Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER 20, 21,22,23 PLEASE I NEED ANSWER NOW For No. 20 21 Nabangsit Corporation reported the following receivables on December 31, 2018: Accounts receivable,

PLEASE ANSWER 20, 21,22,23

PLEASE I NEED ANSWER NOW

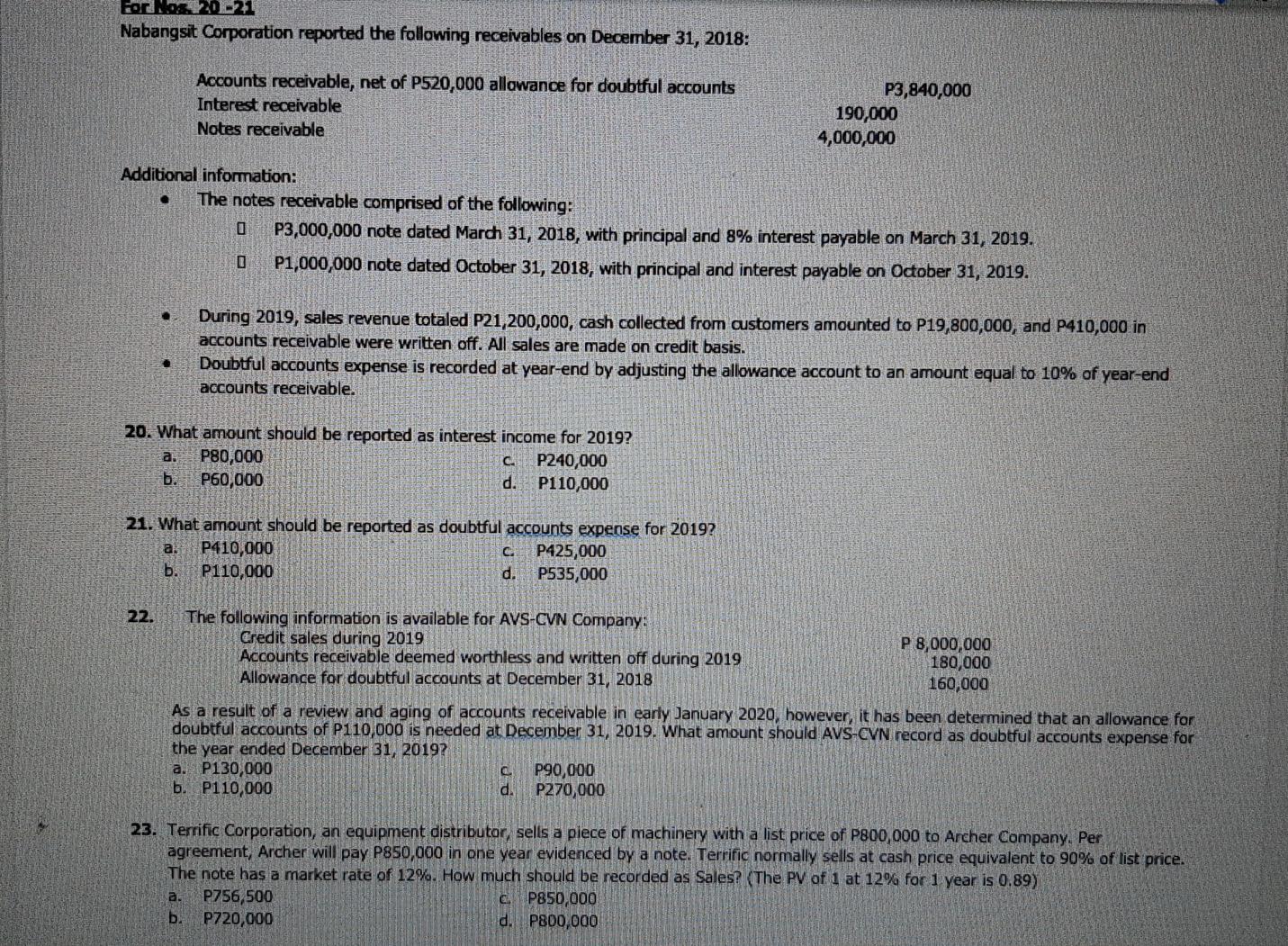

For No. 20 21 Nabangsit Corporation reported the following receivables on December 31, 2018: Accounts receivable, net of P520,000 allowance for doubtful accounts Interest receivable Notes receivable P3,840,000 190,000 4,000,000 Additional information: The notes receivable comprised of the following: P3,000,000 note dated March 31, 2018, with principal and 8% interest payable on March 31, 2019. 0 P1,000,000 note dated October 31, 2018, with principal and interest payable on October 31, 2019. . During 2019, sales revenue totaled P21,200,000, cash collected from customers amounted to P19,800,000, and P410,000 in accounts receivable were written off. All sales are made on credit basis. Doubtful accounts expense is recorded at year-end by adjusting the allowance account to an amount equal to 10% of year-end accounts receivable. 20. What amount should be reported as interest income for 2019? a. P80,000 CA P240,000 b. P60,000 d. P110,000 21. What amount should be reported as doubtful accounts expense for 2019? a P410,000 C P425,000 b. P110,000 d. P535,000 22. The following information is available for AVS-CVN Company: Credit sales during 2019 P 8,000,000 Accounts receivable deemed worthless and written off during 2019 180,000 Allowance for doubtful accounts at December 31, 2018 160,000 As a result of a review and aging of accounts receivable in early January 2020, however, it has been determined that an allowance for doubtful accounts of P110,000 is needed at December 31, 2019. What amount should AVS-CVN record as doubtful accounts expense for the year ended December 31, 2019? a. P130,000 P90,000 b. P110,000 d. P270,000 c. 23. Terrific Corporation, an equipment distributor, sells a piece of machinery with a list price of P800,000 to Archer Company. Per agreement, Archer will pay P850,000 in one year evidenced by a note. Terrific normally sells at cash price equivalent to 90% of list price. The note has a market rate of 12%. How much should be recorded as Sales? The PV of 1 at 12% for 1 year is 0.89) a. P756,500 c. P850,000 b. P720,000 d. P800,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started