Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer 14,15,16 14. Naga Company produces bottled grape juice. Grape juice concentrate is typically bought and sold by the pound. Naga uses 50,000 pounds

Please answer 14,15,16

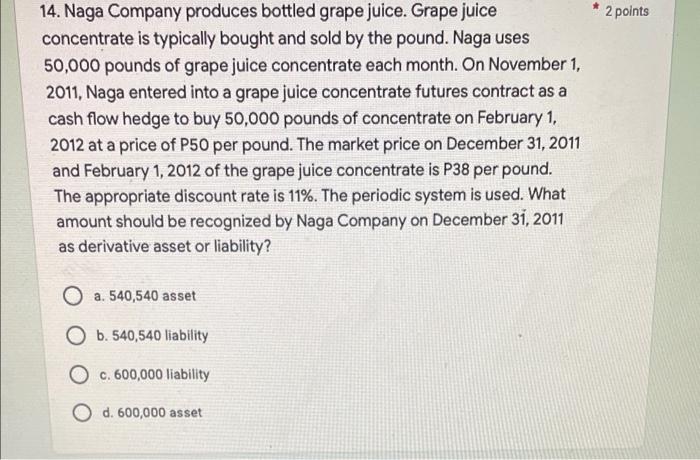

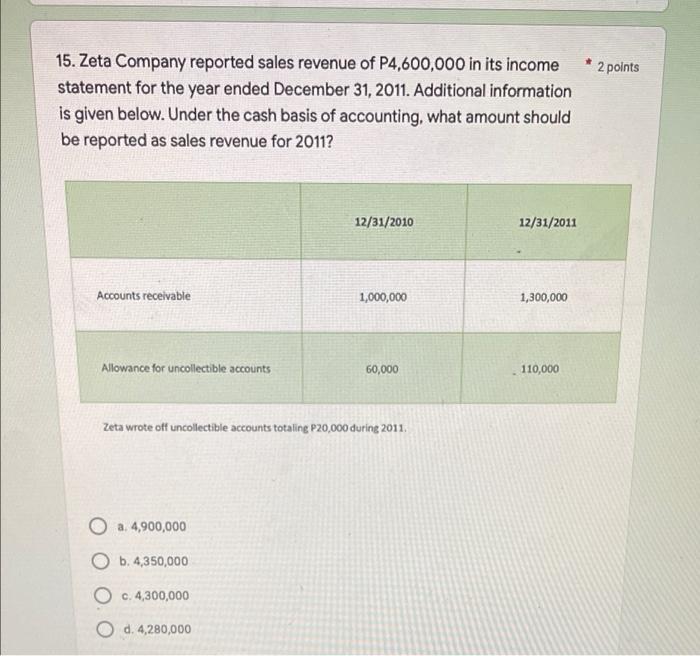

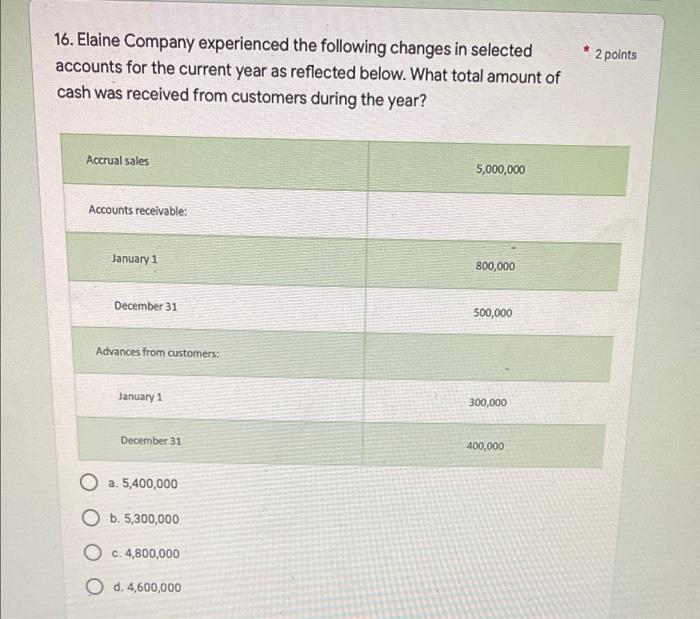

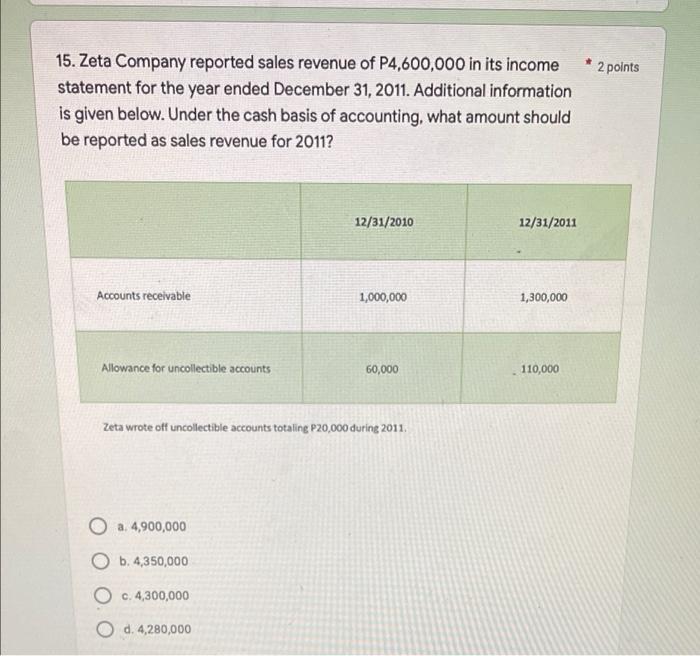

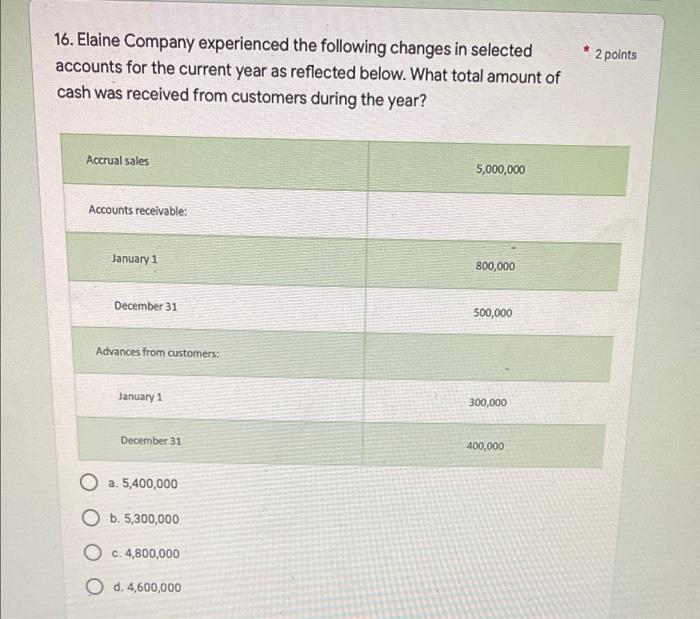

14. Naga Company produces bottled grape juice. Grape juice concentrate is typically bought and sold by the pound. Naga uses 50,000 pounds of grape juice concentrate each month. On November 1, 2011, Naga entered into a grape juice concentrate futures contract as a cash flow hedge to buy 50,000 pounds of concentrate on February 1, 2012 at a price of P50 per pound. The market price on December 31, 2011 and February 1, 2012 of the grape juice concentrate is P38 per pound. The appropriate discount rate is 11%. The periodic system is used. What amount should be recognized by Naga Company on December 31, 2011 as derivative asset or liability? a. 540,540 asset Ob. 540,540 liability Oc. 600,000 liability Od. 600,000 asset 2 points 15. Zeta Company reported sales revenue of P4,600,000 in its income statement for the year ended December 31, 2011. Additional information is given below. Under the cash basis of accounting, what amount should be reported as sales revenue for 2011? 12/31/2010 12/31/2011 Accounts receivable 1,000,000 1,300,000 Allowance for uncollectible accounts 60,000 110,000 Zeta wrote off uncollectible accounts totaling P20,000 during 2011. O a. 4,900,000 Ob. 4,350,000 c. 4,300,000 Od. 4,280,000 2 points 16. Elaine Company experienced the following changes in selected accounts for the current year as reflected below. What total amount of cash was received from customers during the year? Accrual sales 5,000,000 Accounts receivable: January 1 800,000 December 31 500,000 Advances from customers: January 1 300,000 December 31 400,000 O a. 5,400,000 Ob. 5,300,000 c. 4,800,000 d. 4,600,000 2 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started