Please answer 16-35

Please answer 16-35

Please answer 16-35

Please answer 16-35

Please answer 16-35

Please answer 16-35

Please answer 16-35

Please answer 16-35

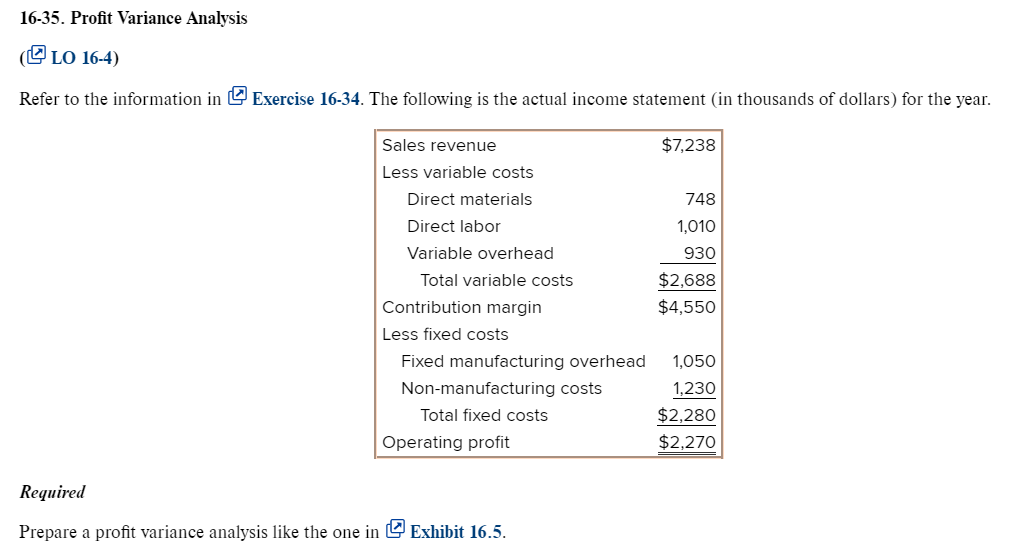

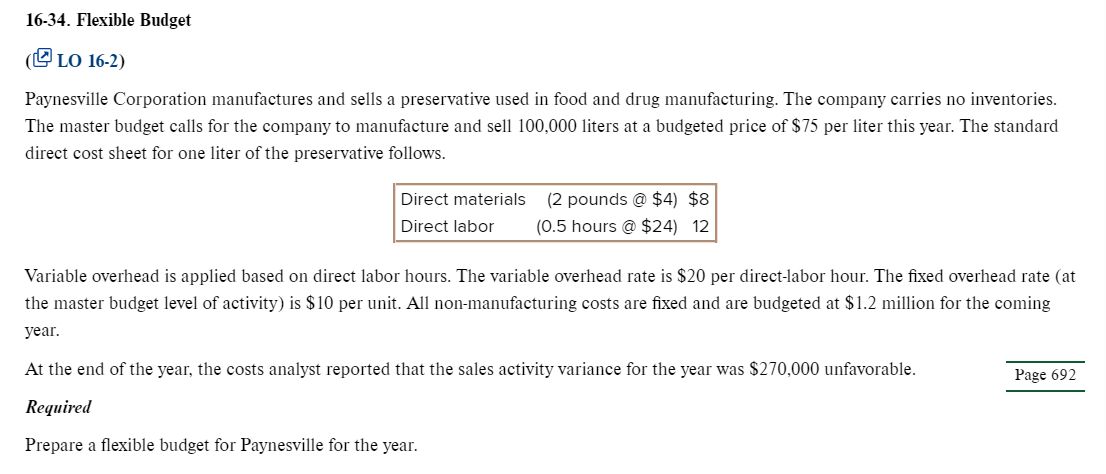

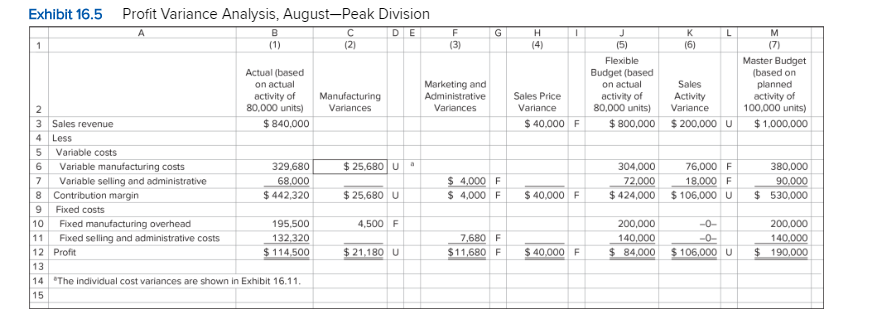

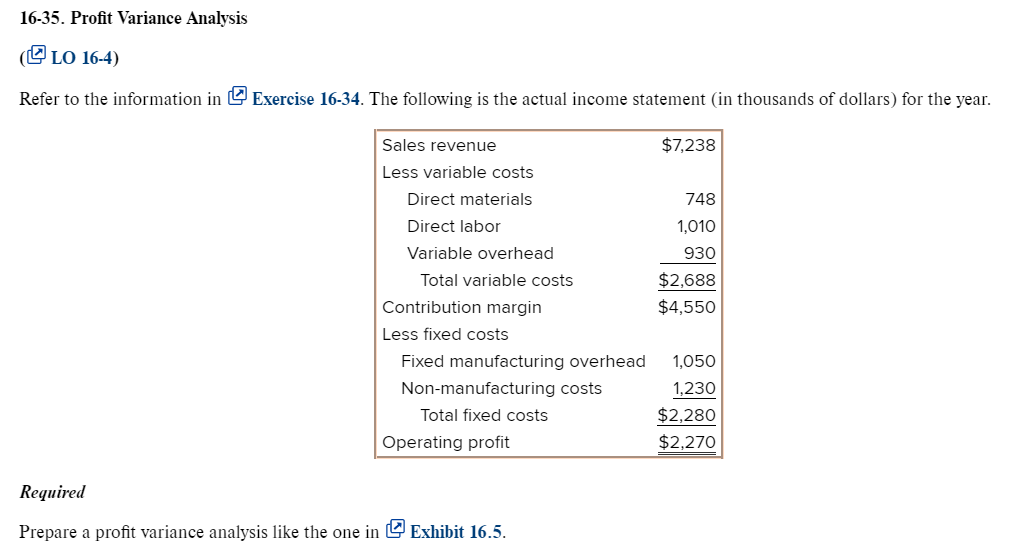

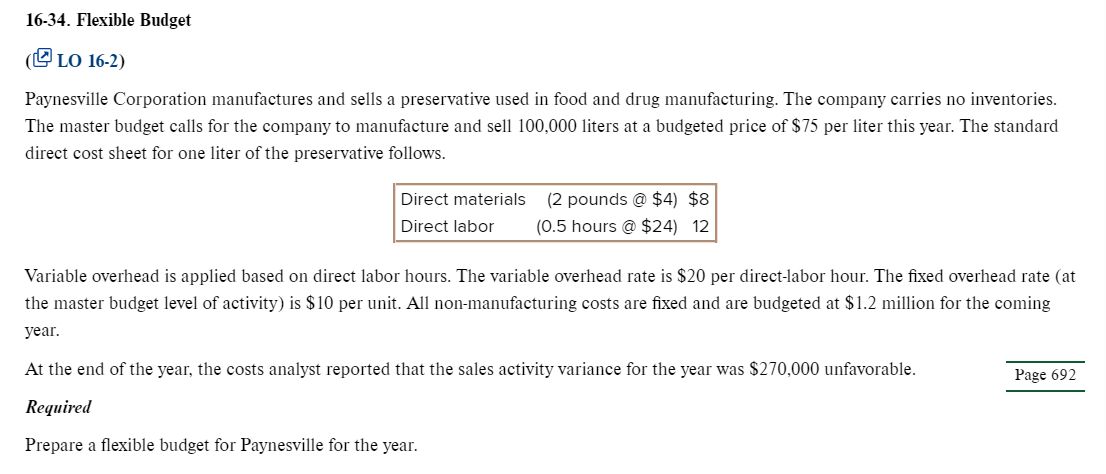

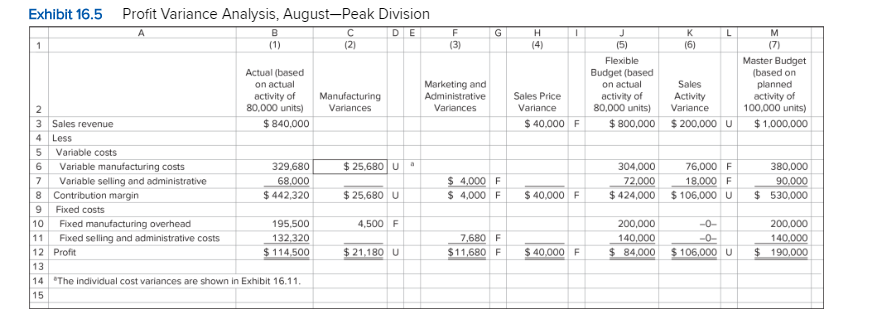

16-34. Flexible Budget (LO 16-2) Paynesville Corporation manufactures and sells a preservative used in food and drug manufacturing. The company carries no inventories. The master budget calls for the company to manufacture and sell 100,000 liters at a budgeted price of $75 per liter this year. The standard direct cost sheet for one liter of the preservative follows. Direct materials Direct labor (2 pounds @ $4) $8 (0.5 hours @ $24) 12 Variable overhead is applied based on direct labor hours. The variable overhead rate is $20 per direct-labor hour. The fixed overhead rate at the master budget level of activity) is $10 per unit. All non-manufacturing costs are fixed and are budgeted at $1.2 million for the coming year. At the end of the year, the costs analyst reported that the sales activity variance for the year was $270,000 unfavorable. Page 692 Required Prepare a flexible budget for Paynesville for the year. Exhibit 16.5 Profit Variance Analysis, August-Peak Division (1) (2) Actual (based on actual activity of 80,000 units) $ 840.000 KL (6) Master Budget (based on Sales planned Activity activity of Variance 100,000 units) $200,000 U $ 1.000.000 (5) Flexible Budget (based on actual activity of 80,000 units) $ 800,000 Marketing and Administrative Variances Manufacturing Variances Sales Price Variance $ 40,000 F $ 25,680 U 3 Sales revenue 4 Less 5 Variable costs 6 Variable manufacturing costs Variable selling and administrative 8 Contribution margin 9 Fixed costs 10 Fixed manufacturing overhead 11 Fixed selling and administrative costs 12 Profit 329,680 68,000 $ 442,320 $ 4,000 $ 4,000 F F 304,000 72,000 $ 424,000 76,000 F 18,000 F $ 106,000 U 380,000 90,000 $ 530,000 $ 25,680 U $ 40,000 F 4,500 F 195,500 132,320 $ 114,500 7,680 F $11,680 F 200,000 140,000 $ 84,000 -0- $ 106,000 U 200,000 140.000 $ 190,000 $ 21,180 U $ 40,000 F 14 "The individual cost variances are shown in Exhibit 16.11. 16-34. Flexible Budget (LO 16-2) Paynesville Corporation manufactures and sells a preservative used in food and drug manufacturing. The company carries no inventories. The master budget calls for the company to manufacture and sell 100,000 liters at a budgeted price of $75 per liter this year. The standard direct cost sheet for one liter of the preservative follows. Direct materials Direct labor (2 pounds @ $4) $8 (0.5 hours @ $24) 12 Variable overhead is applied based on direct labor hours. The variable overhead rate is $20 per direct-labor hour. The fixed overhead rate at the master budget level of activity) is $10 per unit. All non-manufacturing costs are fixed and are budgeted at $1.2 million for the coming year. At the end of the year, the costs analyst reported that the sales activity variance for the year was $270,000 unfavorable. Page 692 Required Prepare a flexible budget for Paynesville for the year. Exhibit 16.5 Profit Variance Analysis, August-Peak Division (1) (2) Actual (based on actual activity of 80,000 units) $ 840.000 KL (6) Master Budget (based on Sales planned Activity activity of Variance 100,000 units) $200,000 U $ 1.000.000 (5) Flexible Budget (based on actual activity of 80,000 units) $ 800,000 Marketing and Administrative Variances Manufacturing Variances Sales Price Variance $ 40,000 F $ 25,680 U 3 Sales revenue 4 Less 5 Variable costs 6 Variable manufacturing costs Variable selling and administrative 8 Contribution margin 9 Fixed costs 10 Fixed manufacturing overhead 11 Fixed selling and administrative costs 12 Profit 329,680 68,000 $ 442,320 $ 4,000 $ 4,000 F F 304,000 72,000 $ 424,000 76,000 F 18,000 F $ 106,000 U 380,000 90,000 $ 530,000 $ 25,680 U $ 40,000 F 4,500 F 195,500 132,320 $ 114,500 7,680 F $11,680 F 200,000 140,000 $ 84,000 -0- $ 106,000 U 200,000 140.000 $ 190,000 $ 21,180 U $ 40,000 F 14 "The individual cost variances are shown in Exhibit 16.11