Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer 1 through 9 Fraud Risk Factors Bond, CPA, is considering audit risk at the financial statement level in planning the audit of Toxic

Please answer 1 through 9

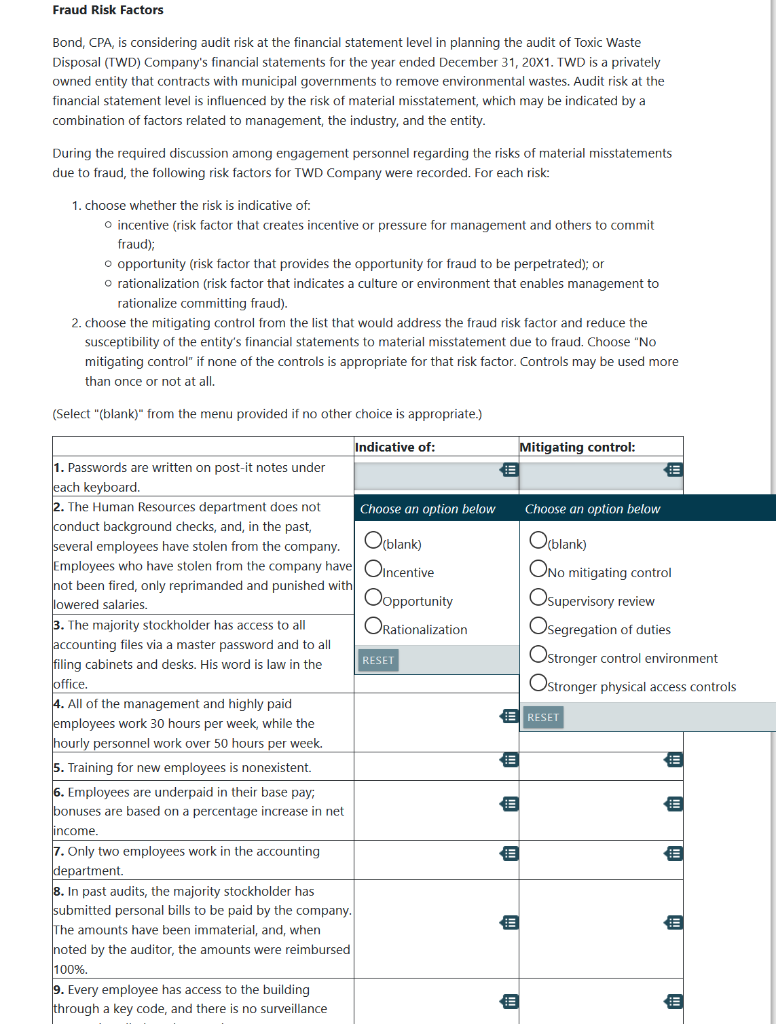

Fraud Risk Factors Bond, CPA, is considering audit risk at the financial statement level in planning the audit of Toxic Waste Disposal (TWD) Company's financial statements for the year ended December 31, 20X1. TWD is a privately owned entity that contracts with municipal governments to remove environmental wastes. Audit risk at the financial statement level is influenced by the risk of material misstatement, which may be indicated by a combination of factors related to management, the industry, and the entity. During the required discussion among engagement personnel regarding the risks of material misstatements due to fraud, the following risk factors for TWD Company were recorded. For each risk: 1. choose whether the risk is indicative of: o incentive (risk factor that creates incentive or pressure for management and others to commit fraud); o opportunity (risk factor that provides the opportunity for fraud to be perpetrated); or o rationalization (risk factor that indicates a culture or environment that enables management to rationalize committing fraud). 2. choose the mitigating control from the list that would address the fraud risk factor and reduce the susceptibility of the entity's financial statements to material misstatement due to fraud. Choose "No mitigating control" if none of the controls is appropriate for that risk factor. Controls may be used more than once or not at all. (Select "blank)" from the menu provided if no other choice is appropriate.) Mitigating control: Choose an option below (blank) (blank) No mitigating control Osupervisory review Osegregation of duties Ostronger control environment Ostronger physical access controls RESET Indicative of: 1. Passwords are written on post-it notes under each keyboard 2. The Human Resources department does not Choose an option below conduct background checks, and, in the past, several employees have stolen from the company. Employees who have stolen from the company have incentive not been fired, only reprimanded and punished with lowered salaries. Oopportunity 3. The majority stockholder has access to all Rationalization accounting files via a master password and to all RESET filing cabinets and desks. His word is law in the office. 4. All of the management and highly paid employees work 30 hours per week, while the hourly personnel work over 50 hours per week. 5. Training for new employees is nonexistent. 6. Employees are underpaid in their base pay, bonuses are based on a percentage increase in net income. 7. Only two employees work in the accounting department 8. In past audits, the majority stockholder has submitted personal bills to be paid by the company. The amounts have been immaterial, and, when noted by the auditor, the amounts were reimbursed 100%. 9. Every employee has access to the building through a key code, and there is no surveillanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started