Answered step by step

Verified Expert Solution

Question

1 Approved Answer

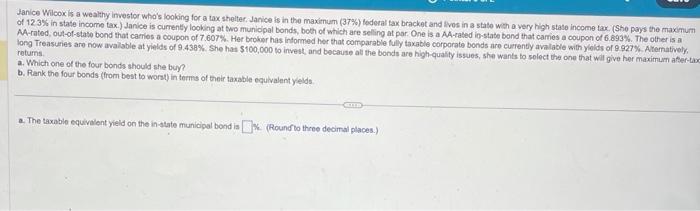

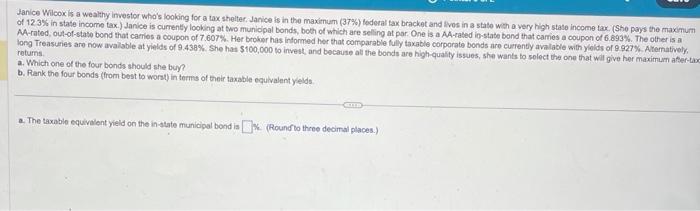

please answer A and B (1-6) of 123% in state incomo tax.) Janice is currenty looking at two municipal bonds, both of which are selling

please answer A and B (1-6)

of 123% in state incomo tax.) Janice is currenty looking at two municipal bonds, both of which are selling at par. One is a AA-rated io-state bond that camies a coupon of 6.893%. The other is a long Treasules are now avalable at yialids of 9.438%. She has $100,000 to invest, and because all the bonds are high-quality issues, she wants to solect the one that will give her maximum aftef-ti returns. a. Which one of the four bonds should she buy? b. Rank the four bonds (from best to worst) in terms of thetr taxable equivalent yelds. a. The taxable equivelent yield on the in-tate municipal bond is K. (Round tho throe decimal places.) of 123% in state incomo tax.) Janice is currenty looking at two municipal bonds, both of which are selling at par. One is a AA-rated io-state bond that camies a coupon of 6.893%. The other is a long Treasules are now avalable at yialids of 9.438%. She has $100,000 to invest, and because all the bonds are high-quality issues, she wants to solect the one that will give her maximum aftef-ti returns. a. Which one of the four bonds should she buy? b. Rank the four bonds (from best to worst) in terms of thetr taxable equivalent yelds. a. The taxable equivelent yield on the in-tate municipal bond is K. (Round tho throe decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started