Answered step by step

Verified Expert Solution

Question

1 Approved Answer

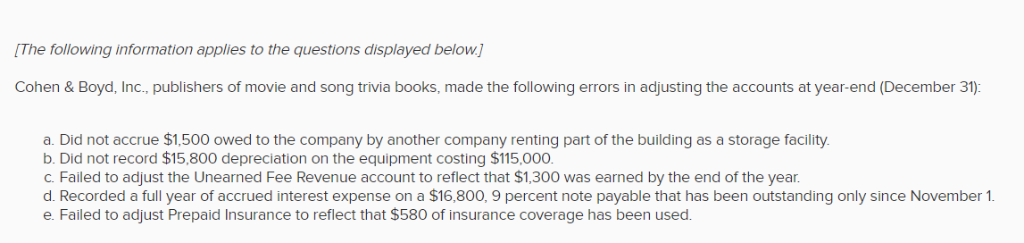

Please answer 1-a, 1-b, and 2. Thank you! The following information applies to the questions displayed below Cohen & Boyd, Inc., publishers of movie and

Please answer 1-a, 1-b, and 2. Thank you!

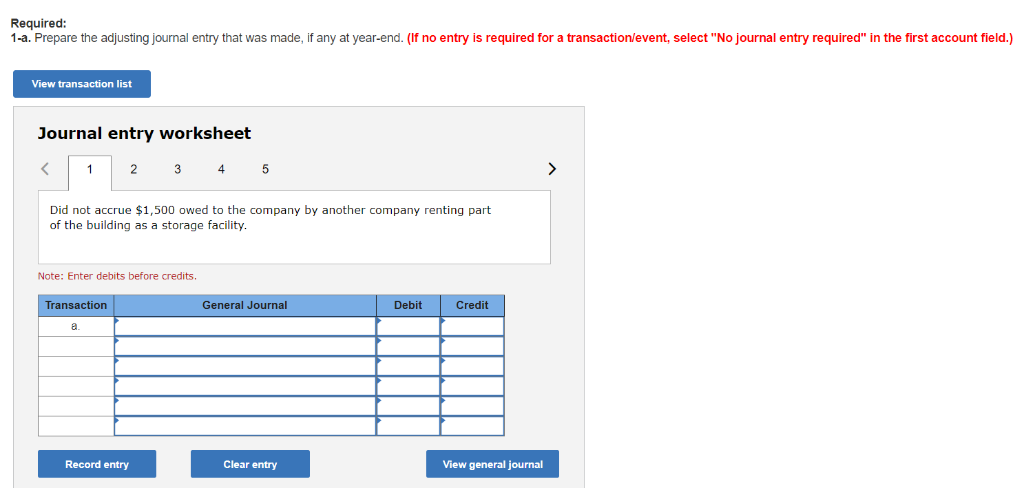

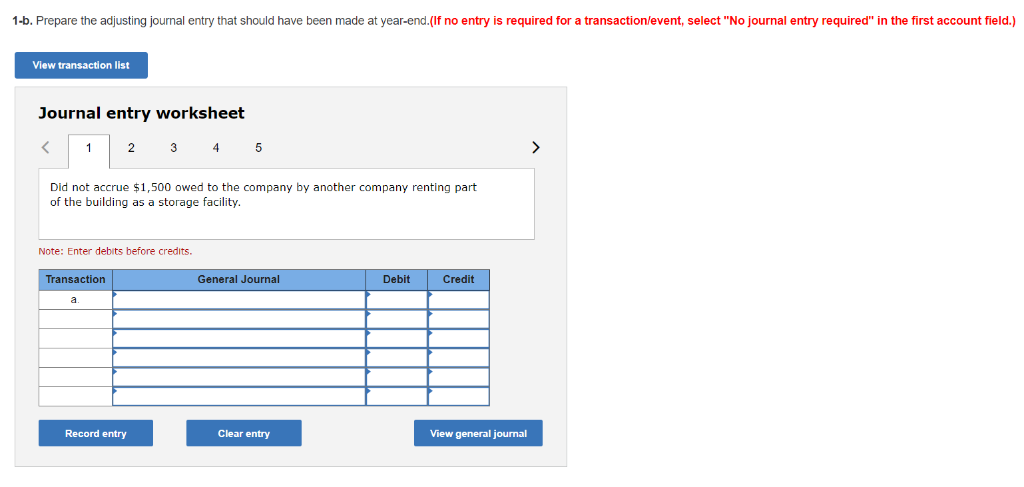

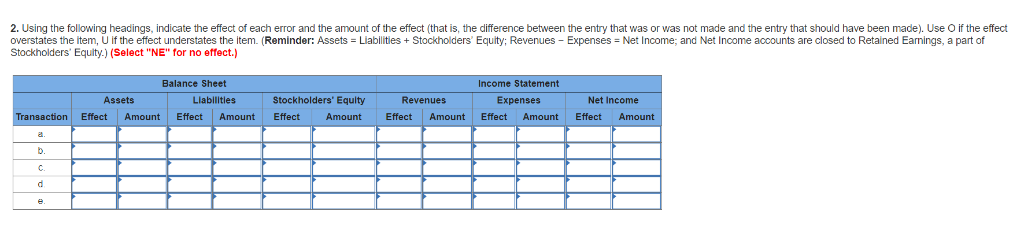

The following information applies to the questions displayed below Cohen & Boyd, Inc., publishers of movie and song trivia books, made the following errors in adjusting the accounts at year-end (December 31) a. Did not accrue $1,500 owed to the company by another company renting part of the building as a storage facility b. Did not record $15,800 depreciation on the equipment costing $115,000. C. Failed to adjust the Unearned Fee Revenue account to reflect that $1,300 was earned by the end of the year. d. Recorded a full year of accrued interest expense on a $16,800, 9 percent note payable that has been outstanding only since November 1 e. Failed to adjust Prepaid Insurance to reflect that $580 of insurance coverage has been used. 1-a. Prepare the adjusting journal entry that was made, if any at year-end. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 4 Did not accrue $1,500 owed to the company by another company renting part of the building as a storage facility Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal 1-b. Prepare the adjusting journal entry that should have been made at year-end.(If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Did not accrue $1,500 owed to the company by another company renting part of the building as a storage facility. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal 2. Using the o ng headings indicate he effect o each error and he amount ofthe efect that is he difference between the ent that was o as not made and he e tr that should have bee ma e Use f heer overstates the item, U if the effect understates the item. (Reminder: Assets Liabilities+ Stockholders' Equity; Revenues Expenses Net Income; and Net Income accounts are closed to Retained Eamings, a part of Stockholders' Equity.) (Select "NE" for no effect.) Balance Sheet Income Statement Expenses Effect Amount Effect Amount Effect Amount Assets Llablities Stockholders' Equity Amount Revenues Net Income ction Effect Amount Effect Amount Effect CStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started