please answer 1-3

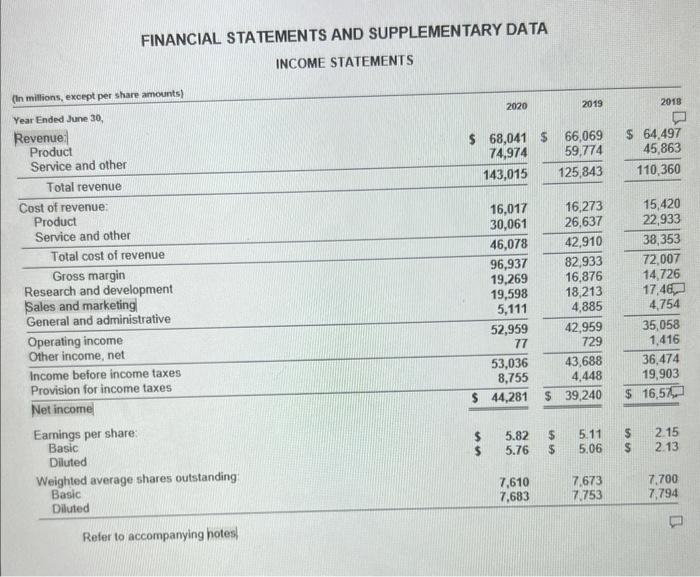

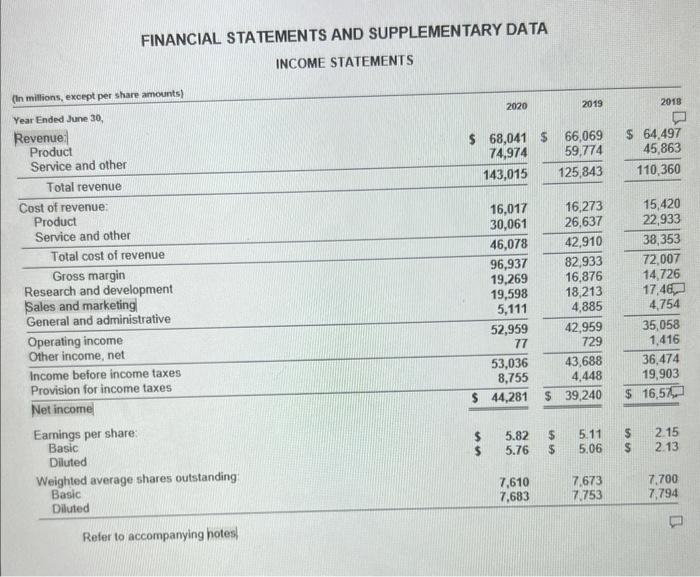

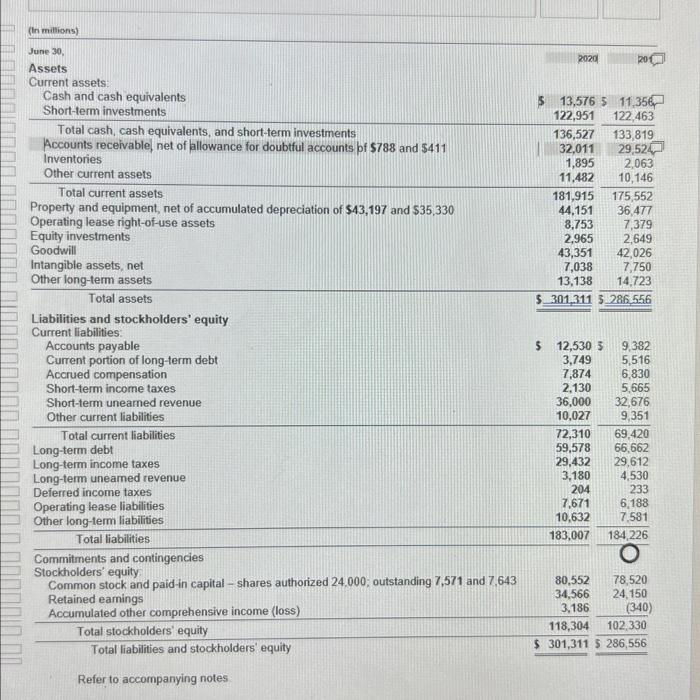

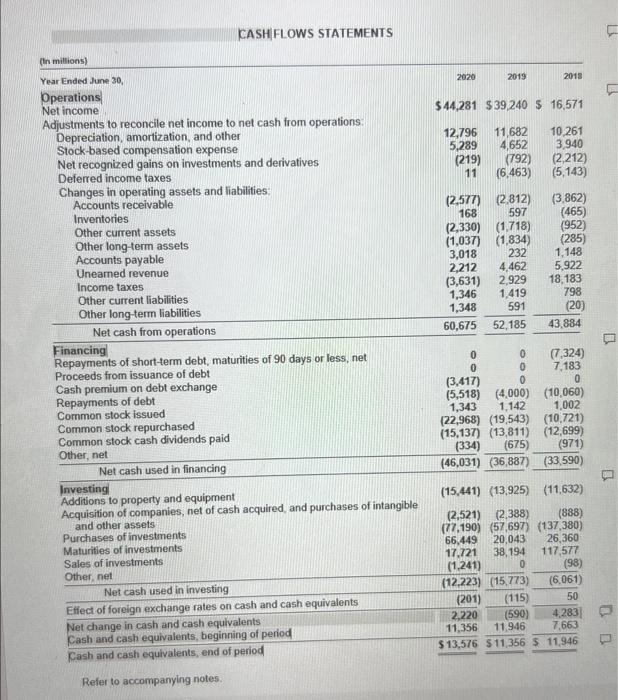

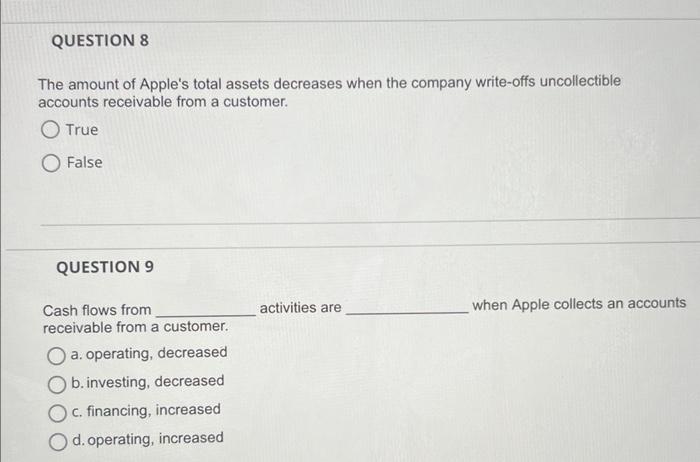

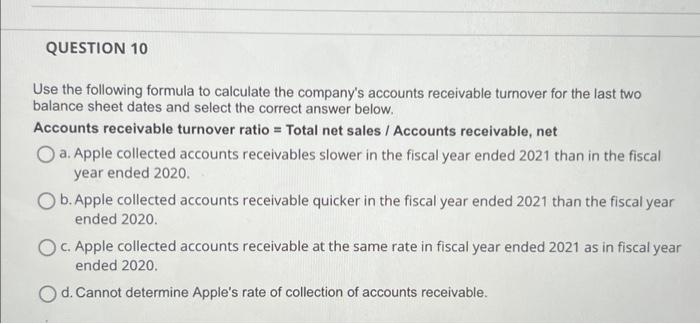

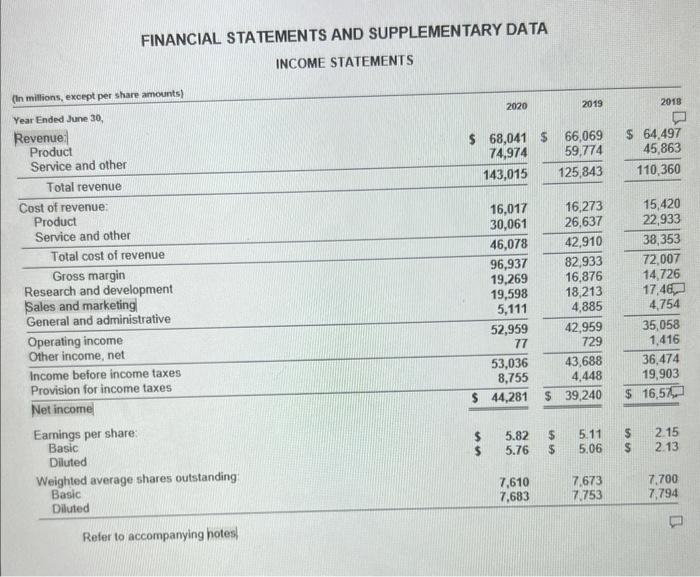

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA ( ln millions) June 30 , Assets Current assets: Cash and cash equivalents Short-term investments Total cash, cash equivalents, and short-term investments Accounts receivable, net of allowance for doubtful accounts pf $788 and 5411 Inventories Other current assets Total current assets Property and equipment, net of accumulated depreciation of $43,197 and $35,330 Onerating lease right-of-use assets Operating lease righ Equity investments Goodwill Goodwill Intangible assets, net Other long-term assets Total assets Liabilities and stockholders' equity Current llabilities: Current liabilities: Accounts payable Current portion of long-term debt Accrued compensation Short-term income taxes. Short-term unearned revenue Other current liabilities Total current liabilities ong-term debt ong-term income taxes ong-tem uneamed revenue Deferred income taxes Operating lease liabilities Totalliabilities.Otherlong-termliabilities Commitments and contingencies Stockholders' equity? Refer to accompanying notes KASHIFLOWS STATEMENTS (tn miltions) Year Ended June 30 Operations Net income Adjustments to reconcile net income to net cash from operations: Depreciation, amortization, and other Stock-based compensation expense Net recognized gains on investments and derivatives Deferred income taxes Changes in operating assets and liabilities: Accounts receivable Inventories Other current assets Other long-term assets Accounts payable Unearned revenue Income taxes Other current liabilities Other long-term liabilities Net cash from operations inancing Prayments of short-term debt, maturitied aceeds from issuance of debt epremium on debt exchange ommonts of debt Aommon stock repurchased Common stock cash dividends paid Acquisition of companies, net of cash acquired, and purchases of intangible and other assets Purchases of investments Maturities of investments $44,281$39,2405,16,571 Refer to accompanying notes. The amount of Apple's total assets decreases when the company write-offs uncollectible accounts receivable from a customer. True False QUESTION 9 Cash flows from activities are when Apple collects an accounts receivable from a customer. a. operating, decreased b. investing, decreased c. financing, increased d. operating, increased Use the following formula to calculate the company's accounts receivable turnover for the last two balance sheet dates and select the correct answer below. Accounts receivable turnover ratio = Total net sales / Accounts receivable, net a. Apple collected accounts receivables slower in the fiscal year ended 2021 than in the fiscal year ended 2020. b. Apple collected accounts receivable quicker in the fiscal year ended 2021 than the fiscal year ended 2020. c. Apple collected accounts receivable at the same rate in fiscal year ended 2021 as in fiscal year ended 2020. d. Cannot determine Apple's rate of collection of accounts receivable