please answer 13-18 thank you

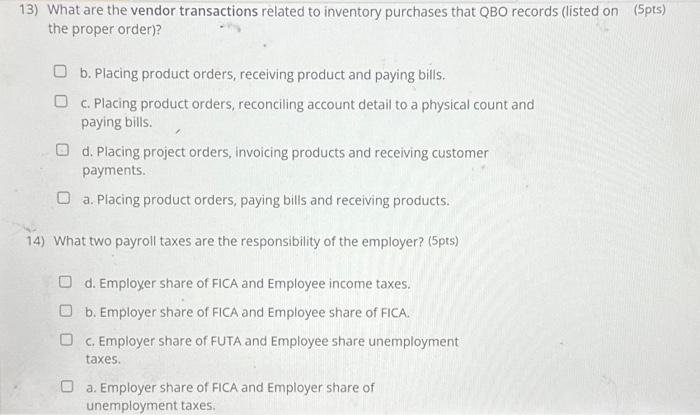

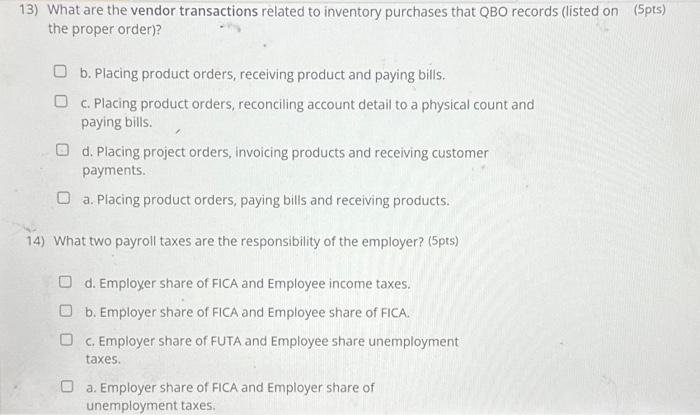

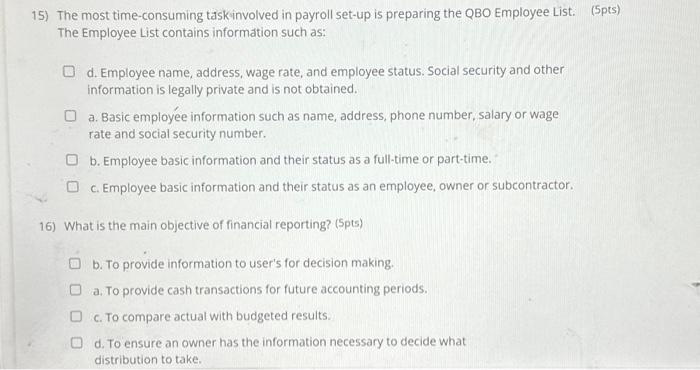

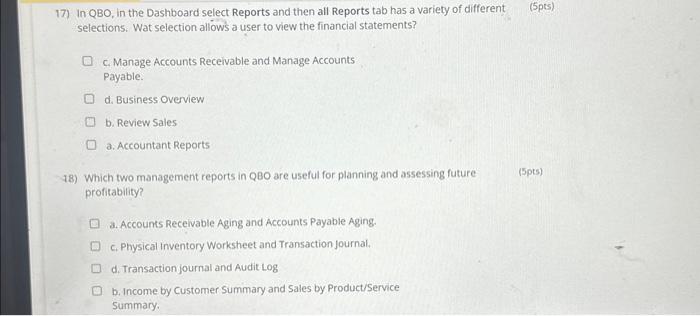

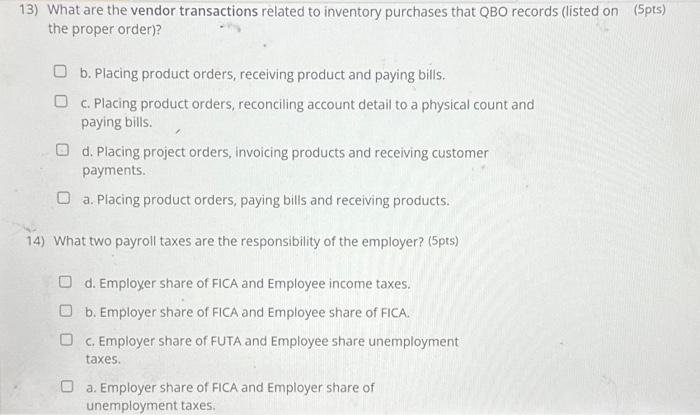

15) The most time-consuming taskinvolved in payroll set-up is preparing the QBO Employee List. (5pts) The Employee List contains information such as: d. Employee name, address, wage rate, and employee status. Social security and other information is legally private and is not obtained. a. Basic employe information such as name, address, phone number, salary or wage rate and social security number. b. Employee basic information and their status as a full-time or part-time. c. Employee basic information and their status as an employee, owner or subcontractor. 16) What is the main objective of financial reporting? (Spts) b. To provide information to user's for decision making. a. To provide cash transactions for future accounting periods. c. To compare actual with budgeted results. d. To ensure an owner has the information necessary to decide what distribution to take. 17) In QBO, in the Dashboard select Reports and then all Reports tab has a variety of different selections. Wat selection allows a user to view the financial statements? (5pts) c. Manage Accounts Receivable and Manage Accounts Payable. d. Business Overview b. Review Sales a. Accountant Reports 48) Which two management reports in QBO are useful for planning and assessing future (5pts) profitability? a. Accounts Receivable Aging and Accounts Payable Aging. c. Physical inventory Worksheet and Transaction Journal. d. Transaction joumal and Audit Log b. Income by Customer Summary and Sales by Product/Service Summary. 13) What are the vendor transactions related to inventory purchases that QBO records (listed on (5pts) the proper order)? b. Placing product orders, receiving product and paying bills. c. Placing product orders, reconciling account detail to a physical count and paying bills. d. Placing project orders, invoicing products and receiving customer payments. a. Placing product orders, paying bills and receiving products. 14) What two payroll taxes are the responsibility of the employer? (5pts) d. Employer share of FICA and Employee income taxes. b. Employer share of FICA and Employee share of FICA. c. Employer share of FUTA and Employee share unemployment taxes. a. Employer share of FICA and Employer share of unemployment taxes