Question

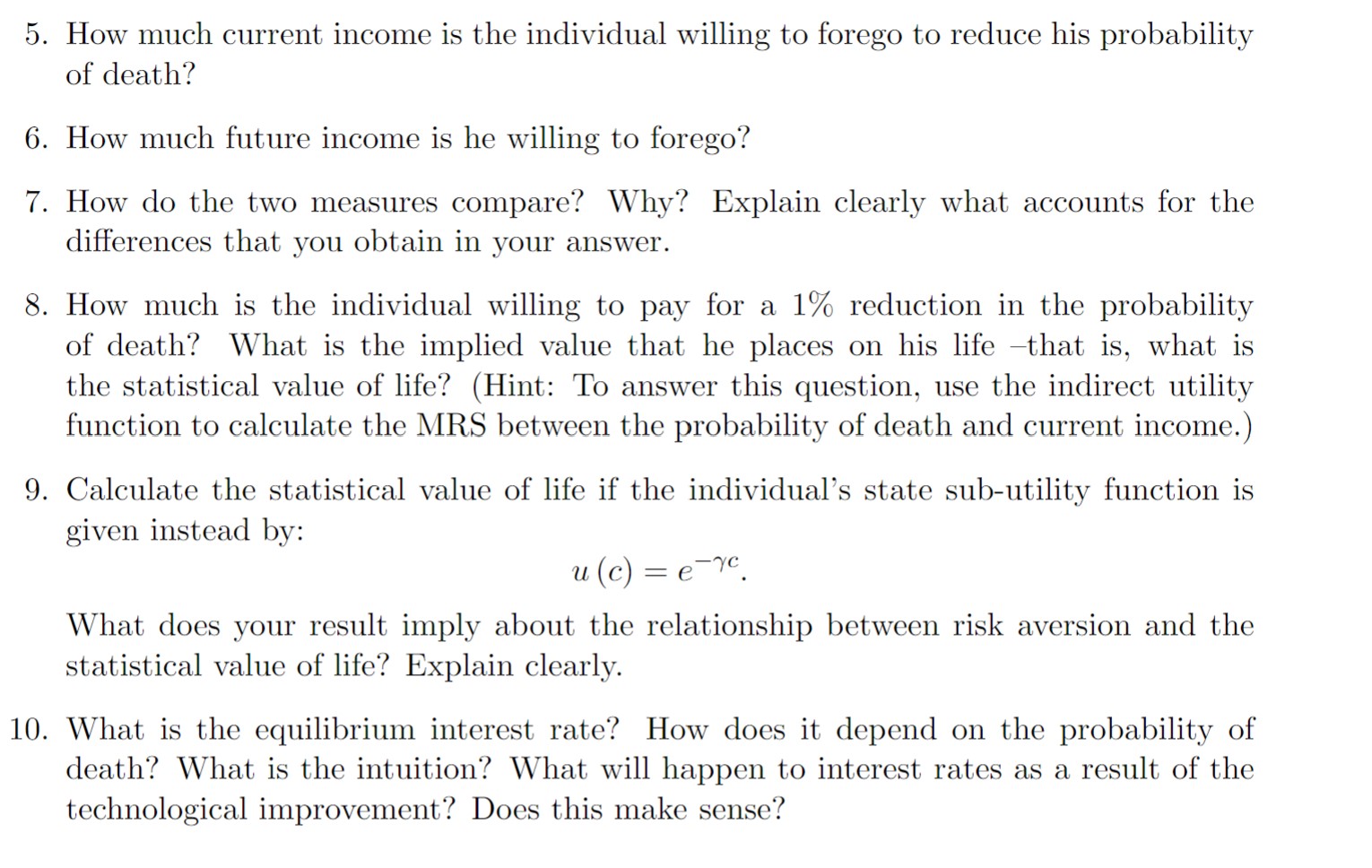

Please answer 10. All figures, tables, data provided. Suppose that an individual may live up to two periods. That is, the individual lives for certain

Please answer 10. All figures, tables, data provided.

Suppose that an individual may live up to two periods. That is, the individual lives for certain during period t. In that period, his sub-utility function is given by: u(ct) = log ct. The individual survives period t and lives into period t+ 1 with probability p. If he is alive in period t + 1, then his state sub-utility function is given by:

u(ct+1) = log ct+1

and if he dies, he receives the fixed utility level B.

We make the following assumptions: 1. The individual has access to a perfect capital market. 2. The individual discounts the future at a rate of . 3. The individual's endowment is given by (t,t+1).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started