Answered step by step

Verified Expert Solution

Question

1 Approved Answer

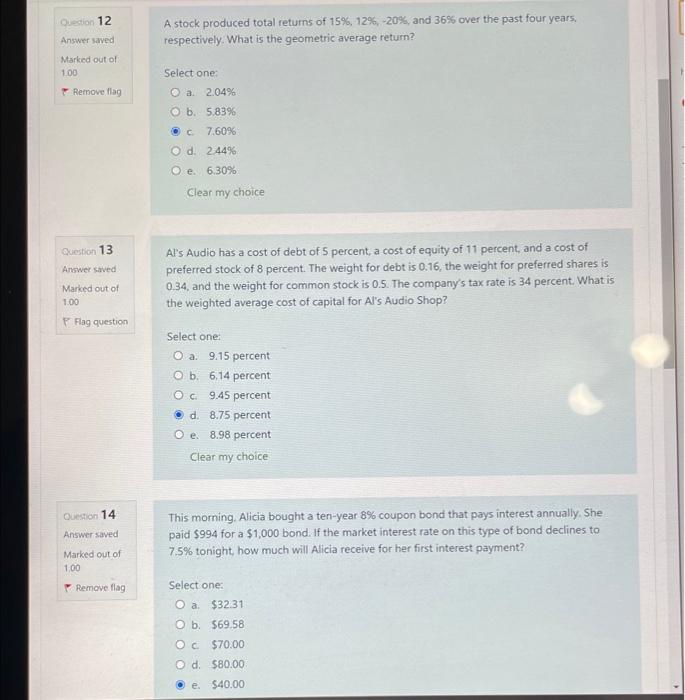

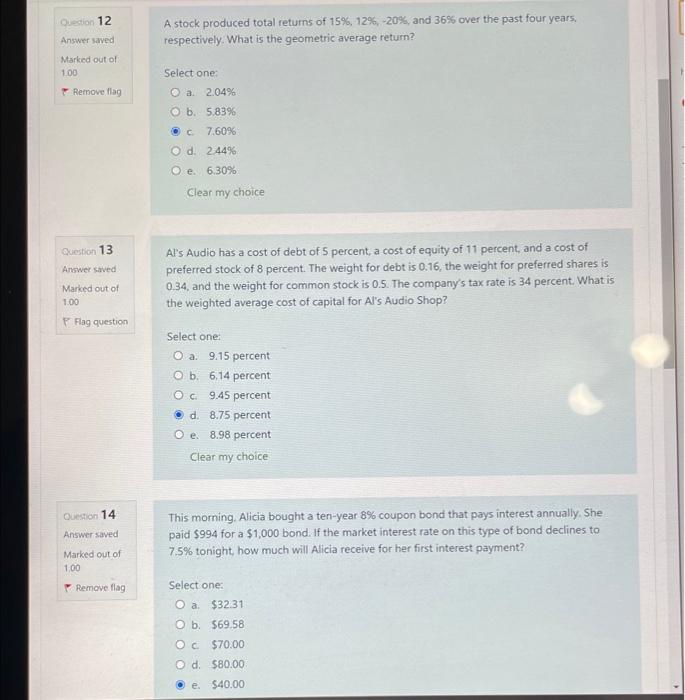

please answer 12 and 14 Quedin 12 Answer saved A stock produced total returns of 15%, 12%, -20% and 36% over the past four years,

please answer 12 and 14

Quedin 12 Answer saved A stock produced total returns of 15%, 12%, -20% and 36% over the past four years, respectively. What is the geometric average return? Marked out of 100 Select one: 2.04% Remove lag b. 5.83% 7.60% d. 2.44% O e. 6.30% Clear my choice a Question 13 Answer saved Al's Audio has a cost of debt of 5 percent, a cost of equity of 11 percent, and a cost of preferred stock of 8 percent. The weight for debt is 0.16, the weight for preferred shares is 0,34, and the weight for common stock is 0.5. The company's tax rate is 34 percent. What is the weighted average cost of capital for Al's Audio Shop? Marked out of 1.00 Flag question Select one: O a. 9.15 percent O b. 6.14 percent Oc 9.45 percent d. 8.75 percent e. 8.98 percent Clear my choice Question 14 Answer saved This morning, Alicia bought a ten-year 8% coupon bond that pays interest annually. She paid $994 for a $1,000 bond. If the market interest rate on this type of bond declines to 7.5% tonight how much will Alicia receive for her first interest payment? Marked out of 1.00 Remove flag Select one: O a $32.31 O b$69.58 OC $70.00 d. $80.00 . e. $40.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started