses Total Equity 20,435 16,587 21,089 17,241 Non Current Liabilities Long Term Borrowings 18,975 19,845 Total Non Current Liabilities 40 064 37,086 Current Liabilities Short Term Borrowings - working capital limits 5, 545 4,985 Trade Payables 11,250 12,150 Other current liabilities 6,244 4,165 Total Current Liabilities 23.039 21,300 Total Liabilities 63,103 58,386 Assets Non Current Assets - Fixed Assets Tangible Assets 36 403 34,950 Intangible Assets 994 1.215 Assets Non Current Assets - Fixed Assets Tangible Assets 36,403 34,950 Intangible Assets 994 1,215 Total Fixed Assets 37,397 36,165 Non Current Investments - MF Units, Bonds etc 8,315 7,485 Total Non Current Assets 45.712 43,650 Current Assets Current Investments 2,459 2.134 Inventories 7,215 6,188 Trade Receivables 6,485 4,895 Cash & Cash Equivalents incl bank balances 536 554 Other Current Assets 696 965 Total Current Assets 17,391 14.736 Total Assets 63,103 58,386 Total Assets 63,103 58,386 Additional information given is as under. Inventory Details - All Values in Rs / Crs X Ltd YE Mar 20 YE Mar 19 A. Inventories Raw materials and components 4,120 3,765 Work-in-progress 1,410 1,183 Finished goods 1,685 1,240 Total Inventory 7,215 6,188 You are required to calculate the key ratios and comment on the comparative aspects of the following: a. Solvency : Calculate the Current & Quick Ratio Comment on the Inventory of Finished goods in relation to the Inventory of Raw Materials and Receivables.(4 Marks) b. Asset Liability Management : Calculate the Long Term Funds to Long Term Assets Ratio . From the same comment on the quality of Asset Liability Management in both the years ( 3Marks) c. Financial Leverage: Calculate the Debt Equity Ratio and Comment on the Company's status during the years givenStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started