Answered step by step

Verified Expert Solution

Question

1 Approved Answer

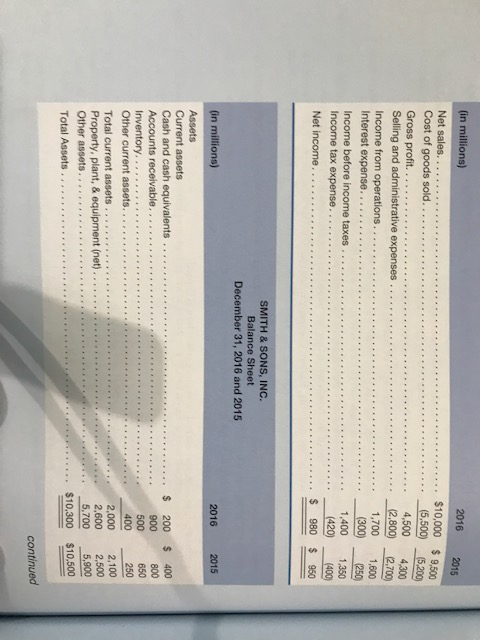

PLEASE ANSWER 5,6,7 THANK YOU in millions) 2016 2015 $10,000 $9,500 (5,500) 5.200 4,500 4,300 (2.800) 12.700 Selling and administrative expenses . (300) (250 1,400

PLEASE ANSWER 5,6,7

THANK YOU

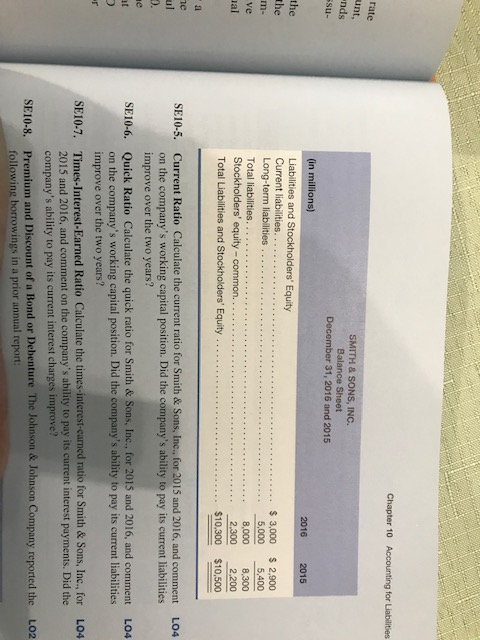

in millions) 2016 2015 $10,000 $9,500 (5,500) 5.200 4,500 4,300 (2.800) 12.700 Selling and administrative expenses . (300) (250 1,400 1,350 Income before income taxes x expense .. . . .. $ 980 $ 950 SMITH & SONS, INC. Balance Sheet December 31, 2016 and 2015 (in millions) 2016 2015 Assets Current assets Cash and cash equivalents .. Accounts receivable. Inventory. . . .*.. . $ 200 400 900 500 400 650 2,000 2,100 2,600 2,500 Total current assets. NO5,700 5,900 her assets . ...$10,300 $10,500 Total Assets. continued Chapter 10 Accounting for Liabilities rate unt nds su SMITH & SONS, INC Balance Sheet December 31, 2016 and 2015 (in millions) 2016 2015 Liabilities and Stockholders' Equity Current liabilities. Long-term liabilities . Total liabilities. Stockholders' equity-common. Total Liabilities and Stockholders' Equity s 3,000 $ 2,900 5,000 5,400 8,000 8,300 2.300 2.200 ..$10.300 $10,500 the m- ve Current Ratio Calculate the current ratio for Smith & Sons, Inc., for 2015 and 2016, and comment on the company's working capital position. Did the company's ability to pay its current liabilities improve over the two years? LO4 SE10-5. Quick Ratio Calculate the quick ratio for Smith & Sons, Inc., for 2015 and 2016, and comment on the company's working capital position. Did the company's ability to pay its current liabilities improve over the two years? LO4 SE10-6. SE10-7. Times-Interest-Earned Ratio Calculate the times-interest-earned ratio for Smith&Sons, Inc., for L04 2015 and 2016, and comment on the company's ability to pay its current interest payments. Did the company's ability to pay its current interest charges improve? Premium and Discount of a Bond or Debenture The Johnson & Johnson Company reported the following borrowings in a prior annual report LO2 SE10-8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started