PLEASE ANSWER 4, 5 and 8

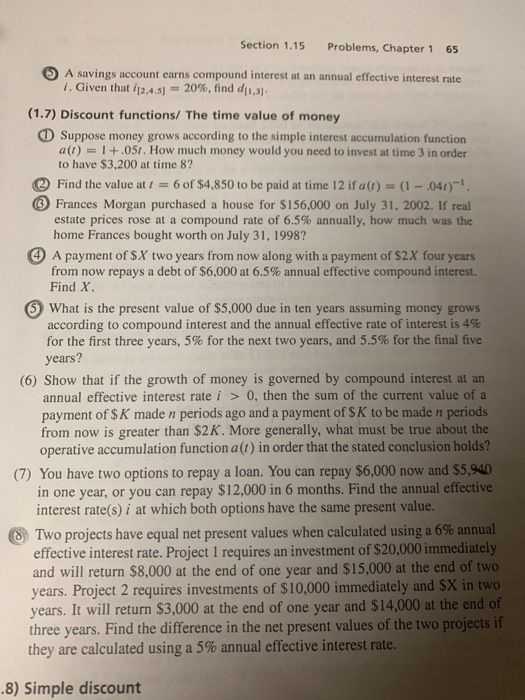

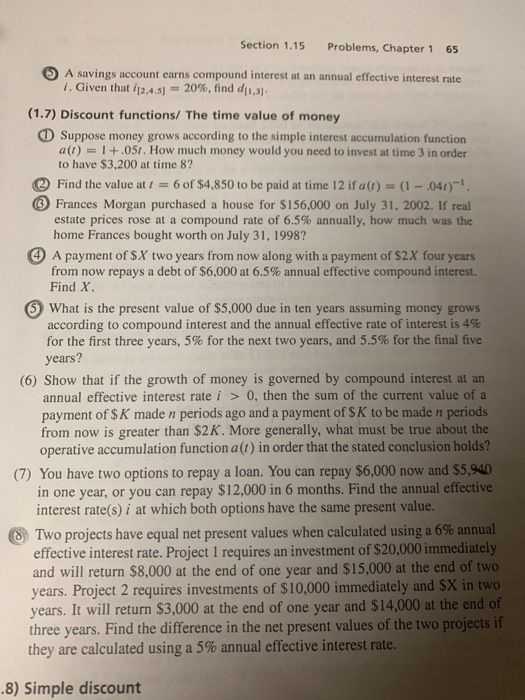

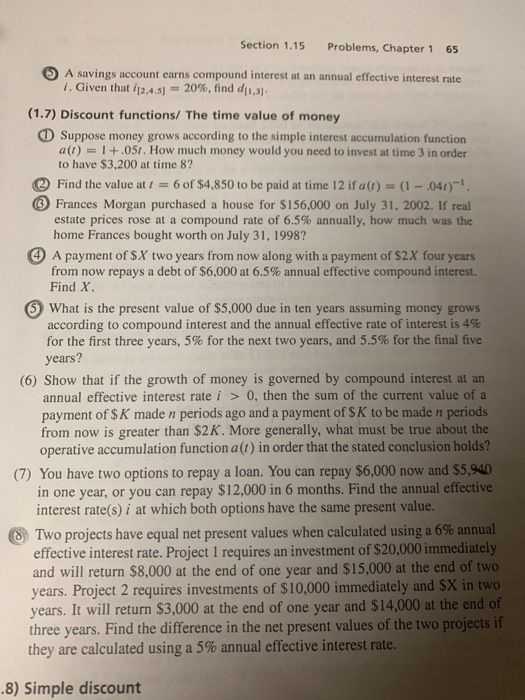

Section 1.15 Problems, Chapter 1 65 A savings account earns compound interest at an annual effective interest rate 1. Given that i[2,45,-20%, fin (1.7) Discount functions/ The time value of money D Suppose money grows according to the simple interest accumulation function a(t) 1.05t. How much money would you need to invest at time 3 in order to have $3,200 at time 8? Find the value at -6 of $4,850 to be paid at time 12 if a()(1-041) Frances Morgan purchased a house for $156,000 on July 31, 2002. If real estate prices rose at a compound rte of 6.5% annually, how much was the home Frances bought worth on July 31, 1998? A payment of S X two years from now along with a payment of $2X four years from now repays a debt of $6,000 at 6.5% annual effective compound interest. Find X 5) What is the present value of $5,000 due in ten years assuming money grows according to compound interest and the annual effective rate of interest is 4% for the first three years, 5% for the next two years, and 5.5% for the final five years? (6) Show that if the growth of money is governed by compound interest annual effective interest rate i >0, then the sum of the current value of payment of S K made n periods ago and a payment of S K to be made n periods from now is greater than $2K. More generally, what must be true about the operative accumulation function a(t) in order that the stated conclusion holds? (7) You have two options to repay a loan. You can repay $6,000 now and $5,940 in one year, or you can repay $12,000 in 6 months. Find the annual effective interest rate(s) i at which both options have the same present value Two projects have equal net present values when calculated using a 6% annual effective interest rate. Project 1 requires an investment of $20,000 immediately and will return $8,000 at the end of one year and $15,000 at the end o years. Project 2 requires investments of $10,000 immediately and SX i years. It will return $3,000 at the end of one year and $14,000 at the end o three years. Find the difference in the net present values of the two proj they are calculated using a 5% annual effective interest rate 8) Simple discount