Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer 17,18,19,20 thankyou Abad, a partner of the accounting firm ABC and Company, decided to withdraw from the partnership. Abad had 30% share in

please answer 17,18,19,20 thankyou

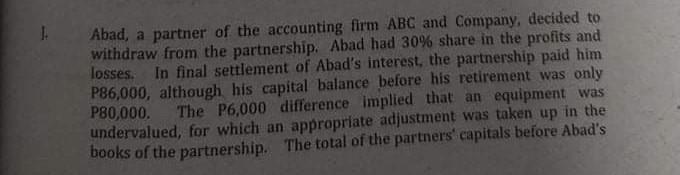

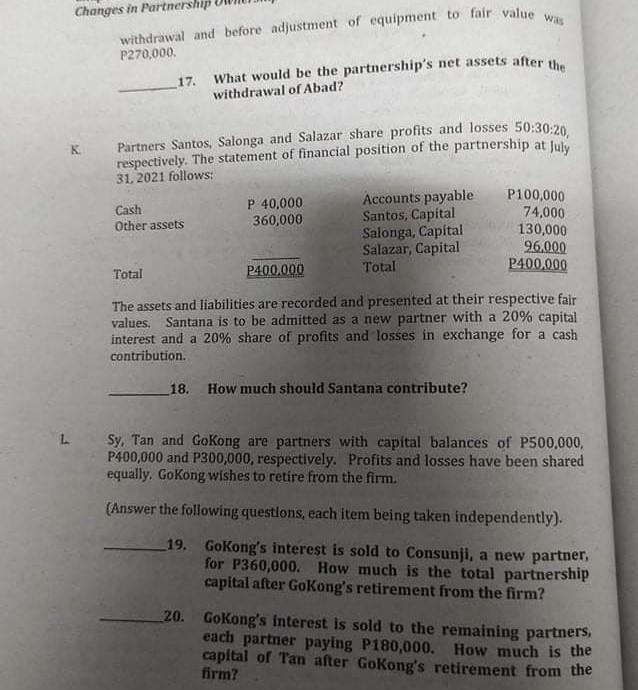

Abad, a partner of the accounting firm ABC and Company, decided to withdraw from the partnership. Abad had 30% share in the profits and losses. In final settlement of Abad's interest the partnership paid him P86,000, although his capital balance before his retirement was only P80,000 The P6,000 difference implied that an equipment was undervalued, for which an appropriate adjustment was taken up in the books of the partnership. The total of the partners' capitals before Abad's Changes in Partnership withdrawal and before adjustment of equipment to fair value was P270,000 17. What would be the partnership's net assets after the withdrawal of Abad? K Partners Santos, Salonga and Salazar share profits and losses 50:30:20, respectively. The statement of financial position of the partnership at July 31, 2021 follows: Accounts payable p 40.000 P100,000 Cash 360,000 Other assets 74,000 Santos, Capital Salonga, Capital 130,000 Salazar, Capital 96,000 Total P400.000 Total P400,000 The assets and liabilities are recorded and presented at their respective fair values. Santana is to be admitted as a new partner with a 20% capital interest and a 20% share of profits and losses in exchange for a cash contribution. 18. How much should Santana contribute? L Sy, Tan and Gokong are partners with capital balances of P500,000, P400,000 and P300,000, respectively. Profits and losses have been shared equally. Gokong wishes to retire from the firm. (Answer the following questions, each item being taken independently). 19. Gokong's interest is sold to Consunji, a new partner, for P360,000. How much is the total partnership capital after Gokong's retirement from the firm? 20. GoKong's interest is sold to the remaining partners, each partner paying P180,000. How much is the capital of Tan after Gokong's retirement from the firmStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started