Please answer 1-10

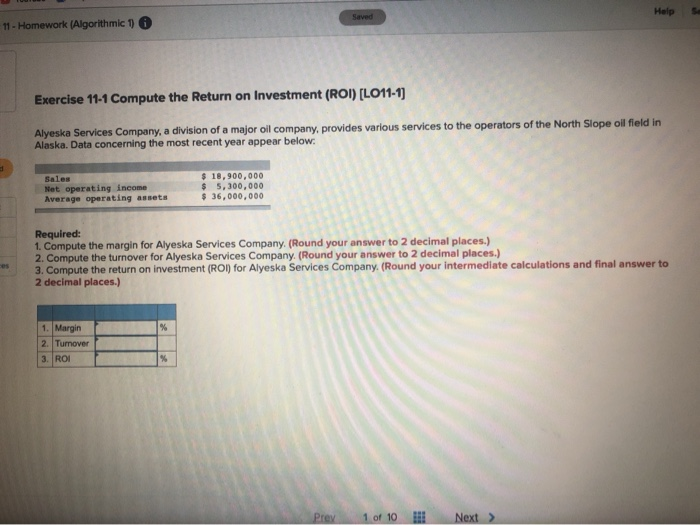

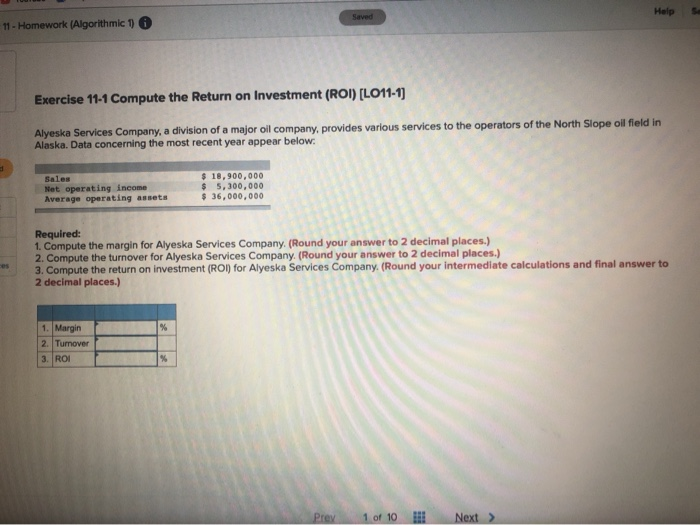

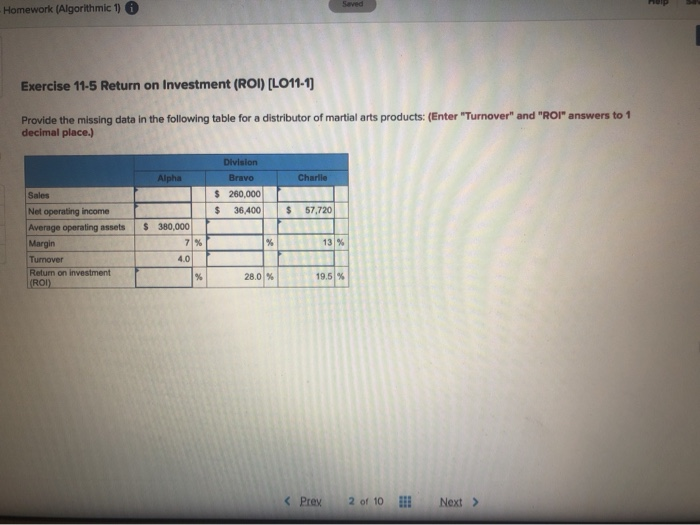

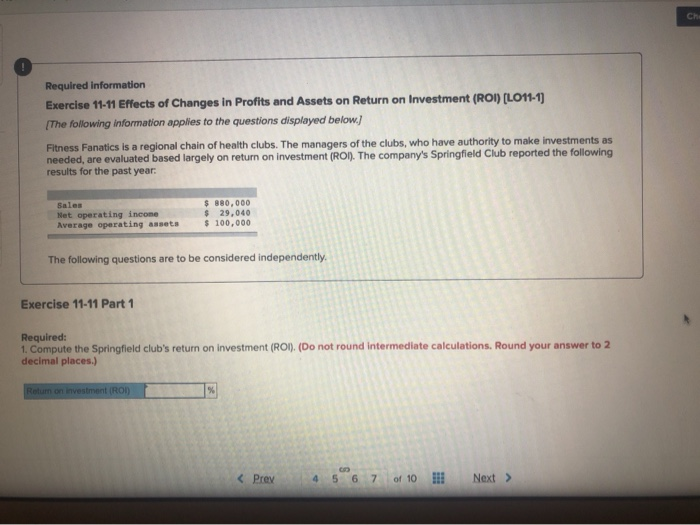

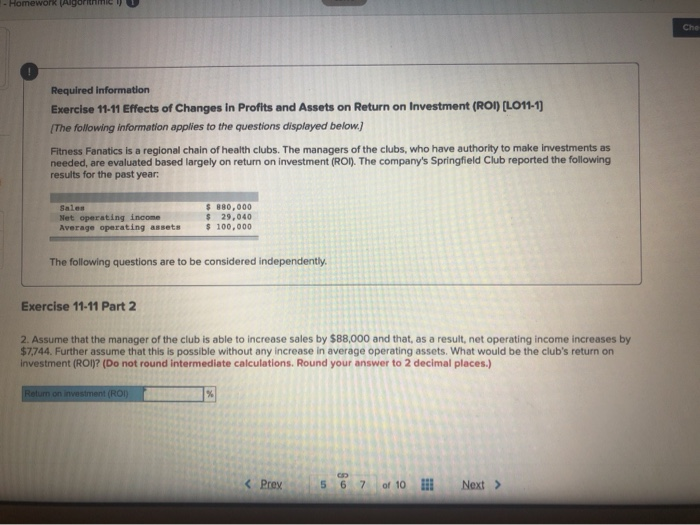

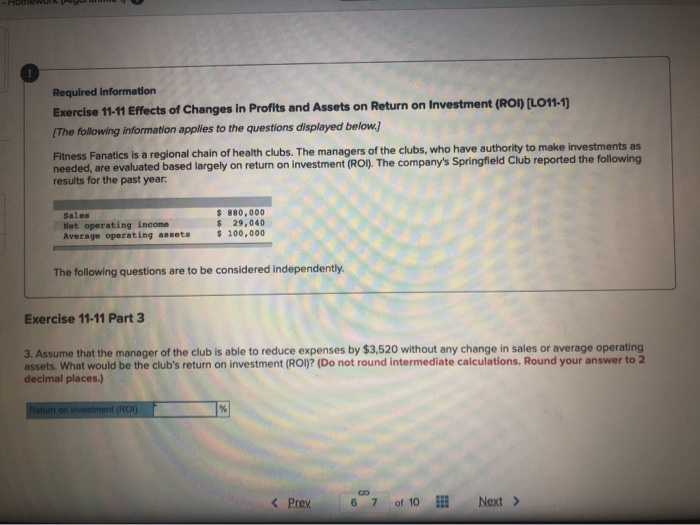

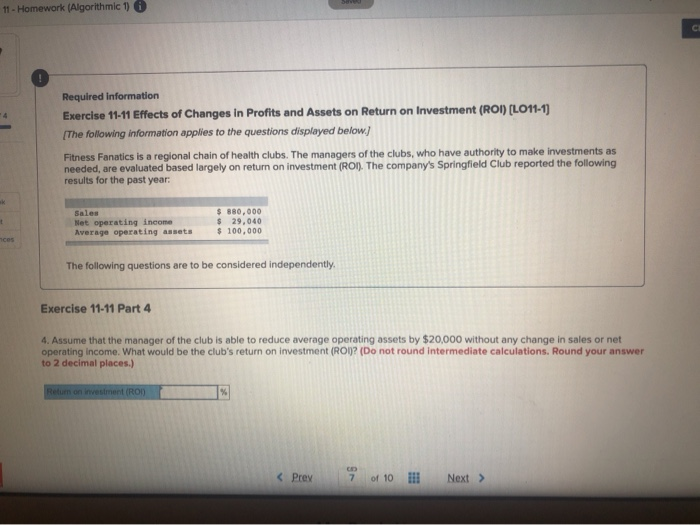

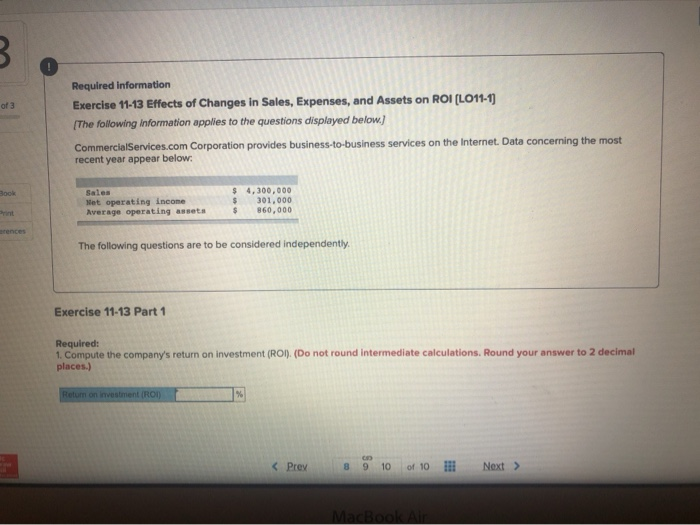

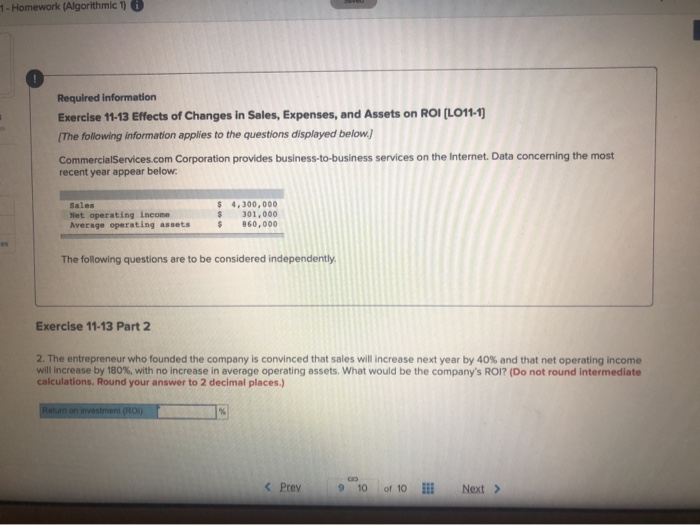

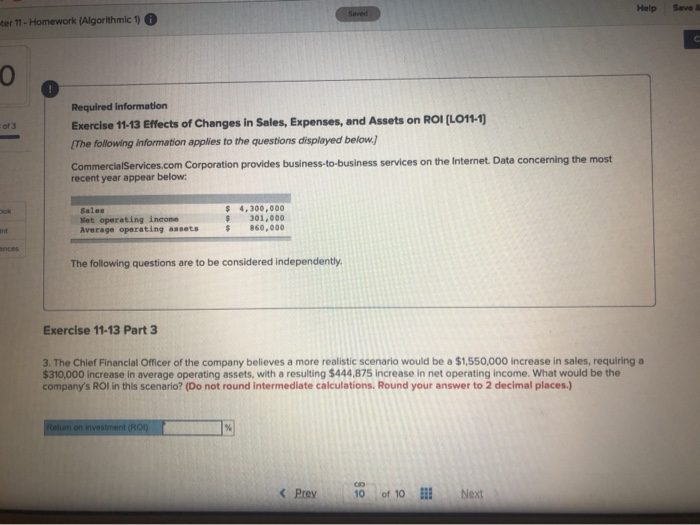

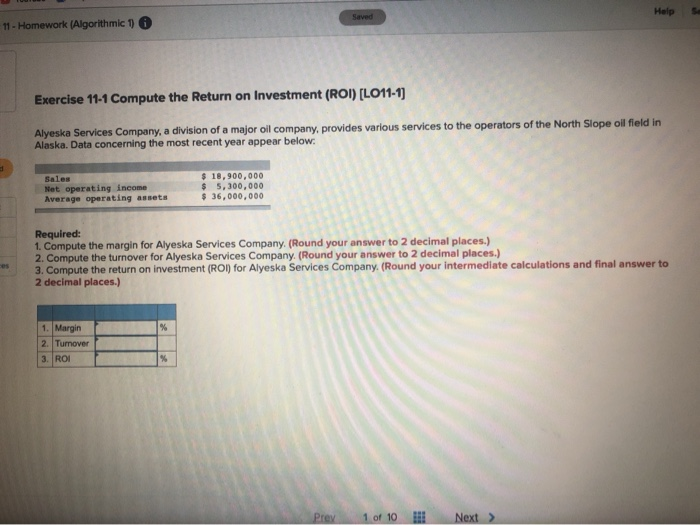

11 - Homework (Algorithmic 1) Help Exercise 11-1 Compute the Return on Investment (ROI) (L011-1) Alyeska Services Company, a division of a major oil company, provides various services to the operators of the North Slope oil field in Alaska. Data concerning the most recent year appear below. Net operating income Average operating assets $18.900.000 $ 5,300.000 $ 36,000,000 Required: 1. Compute the margin for Alyeska Services Company. (Round your answer to 2 decimal places.) 2. Compute the turnover for Alyeska Services Company. (Round your answer to 2 decimal places.) 3. Compute the return on investment (ROI) for Alyeska Services Company. (Round your intermediate calculations and final answer to 2 decimal places.) 1. Margin 2. Tumover 1 of 10 Next > Homework (Algorithmic 1) Exercise 11-5 Return on Investment (ROI) (LO11-1) Provide the missing data in the following table for a distributor of martial arts products: (Enter "Turnover" and "ROT" answers to 1 decimal place.) Division Bravo Alpha Charlie $ $ 260,000 36.400 $ 57,720 Net operating income Average operating assets Margin $ 380,000 13% 4.01 Turnover Return on investment (ROI) % 28.0% 19.5 Homework (Algorithmic 1) 0 Exercise 11-8 Computing and Interpreting Return on Investment (ROI) [LO11-1) Selected operating data for two divisions of Outback Brewing, Ltd., of Australia are given below: Division New South Queensland Wales $ 2.176.000 $3,445,000 $ 640,000 $ 650,000 $ 250.240 $ 275,600 $ 264,000 $ 214,000 Sales Average operating assets Net operating income Property, plant, and equipment (net) Required: 1. Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover, 2. Which divisional manager seems to be doing the better job? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover. (Round your answers to 2 decimal places.) Margin Turnover ROI Queensland division New South Wales division % % Required 2 > Required information Exercise 11-11 Effects of Changes in Profits and Assets on Return on Investment (ROI) (L011-1) The following information applies to the questions displayed below.) Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI. The company's Springfield Club reported the following results for the past year Het operating income Average operating assets $ 880,000 $ 29,040 $ 100,000 The following questions are to be considered independently. Exercise 11-11 Part 1 Required: 1. Compute the Springfield club's return on investment (ROI) (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (RON) - Homework f or U Che Required information Exercise 11-11 Effects of Changes In Profits and Assets on Return on Investment (ROI) (LO11-1) The following information applies to the questions displayed below.) Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make Investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reported the following results for the past year: Net operating income Average operating assets $ 800,000 $ 29,040 $100,000 The following questions are to be considered independently. Exercise 11-11 Part 2 2. Assume that the manager of the club is able to increase sales by $88,000 and that, as a result, net operating income increases by $7,744. Further assume that this is possible without any increase in average operating assets. What would be the club's return on investment (ROI? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (RON) Required information Exercise 11-11 Effects of Changes in Profits and Assets on Return on Investment (ROI) (LO11-1) (The following information applies to the questions displayed below.) Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make Investments as needed, are evaluated based largely on return on investment (ROI. The company's Springfield Club reported the following results for the past year: Sales Met operating income Average operating assets $ 880,000 $ 29,040 $100.000 The following questions are to be considered independently. Exercise 11-11 Part 3 3. Assume that the manager of the club is able to reduce expenses by $3,520 without any change in sales or average operating assets. What would be the club's return on investment (RON? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) 11 - Homework (Algorithmic 1) Required information Exercise 11-11 Effects of Changes in Profits and Assets on Return on Investment (ROI) (LO11-1) (The following information applies to the questions displayed below.) Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI. The company's Springfield Club reported the following results for the past year: S880,000 29.040 Net operating income The following questions are to be considered independently Exercise 11-11 Part 4 4. Assume that the manager of the club is able to reduce average operating assets by $20,000 without any change in sales or net operating income. What would be the club's return on investment (ROI? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) of 3 Required information Exercise 11-13 Effects of Changes in Sales, Expenses, and Assets on ROI (LO11-1) The following information applies to the questions displayed below.) CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below. $ $ Net operating income Average operating assets 4,300,000 301.000 860,000 The following questions are to be considered independently. Exercise 11-13 Part 1 Required: 1. Compute the company's return on investment (ROI). (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) % 1 - Homework (Algorithmic 1) Required information Exercise 11-13 Effects of Changes in Sales, Expenses, and Assets on ROI (L011-1) (The following information applies to the questions displayed below! CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below. Net operating income Average operating assets $ $ $ 4,300,000 301.000 860.000 The following questions are to be considered independently. Exercise 11-13 Part 2 2. The entrepreneur who founded the company is convinced that sales will increase next year by 40% and that net operating income will increase by 180%, with no increase in average operating assets. What would be the company's ROI? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (RON) ter 11 - Homework (Algorithmic 1) Required information Exercise 11-13 Effects of Changes in Sales, Expenses, and Assets on ROI (L011-1) The following information applies to the questions displayed below.) CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below. $ Sales Nat operating income Average operating assets 4,300.000 301.000 360.000 The following questions are to be considered independently, Exercise 11-13 Part 3 3. The Chief Financial Officer of the company believes a more realistic scenario would be a $1,550,000 increase in sales, requiring a $310,000 increase in average operating assets, with a resulting $444,875 increase in net operating income. What would be the company's ROI in this scenario? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Rem on investment (RON) Homework (Algorithmic 1) Exercise 11-5 Return on Investment (ROI) (LO11-1) Provide the missing data in the following table for a distributor of martial arts products: (Enter "Turnover" and "ROT" answers to 1 decimal place.) Division Bravo Alpha Charlie $ $ 260,000 36.400 $ 57,720 Net operating income Average operating assets Margin $ 380,000 13% 4.01 Turnover Return on investment (ROI) % 28.0% 19.5 Homework (Algorithmic 1) 0 Exercise 11-8 Computing and Interpreting Return on Investment (ROI) [LO11-1) Selected operating data for two divisions of Outback Brewing, Ltd., of Australia are given below: Division New South Queensland Wales $ 2.176.000 $3,445,000 $ 640,000 $ 650,000 $ 250.240 $ 275,600 $ 264,000 $ 214,000 Sales Average operating assets Net operating income Property, plant, and equipment (net) Required: 1. Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover, 2. Which divisional manager seems to be doing the better job? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover. (Round your answers to 2 decimal places.) Margin Turnover ROI Queensland division New South Wales division % % Required 2 > Required information Exercise 11-11 Effects of Changes in Profits and Assets on Return on Investment (ROI) (L011-1) The following information applies to the questions displayed below.) Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI. The company's Springfield Club reported the following results for the past year Het operating income Average operating assets $ 880,000 $ 29,040 $ 100,000 The following questions are to be considered independently. Exercise 11-11 Part 1 Required: 1. Compute the Springfield club's return on investment (ROI) (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (RON) - Homework f or U Che Required information Exercise 11-11 Effects of Changes In Profits and Assets on Return on Investment (ROI) (LO11-1) The following information applies to the questions displayed below.) Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make Investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reported the following results for the past year: Net operating income Average operating assets $ 800,000 $ 29,040 $100,000 The following questions are to be considered independently. Exercise 11-11 Part 2 2. Assume that the manager of the club is able to increase sales by $88,000 and that, as a result, net operating income increases by $7,744. Further assume that this is possible without any increase in average operating assets. What would be the club's return on investment (ROI? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (RON) Required information Exercise 11-11 Effects of Changes in Profits and Assets on Return on Investment (ROI) (LO11-1) (The following information applies to the questions displayed below.) Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make Investments as needed, are evaluated based largely on return on investment (ROI. The company's Springfield Club reported the following results for the past year: Sales Met operating income Average operating assets $ 880,000 $ 29,040 $100.000 The following questions are to be considered independently. Exercise 11-11 Part 3 3. Assume that the manager of the club is able to reduce expenses by $3,520 without any change in sales or average operating assets. What would be the club's return on investment (RON? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) 11 - Homework (Algorithmic 1) Required information Exercise 11-11 Effects of Changes in Profits and Assets on Return on Investment (ROI) (LO11-1) (The following information applies to the questions displayed below.) Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI. The company's Springfield Club reported the following results for the past year: S880,000 29.040 Net operating income The following questions are to be considered independently Exercise 11-11 Part 4 4. Assume that the manager of the club is able to reduce average operating assets by $20,000 without any change in sales or net operating income. What would be the club's return on investment (ROI? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) of 3 Required information Exercise 11-13 Effects of Changes in Sales, Expenses, and Assets on ROI (LO11-1) The following information applies to the questions displayed below.) CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below. $ $ Net operating income Average operating assets 4,300,000 301.000 860,000 The following questions are to be considered independently. Exercise 11-13 Part 1 Required: 1. Compute the company's return on investment (ROI). (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) % 1 - Homework (Algorithmic 1) Required information Exercise 11-13 Effects of Changes in Sales, Expenses, and Assets on ROI (L011-1) (The following information applies to the questions displayed below! CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below. Net operating income Average operating assets $ $ $ 4,300,000 301.000 860.000 The following questions are to be considered independently. Exercise 11-13 Part 2 2. The entrepreneur who founded the company is convinced that sales will increase next year by 40% and that net operating income will increase by 180%, with no increase in average operating assets. What would be the company's ROI? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Return on investment (RON) ter 11 - Homework (Algorithmic 1) Required information Exercise 11-13 Effects of Changes in Sales, Expenses, and Assets on ROI (L011-1) The following information applies to the questions displayed below.) CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below. $ Sales Nat operating income Average operating assets 4,300.000 301.000 360.000 The following questions are to be considered independently, Exercise 11-13 Part 3 3. The Chief Financial Officer of the company believes a more realistic scenario would be a $1,550,000 increase in sales, requiring a $310,000 increase in average operating assets, with a resulting $444,875 increase in net operating income. What would be the company's ROI in this scenario? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Rem on investment (RON)