Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer 18 and 19 with work. Thanks! Use the table below to complete the next 2 Questions (18 and 19) Use the table above

Please answer 18 and 19 with work. Thanks!

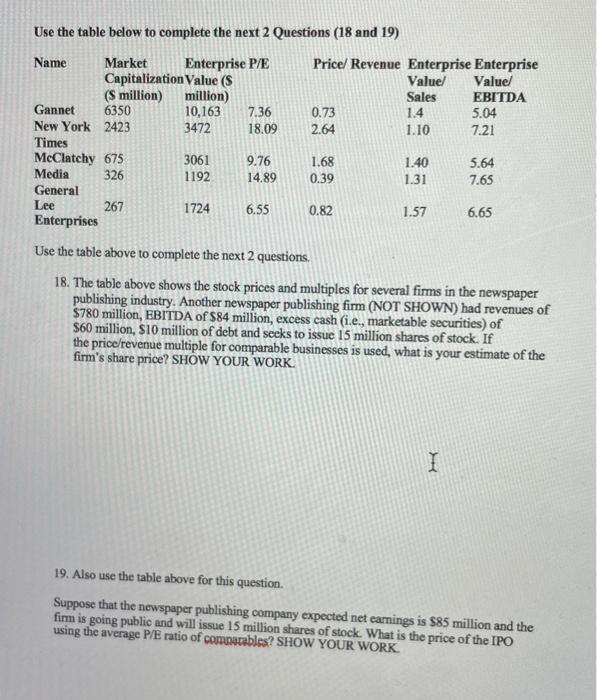

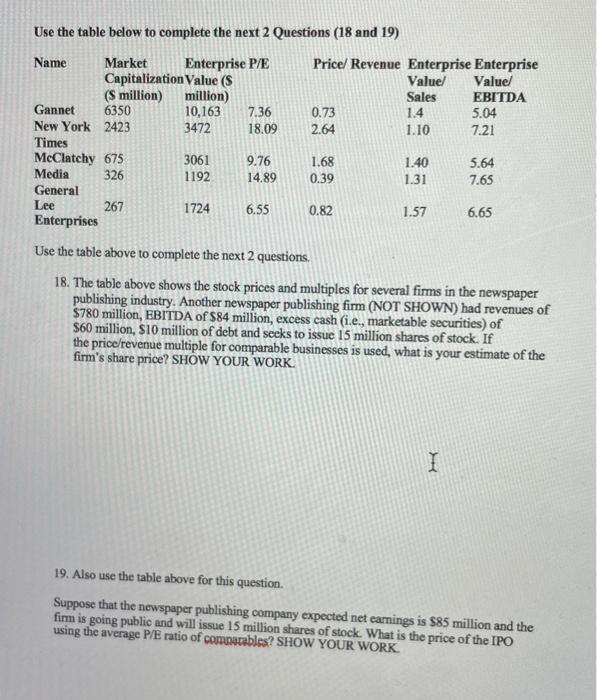

Use the table below to complete the next 2 Questions (18 and 19) Use the table above to complete the next 2 questions. 18. The table above shows the stock prices and multiples for several firms in the newspaper publishing industry. Another newspaper publishing firm (NOT SHOWN) had revenues of $780 million, EBITDA of $84 million, excess cash (i.e., marketable securities) of $60 million, $10 million of debt and secks to issue 15 million shares of stock. If the price/revenue multiple for comparable businesses is used, what is your estimate of the firm's share price? SHOW YOUR WORK. 19. Also use the table above for this question. Suppose that the newspaper publishing company expected net earnings is $85 million and the firm is going public and will issue 15 million shares of stock. What is the price of the IPO using the average P/E ratio of comnarables? SHOW YOUR WORK. Use the table below to complete the next 2 Questions (18 and 19) Use the table above to complete the next 2 questions. 18. The table above shows the stock prices and multiples for several firms in the newspaper publishing industry. Another newspaper publishing firm (NOT SHOWN) had revenues of $780 million, EBITDA of $84 million, excess cash (i.e., marketable securities) of $60 million, $10 million of debt and secks to issue 15 million shares of stock. If the price/revenue multiple for comparable businesses is used, what is your estimate of the firm's share price? SHOW YOUR WORK. 19. Also use the table above for this question. Suppose that the newspaper publishing company expected net earnings is $85 million and the firm is going public and will issue 15 million shares of stock. What is the price of the IPO using the average P/E ratio of comnarables? SHOW YOUR WORK

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started