please answer 22 and 23

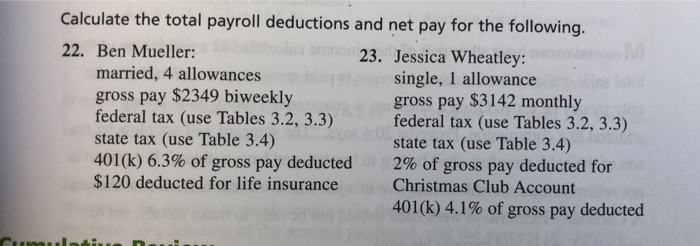

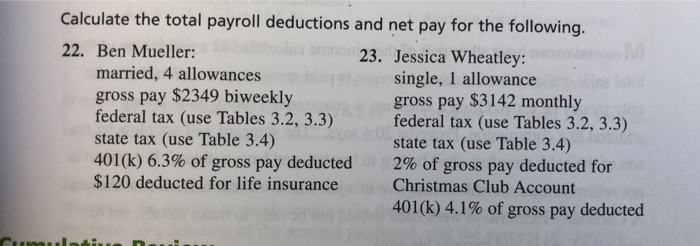

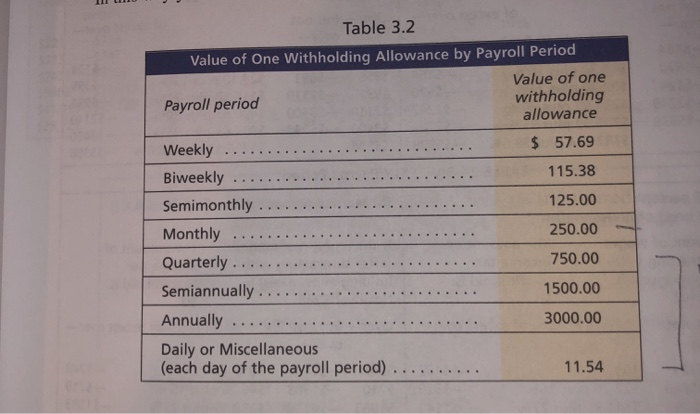

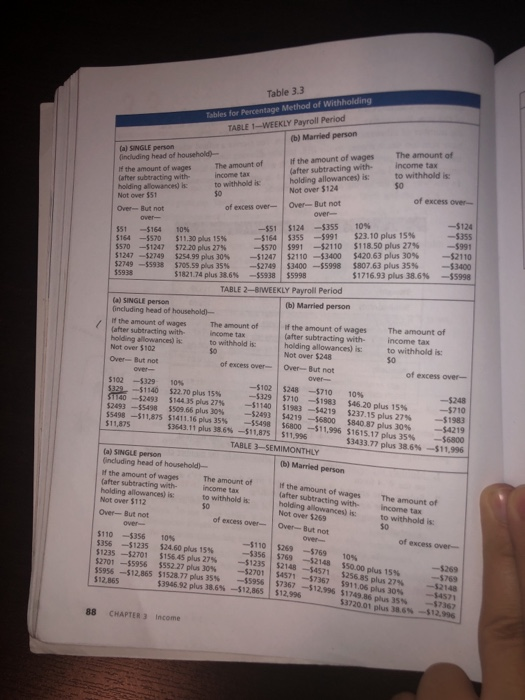

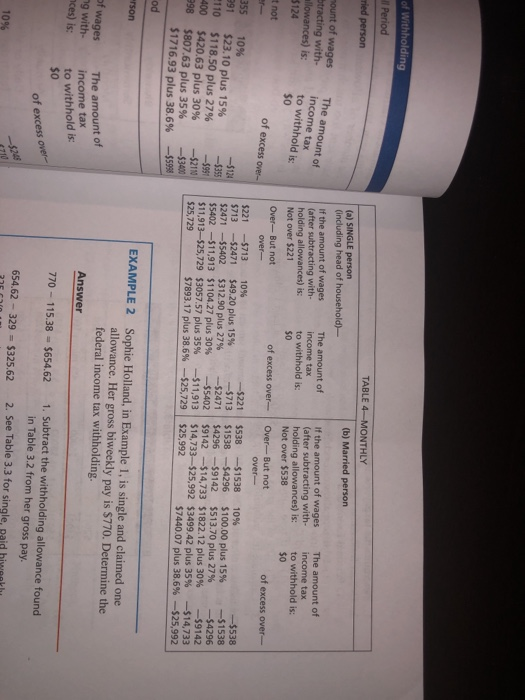

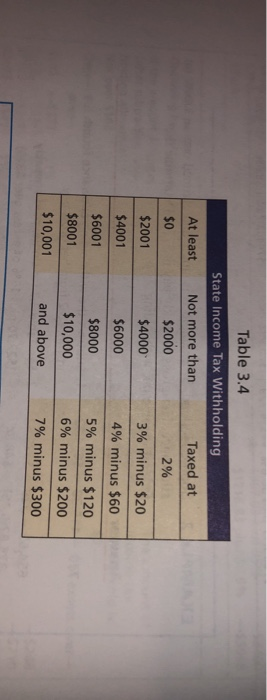

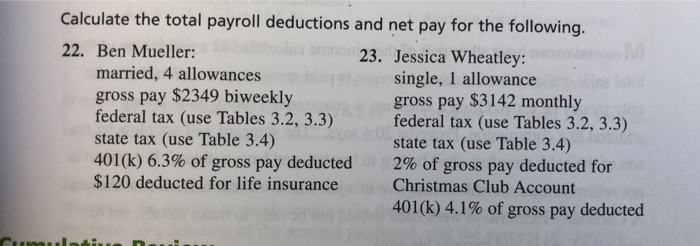

Calculate the total payroll deductions and net pay for the following. 22. Ben Mueller: 23. Jessica Wheatley: married, 4 allowances single, 1 allowance gross pay $2349 biweekly gross pay $3142 monthly federal tax (use Tables 3.2, 3.3) federal tax (use Tables 3.2, 3.3) state tax (use Table 3.4) state tax (use Table 3.4) 401(k) 6.3% of gross pay deducted 2% of gross pay deducted for $120 deducted for life insurance Christmas Club Account 401(k) 4.1% of gross pay deducted Table 3.2 Value of One Withholding Allowance by Payroll Period Value of one Payroll period withholding allowance Weekly . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 57.69 Biweekly . . . . . . . . . . . . . . . . . . . . . . . . . ... 115.38 Semimonthly . . . . . . . . . . . . . . . . . . . . . . ... 125.00 Monthly ............................ 250.00 Quarterly ............. 750.00 Semiannually ........ 1500.00 Annually ....... 3000.00 Daily or Miscellaneous (each day of the payroll period) ...... 11.54 Table 3.3 Tables for Percentage Method of Withholding TABLE 1-WEEKLY Payroll Period (b) Married person (a) SINGLE person including head of household) If the amount of wages The amount of If the amount of wages The amount of Income tax Cafter subtracting with Income tax (after subtracting with holding allowances) is: to withholdis: holding allowances) to withhold i SO Not over $51 Not over $124 Over But not of excess over Over But not of excess over over 551 -$51 - $164 5124 105 5355 -$124 $164 -5570 $11.30 plus 15% -5164 $355 $991 $23.10 plus 15% -$355 $570 -51247 572.20 plus 27 -5570 $991 -$2110 $118.50 plus 27% $991 51247 -$2749 $254.99 plus 30% -51247 $2110 -$3400 $420.63 plus 30% -$2110 $2749-55938 $705.59 plus 35% -5274953400-$5998 $807.63 plus 35% $5938 -$3400 $1821.74 plus 38.6% --$5938 $5998 $1716.93 plus 38.6% -55998 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person including head of household [b] Married person If the amount of wages The amount of Cafter subtracting with of the amount of wages holding allowance income tax The amount of is Not over $102 income tax to withholdis: over- 10% -5248 -$710 after subtracting with to withhold is holding allowances) Not over $248 Over But not of excess over Over-But not of excess over- over $102 -5129 --$102 5243 -5710 105 $329 -$1140 $22.70 plus 15 $329 $710 - $1983 $46.20 plus 15% SIDO-2493 $144.35 plus 27% -51140 51983 -54219 $237.15 plus 27% -$1983 9) --$548 5509.56 plus 30% -52493 54219-56800 5840 87 plus 30% -$4219 $544 511,875 51411.16 plus 35% -55498 $6800-$11.996 $1615 17 plus 35 $11.875 343 11 plus 18.6% -511,875 -56800 $11,995 53433.77 plus 3 64 $11.996 TABLE 3-SEMIMONTHLY (a) SINGLE person 0) Married person including head of household If the amount of wages The amount of w the amount of wages Cafter subtracting with Income tax The amount of holding allowance is to withhold i Income tax Not over $112 Not over $269 to withholdi Over-But not of excess over Over-But not of excess over 110 -$356 10% 3156 5 1235 524.60 plus 15% -5356 5769 -2148 $1235-$2701 5156.45 plus 27 $1235 52701 -55956 5552 27 plus 30% 5214 $5956 -$12.855 51528.77 plus 35% 5595657367512 $3946 92 plus 38.6% -512,865 $12,906 5 7367 $3720.01 plus 38.64 $12.996 after subtracting with holding allowances) -5110 $269 -5769 10% 550.00 plus 15% 52148-54571 $256.85 plus 27% $4571-57367 5911.06 plus 30% -$12.796 51749.86 plus 35 -$2701 $269 -5769 $12,865 88 CHAPTER 3 Income of Withholding | Period Tied person mount of wages btracting with allowances) is: 5124 The amount of income tax to withhold is: $0 t not TABLE 4-MONTHLY (a) SINGLE person (b) Married person (including head of household) If the amount of wages The amount of If the amount of wages The amount of (after subtracting with income tax (after subtracting with income tax holding allowances) is: to withhold is: holding allowances) is: to withhold is: Not over $221 50 Not over $538 $0 Over- But not of excess over Over-But not of excess over over- over- $221 -5713 10% ----$221 $538 -$1538 10% $713 --$2471 $49.20 plus 15% -$538 -$713 $1538 -54296 $100.00 plus 15% $2471 ---$5402 $312.90 plus 27% -$1538 -$2471 55402 --$11,913 $1104.27 plus 30% 54296---59142 $513.70 plus 27% -55402 -54296 $11,913-525,729 53057.57 plus 35% 59142--$14,733 $1822.12 plus 30% -511,913 -59142 $25,729 $14,733-$25.992 $3499.42 plus 35% $7893.17 plus 38.6% --$25,729 -514733 $25,992 $7440.07 plus 38.6% -$25,992 of excess over- 10% 355 291 110 400 298 $23.10 plus 15% $118.50 plus 27% $420.63 plus 30% $807.63 plus 35% 51716.93 plus 38.6% -5991 -52110 -53400 -$5998 rson of wages ng with EXAMPLE 2 Sophie Holland, in Example 1. is single and claimed one allowance. Her gross biweekly pay is $770. Determine the federal income tax withholding. Answer nces) is: The amount of income tax to withhold is: $0 770 - 115.38 = 5654.62 of excess over 1. Subtract the withholding allowance found in Table 3.2 from her gross pay. 2. See Table 3.3 for single, paid hiweathe 654.62 - 329 - $325.62 10% At least $0 $2001 Table 3.4 State Income Tax Withholding Not more than Taxed at $2000 2% $4000 3% minus $20 $6000 4% minus $60 $8000 5% minus $120 $10,000 6% minus $200 and above 7% minus $300 $4001 $6001 $8001 $10,001