please ans through excel formulas

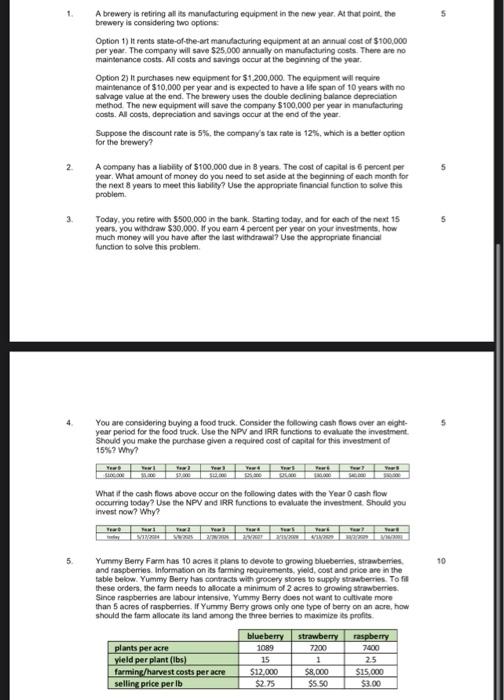

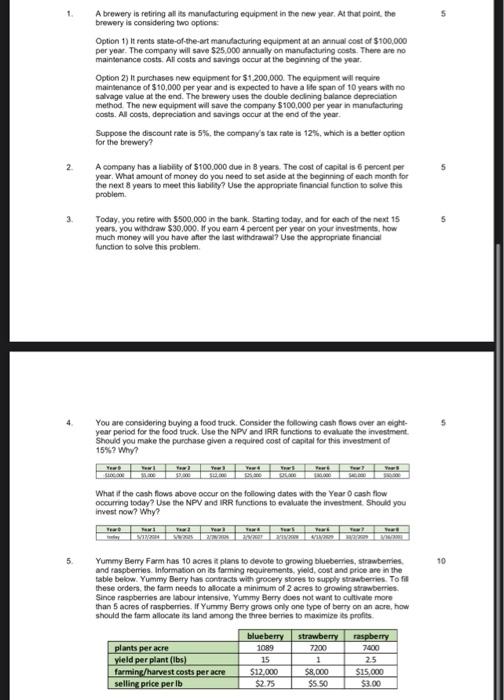

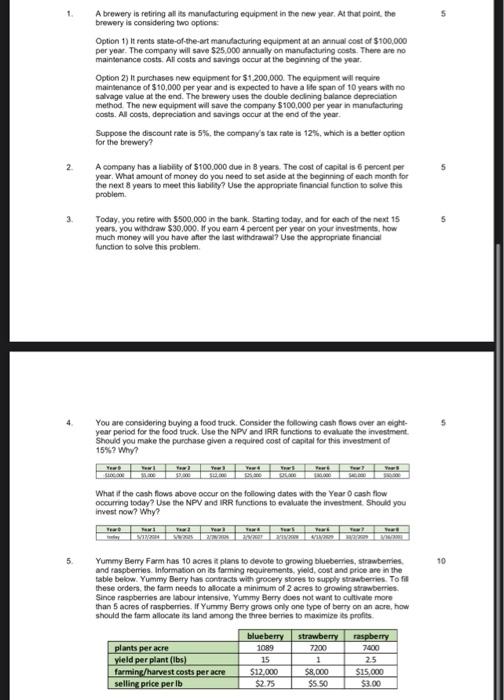

1. A brewery is retiring all its manufacturing equipenent in the new year. At that poine, the 5 brewery is considering two options: Option 1) it rents state-of-the-art manulacturing equipment at an annual cost of $100,000 per year. The company will save $25,000 annually on manufacturing costs. There are no maintenance costs. At costs and savings occur at the beginning of the yoar. Option 2) it purchates new equipment for $1,200,000. The equipment wil require mainsenance of $10,000 per year and is expected to have a life span of 10 years with no salvage value at the end. The brewery uses the double declining balance depreciation method. The new equipment will save the company $100,000 per year in manulacturing costs. All costs, depreciation and savings occur at the end of the year. Suppose the discount rate is 5%, the company's tax rale is 12%, which is a betler option for the brewery? 2. A company has a liabeity of $100.000 due in B years. The cost of capital is 6 percent per 5 year. What amount of money do you need to set aside at the beginning of each month for the next 8 years to meet this labilif? Use the appropriate financial finction to solve this problem. 3. Today, you retire with $500,000 in the bank. Starting today, and for each of the next 15 5 years. you withdraw $30.000. If you eam 4 percent per year on your investments, how much money will you have after the last withdrawal? Use the appropriate financial function to solve this problem. 4. You are considering buying a food truck. Consider the following cash flows over an eight- 5 year period for the food truck. Use the NPV and IRR functions to evaluate the investment. Should you make the purchase given a required cost of capital for this investment of 15% ? Wry? What it the cash flows above occur on the following dates with the Year 0 cash flow occurring today? Use the NPV and IRR functions to evaluate the investment. Should you invest now? Why? 5. Yummy Berry Farm has 10 acres z plans to devote to growing blueberries, strawberries and raspberries. Informaton on its farming requirements, yleld, cost and price are in the table below. Yummy Berry has contracts with grocery stores to supply stramberries. To fib these orders, the farm needs to allocate a minimum of 2 acres to growing strawberries. Since raspbernes are labour intensive, Yummy Berry does not wart to cultivate more than 5 acres of raspberries. If Yurnmy Benry grows only one type of berty on an acre, haw should the famm allocate its land among the three bernes to maximize is profits. 1. A brewery is retiring all its manufacturing equipenent in the new year. At that poine, the 5 brewery is considering two options: Option 1) it rents state-of-the-art manulacturing equipment at an annual cost of $100,000 per year. The company will save $25,000 annually on manufacturing costs. There are no maintenance costs. At costs and savings occur at the beginning of the yoar. Option 2) it purchates new equipment for $1,200,000. The equipment wil require mainsenance of $10,000 per year and is expected to have a life span of 10 years with no salvage value at the end. The brewery uses the double declining balance depreciation method. The new equipment will save the company $100,000 per year in manulacturing costs. All costs, depreciation and savings occur at the end of the year. Suppose the discount rate is 5%, the company's tax rale is 12%, which is a betler option for the brewery? 2. A company has a liabeity of $100.000 due in B years. The cost of capital is 6 percent per 5 year. What amount of money do you need to set aside at the beginning of each month for the next 8 years to meet this labilif? Use the appropriate financial finction to solve this problem. 3. Today, you retire with $500,000 in the bank. Starting today, and for each of the next 15 5 years. you withdraw $30.000. If you eam 4 percent per year on your investments, how much money will you have after the last withdrawal? Use the appropriate financial function to solve this problem. 4. You are considering buying a food truck. Consider the following cash flows over an eight- 5 year period for the food truck. Use the NPV and IRR functions to evaluate the investment. Should you make the purchase given a required cost of capital for this investment of 15% ? Wry? What it the cash flows above occur on the following dates with the Year 0 cash flow occurring today? Use the NPV and IRR functions to evaluate the investment. Should you invest now? Why? 5. Yummy Berry Farm has 10 acres z plans to devote to growing blueberries, strawberries and raspberries. Informaton on its farming requirements, yleld, cost and price are in the table below. Yummy Berry has contracts with grocery stores to supply stramberries. To fib these orders, the farm needs to allocate a minimum of 2 acres to growing strawberries. Since raspbernes are labour intensive, Yummy Berry does not wart to cultivate more than 5 acres of raspberries. If Yurnmy Benry grows only one type of berty on an acre, haw should the famm allocate its land among the three bernes to maximize is profits