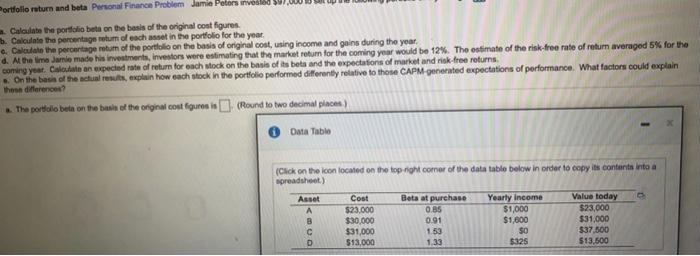

28-27 (similar to) Portfolio return and beta Personal Finance Problem Jamie Peters invested 597,000 to set the following portfolio one year ago Calculate the portfolio bela on the basis of the original costures Care the percentage lumeachas in the portfolio for the year, Calculate the percentage return of the portfolio on the basis of original cost using income and gain during the your d. At the time Jurie made his vestra, Investors were stimating that the market return for the coming you would be 12%. The climate of the risk free rate of return averaged for the coming year. Calean expected rate of retum for each shock on the basis of a bend expectations of market and it rebum. a. On the basis of the scheus, explain how each stock in the portfolio performed different relative to those CAPM generated expectations of performance. What factors could explain the differences The portfolio berts on the the original cost for Pound to two decimal places) Data Table (Click on the colocated on the top right comer of the data ile below in order to copy its contos pradet) Ass Cest Best purchase Yearly income Value today $23.000 0.86 $1.000 123.000 $30,000 091 31,000 151000 $31.000 50 30 137.500 D $13,000 130 5326 $13.500 Portfolio return and beta Personal Finance Problem Jamie Pelors invested su Calculate the portfolio bet on the basis of the original cost figures. Calculate the percentage return of each set in the portfolio for the year e Calculate the percentage return of the portfolio on the basis of original cost, using income and gains during the year. d. At the time Jale made his investments, Investors were estimating that the market return for the coming year would be 12%. The estimate of the risk-free rate of return averaged 5% for the coming year. Calculate an expected rate of return for each stock on the basis of its bets and the expectations of market and risk-free returns On the basis of the actuals, explain how each stock in the portfolio performed differently relative to those CAPM-generated expectations of performance. What factors could explain these difference? The portfolio bet on the basis of the original cout figures is (Round to two decimal place) Data Table (Click on the icon located on the top right comer of the data table below in order to copy its contents into a spreadsheet) Asset B D Cost $23.000 $30,000 $31,000 $13,000 Bota at purchase 0.85 0.91 153 1.33 Yearly income $1,000 $1,600 50 $325 Value today $23,000 $31,000 $37,800 $13,500