Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer 16,17,&18 16. Ana Smith does not believe that the international Fisher effect (IFE) holds. Current one-year interest rates in Europe are 12 percent,

Please answer 16,17,&18

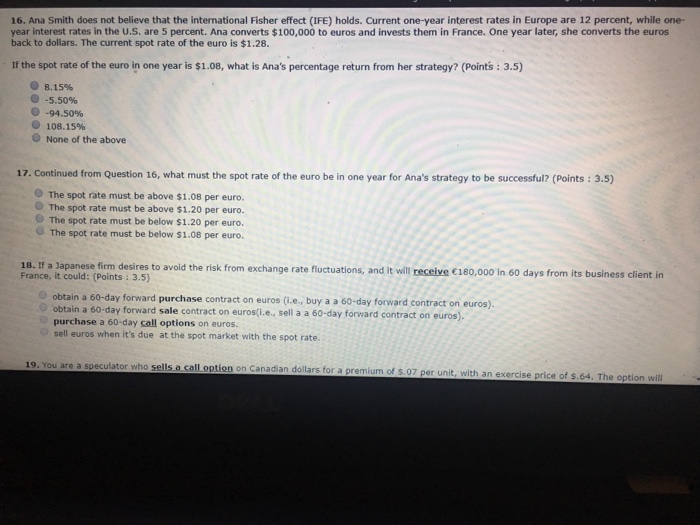

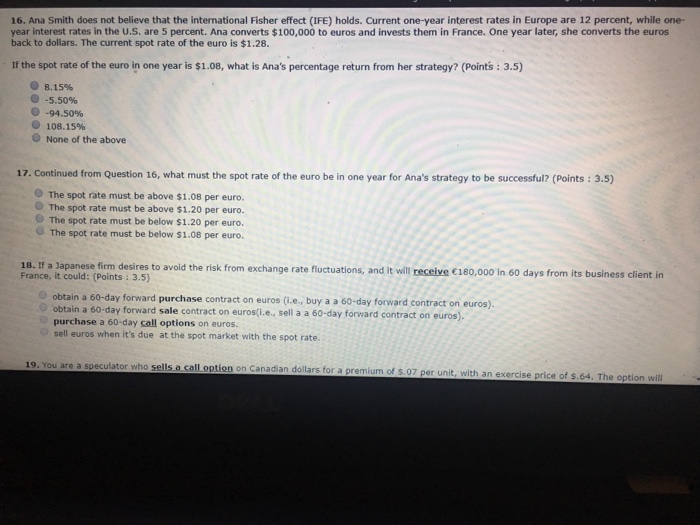

16. Ana Smith does not believe that the international Fisher effect (IFE) holds. Current one-year interest rates in Europe are 12 percent, while one- year interest rates in the U.S. are 5 percent. Ana converts $100,000 to euros and invests them in France. One year later, she converts the euros back to dollars. The current spot rate of the euro is $1.28. If the spot rate of the euro in one year is $1.08, what is Ana's percentage return from her strategy? (Points : 3.5) 8.15% @-5,50% -94.50% 108.15% O None of the above 17. Continued from Question 16, what must the spot rate of the euro be in one year for Ana's strategy to be successful? (Points : 3.5) The spot rate must be above $1.08 per euro. O The spot rate must be above $1.20 per euro. - The spot rate must be below $1.20 per euro. The spot rate must be below $1.08 per euro. desires to avoid the risk from exchange rate fluctuations, and it will receive 180,000 in 60 days from its business client in France, it could: (Points : 3.5) obtain a 60-day forward purchase contract on euros (i.e., buy a a 60-day forward contract on euros). obtain a 60-day forward sale contract on eurosti.e., sell a a 60-day forward contract on euros). purchase a 60-day call options on euros. sell euros when it's due at the spot market with the spot rate. 19. You are a speculator who sells a call option on Canadian dollars for a premium of s.07 per unit with an exercise price of $.64. The option will

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started