please answer 1-3

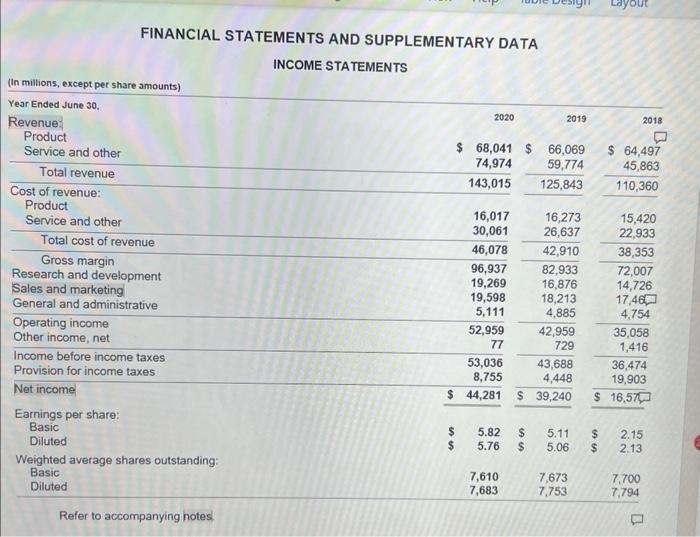

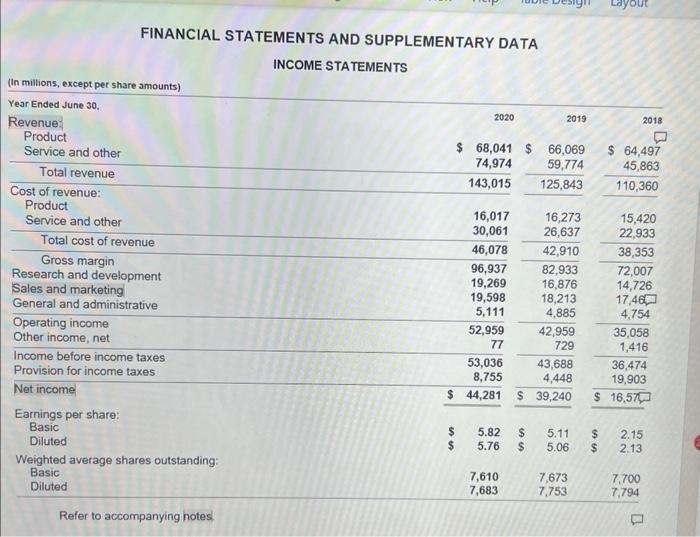

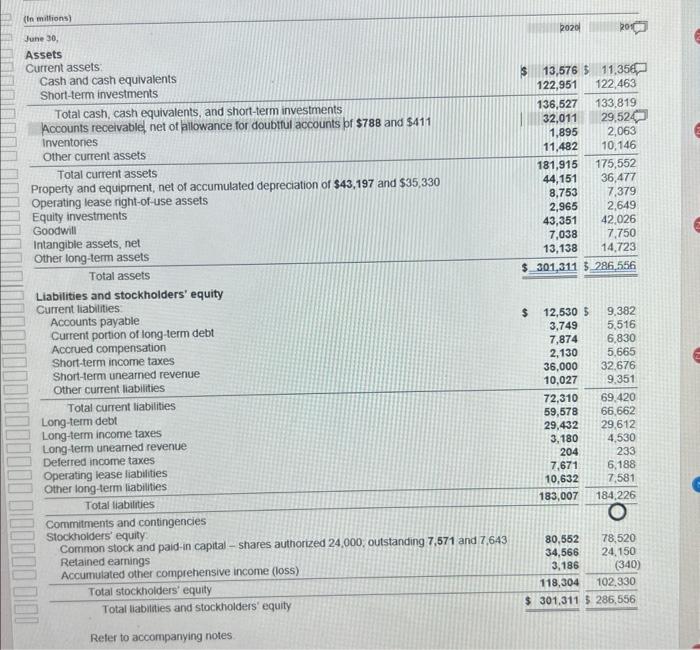

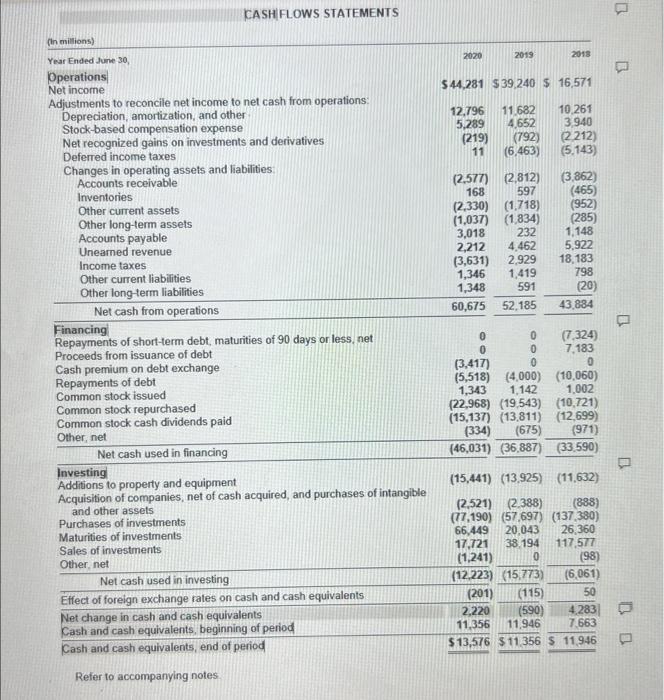

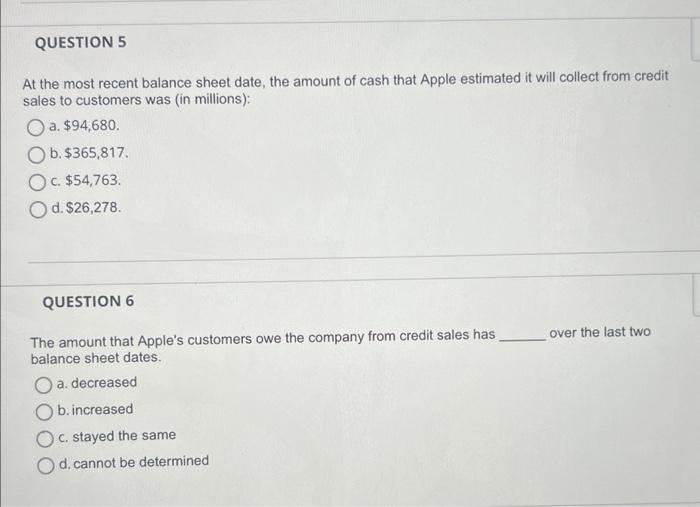

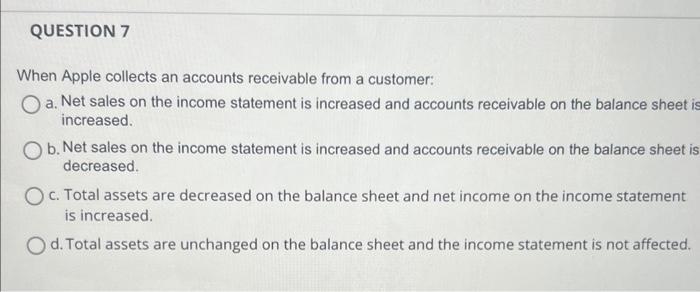

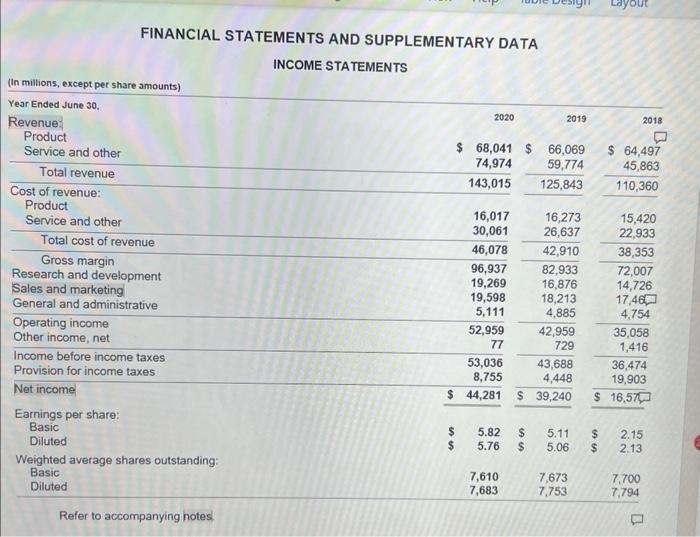

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA (tn mittions) June 30, Assets Current assets; Cash and cash equivalents Short-term investments Total cash, cash equivalents, and short-term investments Total cash, cash equivalents, and short-tem investments Accounts receivable, net of pllowance for doubtul accounts of $788 and $411 Inventories Other current assets Total current assets Property and equipment, net of accumulated depreciation of $43,197 and $35,330 KASHIFLOWS STATEMENTS (In miltions) Year Ended June 30 Operations. Net income Adjustments to reconcile net income to net cash from operations: Depreciation, amortization, and other Stock-based compensation expense Net recognized gains on investments and derivatives Deferred income taxes Changes in operating assets and liabilities: Accounts receivable Inventories Other cument assets Other long-term assets Accounts payable Uneamed revenue Income taxes Other current liabilities Other long-term liabilities Net cash from operations Nancing Proceeds from issuance of debt Cash premium on debt exchange Repayments of debt Common stock issued Common stock repurchased Common stock cash dividends paid Other, net Investing cash used in financing Additions to property and equipment Acquisition of companies, net of cash acquired, and purchases of intangible and other assets Purchases of investments Maturities of irvestments Sales of investments (15,441)(13,925)(11,632) Refer to accompanying notes. At the most recent balance sheet date, the amount of cash that Apple estimated it will collect from credit sales to customers was (in millions): a. $94,680. b. $365,817 c. $54,763. d. $26,278. QUESTION 6 The amount that Apple's customers owe the company from credit sales has over the last two balance sheet dates. a. decreased b. increased c. stayed the same d. cannot be determined When Apple collects an accounts receivable from a customer: a. Net sales on the income statement is increased and accounts receivable on the balance sheet increased. b. Net sales on the income statement is increased and accounts receivable on the balance sheet decreased. c. Total assets are decreased on the balance sheet and net income on the income statement is increased. d. Total assets are unchanged on the balance sheet and the income statement is not affected