Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer 76,84 asap Maid In Canada (MIC) is a new business you started this year. You perform custom cleaning and concierge services for customers

please answer 76,84 asap

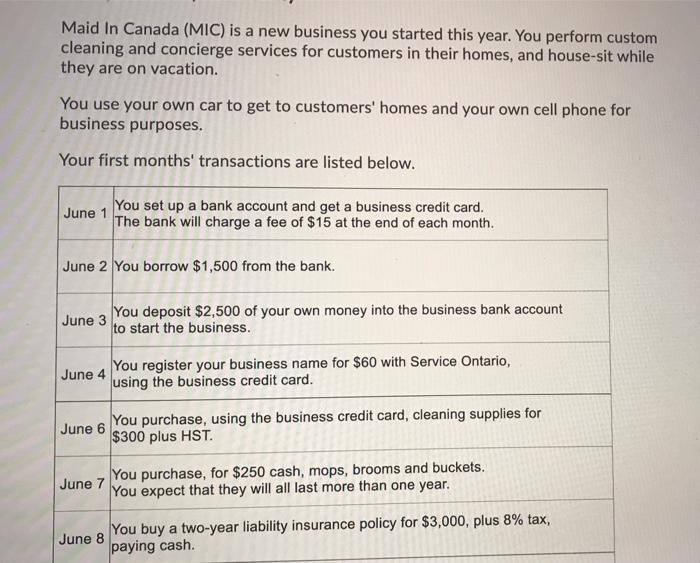

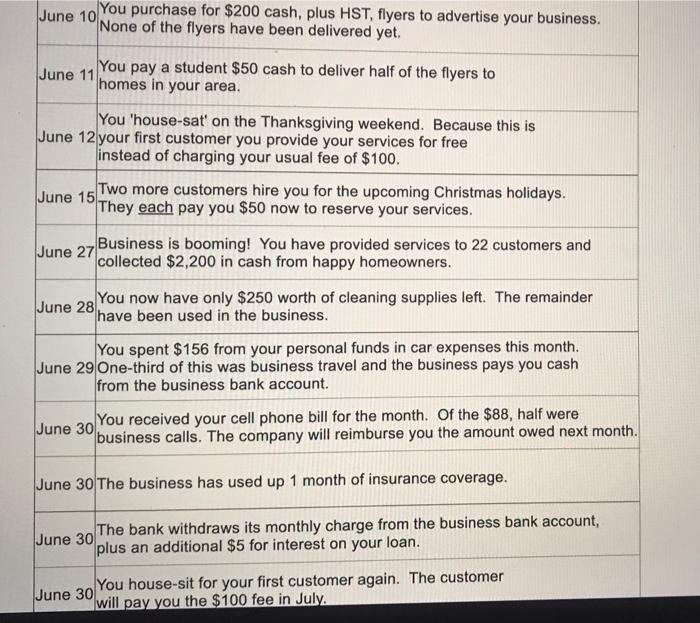

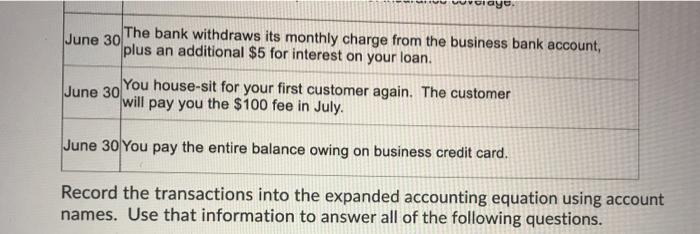

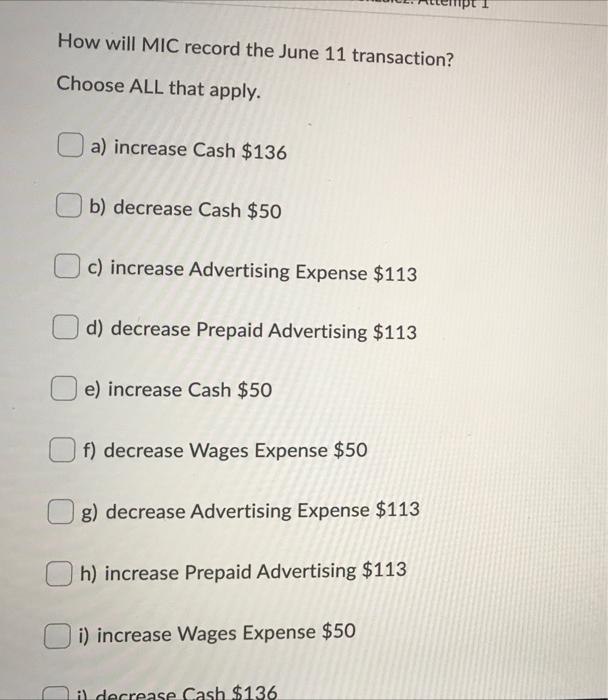

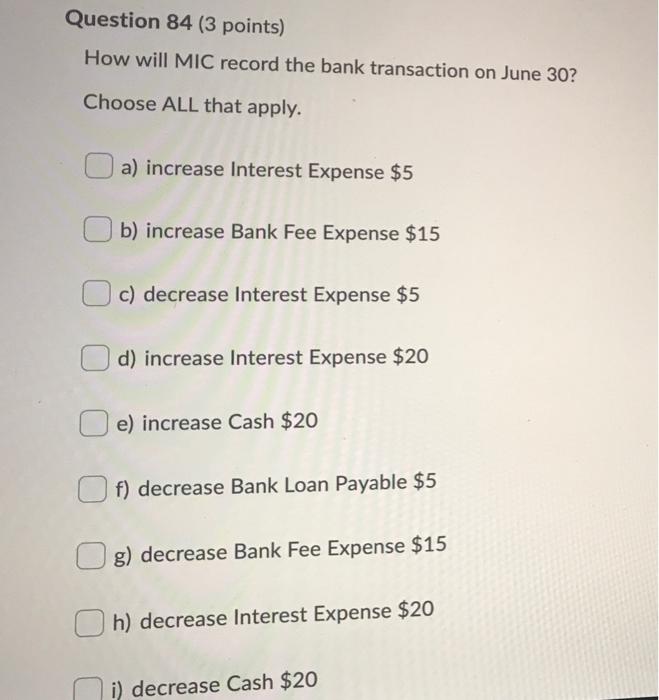

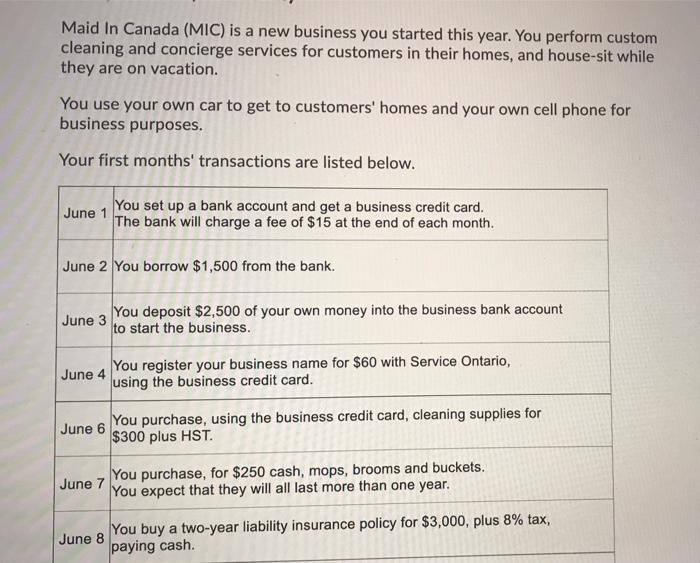

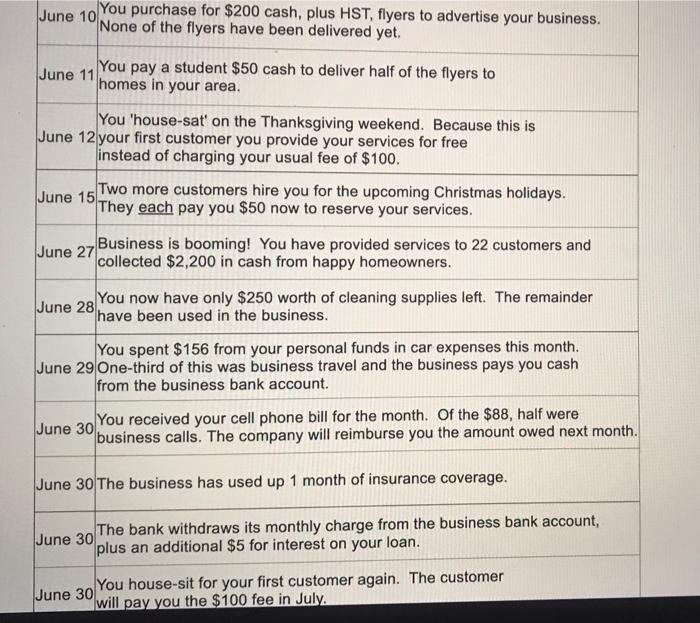

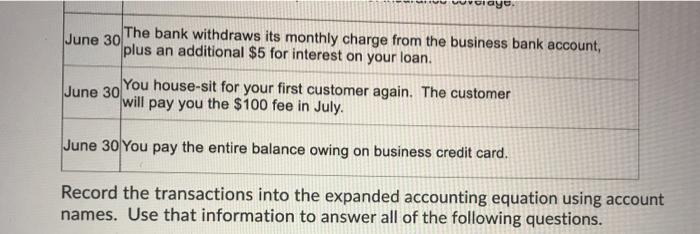

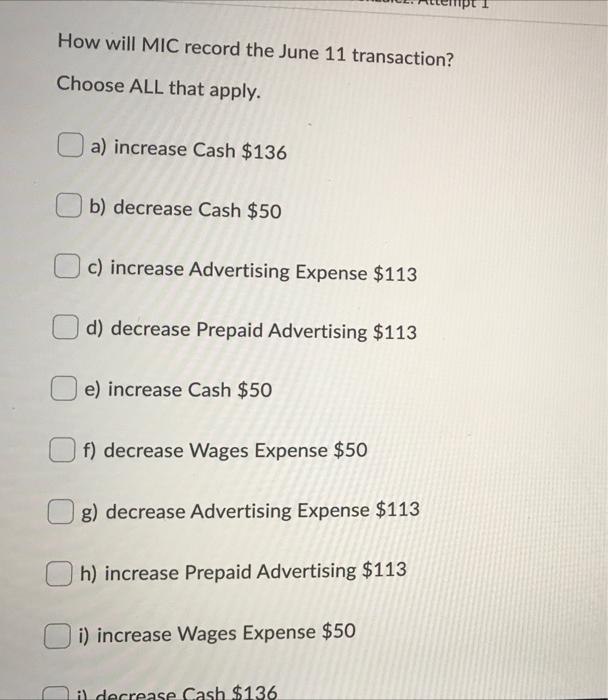

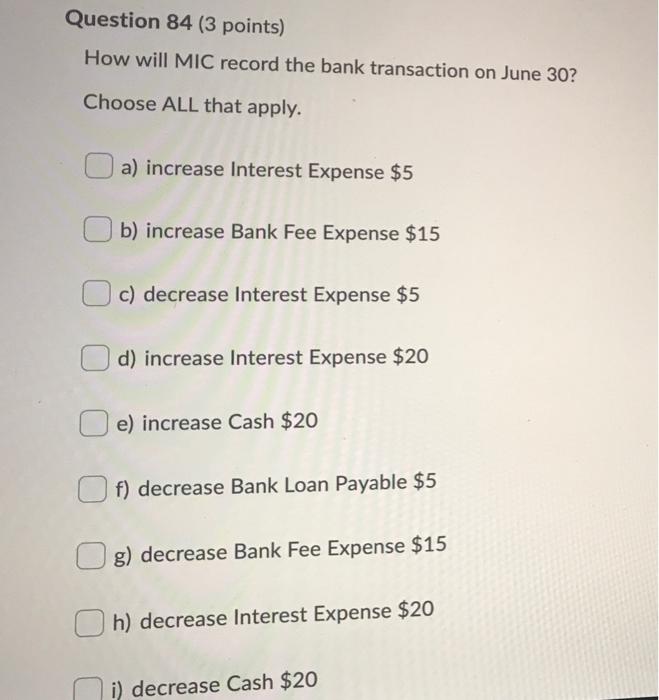

Maid In Canada (MIC) is a new business you started this year. You perform custom cleaning and concierge services for customers in their homes, and house-sit while they are on vacation. You use your own car to get to customers' homes and your own cell phone for business purposes. Your first months' transactions are listed below. You set up a bank account and get a business credit card. June 1 The bank will charge a fee of $15 at the end of each month. June 2 You borrow $1,500 from the bank. June 3 You deposit $2,500 of your own money into the business bank account to start the business. June 4 You register your business name for $60 with Service Ontario, using the business credit card. June 6 You purchase, using the business credit card, cleaning supplies for $300 plus HST. June 7 You purchase, for $250 cash, mops, brooms and buckets. You expect that they will all last more than one year. June 8 You buy a two-year liability insurance policy for $3,000, plus 8% tax, paying cash. June 10 You purchase for $200 cash, plus HST, flyers to advertise your business. None of the flyers have been delivered yet. June 11 You pay a student $50 cash to deliver half of the flyers to homes in your area. You 'house-sat' on the Thanksgiving weekend. Because this is June 12 your first customer you provide your services for free instead of charging your usual fee of $100. Two more customers hire you for the upcoming Christmas holidays. June 15 They each pay you $50 now to reserve your services. June 27 Business is booming! You have provided services to 22 customers and collected $2,200 in cash from happy homeowners. June 28 You now have only $250 worth of cleaning supplies left. The remainder have been used in the business. You spent $156 from your personal funds in car expenses this month. June 29 One-third of this was business travel and the business pays you cash from the business bank account. June 30 You received your cell phone bill for the month. Of the $88, half were business calls. The company will reimburse you the amount owed next month. June 30 The business has used up 1 month of insurance coverage. June 30 The bank withdraws its monthly charge from the business bank account, plus an additional $5 for interest on your loan. June 30 You house-sit for your first customer again. The customer will pay you the $100 fee in July clayo June 30 The bank withdraws its monthly charge from the business bank account, plus an additional $5 for interest on your loan. You house-sit for your first customer again. The customer June 30 will pay you the $100 fee in July June 30 You pay the entire balance owing on business credit card. Record the transactions into the expanded accounting equation using account names. Use that information to answer all of the following questions. How will MIC record the June 11 transaction? Choose ALL that apply. a) increase Cash $136 b) decrease Cash $50 c) increase Advertising Expense $113 d) decrease Prepaid Advertising $113 e) increase Cash $50 f) decrease Wages Expense $50 g) decrease Advertising Expense $113 h) increase Prepaid Advertising $113 i) increase Wages Expense $50 i decrease Cash $136 Question 84 (3 points) How will MIC record the bank transaction on June 302 Choose ALL that apply. a) increase Interest Expense $5 b) increase Bank Fee Expense $15 c) decrease Interest Expense $5 d) increase Interest Expense $20 e) increase Cash $20 f) decrease Bank Loan Payable $5 g) decrease Bank Fee Expense $15 h) decrease Interest Expense $20 i) decrease Cash $20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started