Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer 2nd and 3rd page...dont make your own format...thank you Blue Spruce Industries is a small, owner managed business that sells artificial Christmas trees

please answer 2nd and 3rd page...dont make your own format...thank you

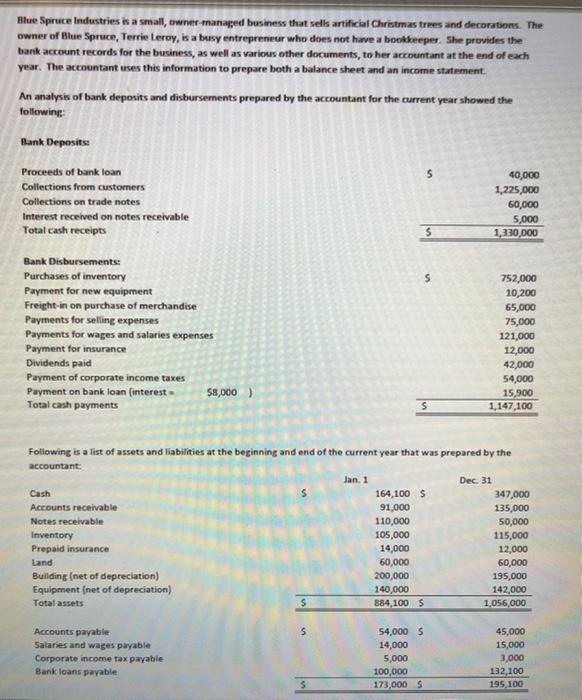

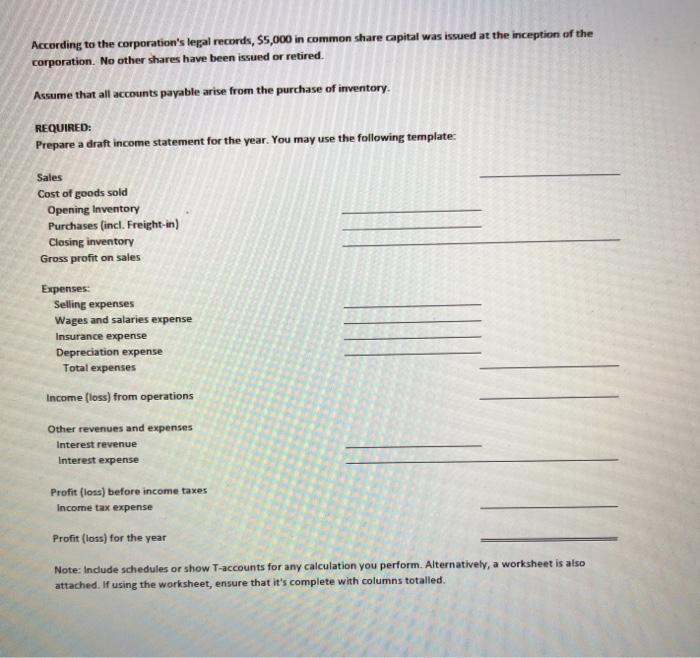

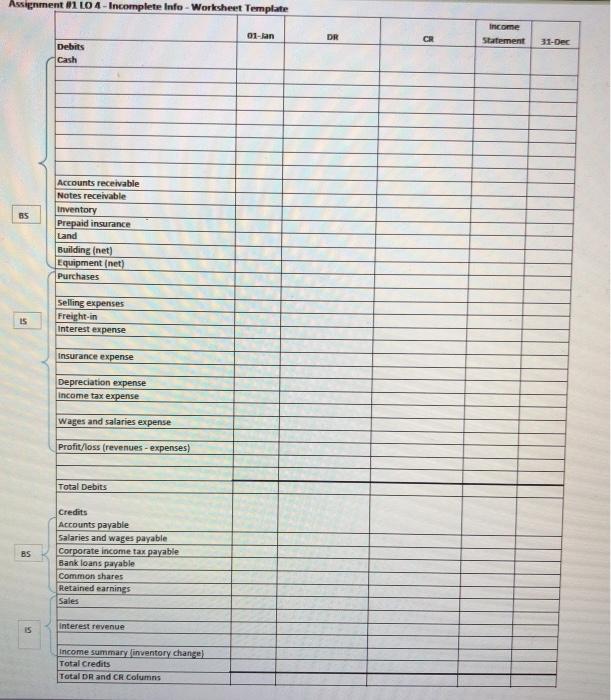

Blue Spruce Industries is a small, owner managed business that sells artificial Christmas trees and decorations. The owner of Blue Spruce, Terrie Leroy, is a busy entrepreneur who does not have a bookkeeper. She provides the bank account records for the business, as well as various other documents, to her accountant at the end of each year. The accountant uses this information to prepare both a balance sheet and an income statement. An analysis of bank deposits and disbursements prepared by the accountant for the current year showed the following: Bank Deposits $ Proceeds of bank loan Collections from customers Collections on trade notes Interest received on notes receivable Total cash receipts 40,000 1,225,000 60,000 5,000 1,330,000 $ $ Bank Disbursements: Purchases of inventory Payment for new equipment Freight-in on purchase of merchandise Payments for selling expenses Payments for wages and salaries expenses Payment for insurance Dividends paid Payment of corporate income taxes Payment on bank loan (interest $8,000) Total cash payments 752,000 10,200 65,000 75,000 121,000 12,000 42,000 54,000 15,900 1,147,100 s Following is a list of assets and liabilities at the beginning and end of the current year that was prepared by the accountant Jan. 1 Cash Accounts receivable Notes receivable Inventory Prepaid insurance Land Building (net of depreciation) Equipment (net of depreciation) Total assets 164,100 S 91,000 110,000 105,000 14,000 60,000 200,000 140,000 884,100 S Dec. 31 347,000 135,000 50,000 115,000 12,000 60,000 195,000 142,000 1,056,000 S S Accounts payable Salaries and wages payable Corporate income tax payable Bank loans payable 54,000 5 14,000 5,000 100,000 173,000 5 45,000 15,000 3,000 132, 100 195 100 According to the corporation's legal records, $5,000 in common share capital was issued at the inception of the corporation. No other shares have been issued or retired. Assume that all accounts payable arise from the purchase of inventory REQUIRED: Prepare a draft income statement for the year. You may use the following template Sales Cost of goods sold Opening Inventory Purchases (incl. Freight-in) Closing inventory Gross profit on sales Expenses: Selling expenses Wages and salaries expense Insurance expense Depreciation expense Total expenses Income (loss) from operations Other revenues and expenses Interest revenue Interest expense Profit (loss) before income taxes Income tax expense Profit (loss) for the year Note: Include schedules or show T-accounts for any calculation you perform. Alternatively, a worksheet is also attached. If using the worksheet, ensure that it's complete with columns totalled. Assignment 01 L04-Incomplete Info - Worksheet Template 01-lan DR income Statement CR 31-Dec Debits Cash BS Accounts receivable Notes receivable Inventory Prepaid insurance Land Building (net) Equipment (net) Purchases IS Selling expenses Freight-in Interest expense Insurance expense Depreciation expense income tax expense Wages and salaries expense Profit/loss (revenues - expenses) Total Debits BS Credits Accounts payable Salaries and wages payable Corporate income tax payable Bank loans payable Common shares Retained earnings Sales 5 interest revenue Income summary inventory change) Total Credits Total DR and CR Columns Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started