Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Answer 1 Questions. Some assumptions to be used in the case analysis: i) Blaine earns 5.85% interest on its cash & marketable securities, ii)

Please Answer 1

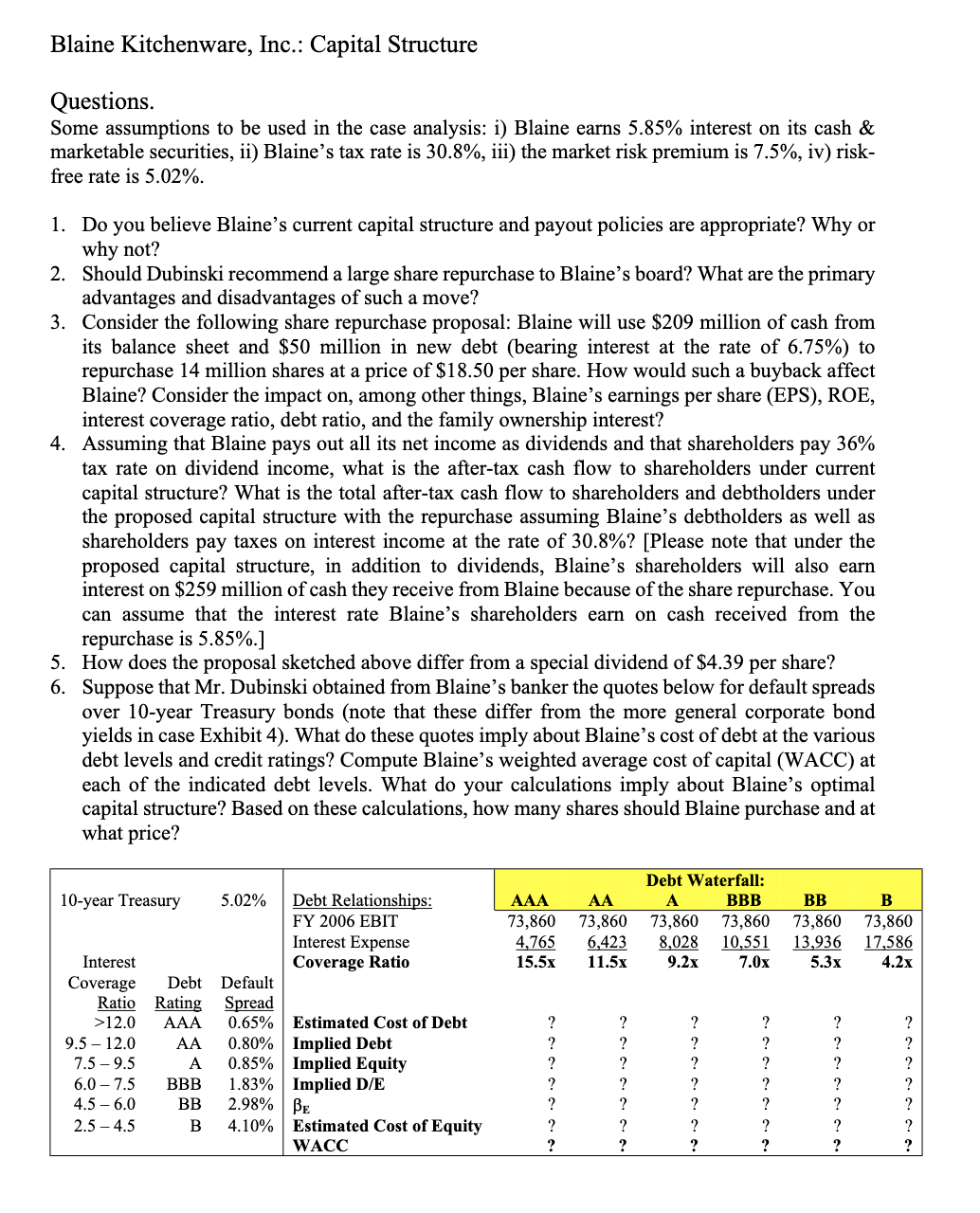

Questions. Some assumptions to be used in the case analysis: i) Blaine earns 5.85% interest on its cash \& marketable securities, ii) Blaine's tax rate is 30.8%, iii) the market risk premium is 7.5%, iv) riskfree rate is 5.02%. 1. Do you believe Blaine's current capital structure and payout policies are appropriate? Why or why not? 2. Should Dubinski recommend a large share repurchase to Blaine's board? What are the primary advantages and disadvantages of such a move? 3. Consider the following share repurchase proposal: Blaine will use \$209 million of cash from its balance sheet and $50 million in new debt (bearing interest at the rate of 6.75% ) to repurchase 14 million shares at a price of $18.50 per share. How would such a buyback affect Blaine? Consider the impact on, among other things, Blaine's earnings per share (EPS), ROE, interest coverage ratio, debt ratio, and the family ownership interest? 4. Assuming that Blaine pays out all its net income as dividends and that shareholders pay 36% tax rate on dividend income, what is the after-tax cash flow to shareholders under current capital structure? What is the total after-tax cash flow to shareholders and debtholders under the proposed capital structure with the repurchase assuming Blaine's debtholders as well as shareholders pay taxes on interest income at the rate of 30.8\%? [Please note that under the proposed capital structure, in addition to dividends, Blaine's shareholders will also earn interest on $259 million of cash they receive from Blaine because of the share repurchase. You can assume that the interest rate Blaine's shareholders earn on cash received from the repurchase is 5.85%.] 5. How does the proposal sketched above differ from a special dividend of $4.39 per share? 6. Suppose that Mr. Dubinski obtained from Blaine's banker the quotes below for default spreads over 10-year Treasury bonds (note that these differ from the more general corporate bond yields in case Exhibit 4). What do these quotes imply about Blaine's cost of debt at the various debt levels and credit ratings? Compute Blaine's weighted average cost of capital (WACC) at each of the indicated debt levels. What do your calculations imply about Blaine's optimal capital structure? Based on these calculations, how many shares should Blaine purchase and at what priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started