Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER 4.4 AND 4.5 AND SHOW WORKINGS CLEARLY QUESTION 4 [25 Marks) Tessa Ltd.'s earnings and dividends have been growing at a rate of

PLEASE ANSWER 4.4 AND 4.5 AND SHOW WORKINGS CLEARLY

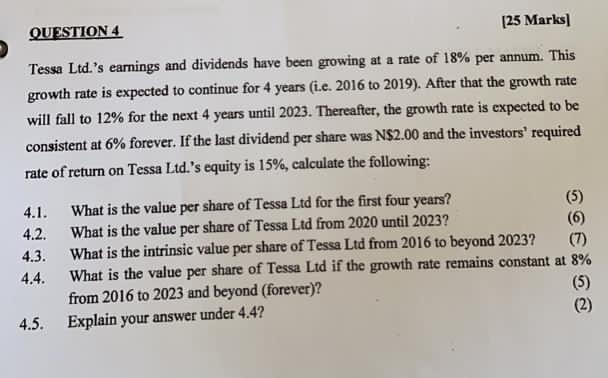

QUESTION 4 [25 Marks) Tessa Ltd.'s earnings and dividends have been growing at a rate of 18% per annum. This growth rate is expected to continue for 4 years (i.c. 2016 to 2019). After that the growth rate will fall to 12% for the next 4 years until 2023. Thereafter, the growth rate is expected to be consistent at 6% forever. If the last dividend per share was N$2.00 and the investors' required rate of return on Tessa Ltd.'s equity is 15%, calculate the following: 4.1. 4.2. 4.3. 4.4. What is the value per share of Tessa Ltd for the first four years? (5) What is the value per share of Tessa Ltd from 2020 until 2023? What is the intrinsic value per share of Tessa Ltd from 2016 to beyond 2023? (7) What is the value per share of Tessa Ltd if the growth rate remains constant at 8% from 2016 to 2023 and beyond (forever)? (5) Explain your answer under 4.4? (2) 4.5. QUESTION 4 [25 Marks) Tessa Ltd.'s earnings and dividends have been growing at a rate of 18% per annum. This growth rate is expected to continue for 4 years (i.c. 2016 to 2019). After that the growth rate will fall to 12% for the next 4 years until 2023. Thereafter, the growth rate is expected to be consistent at 6% forever. If the last dividend per share was N$2.00 and the investors' required rate of return on Tessa Ltd.'s equity is 15%, calculate the following: 4.1. 4.2. 4.3. 4.4. What is the value per share of Tessa Ltd for the first four years? (5) What is the value per share of Tessa Ltd from 2020 until 2023? What is the intrinsic value per share of Tessa Ltd from 2016 to beyond 2023? (7) What is the value per share of Tessa Ltd if the growth rate remains constant at 8% from 2016 to 2023 and beyond (forever)? (5) Explain your answer under 4.4? (2) 4.5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started