Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer a and b. A second version of the Markowitz portfolio model maximizes expected return subject to a constraint that the variance of the

Please answer a and b.

A second version of the Markowitz portfolio model maximizes expected return subject to a constraint that the variance of the portfolio must be less than or equal to some specified amount. Consider the Hauck Financial Service data.

| Mutual Fund | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Foreign Stock | 10.060 | 13.120 | 13.470 | 45.420 | -21.930 | |

| Intermediate-Term Bond | 17.640 | 3.250 | 7.510 | -1.330 | 7.360 | |

| Large-Cap Growth | 32.410 | 18.710 | 33.280 | 41.460 | -23.260 | |

| Large-Cap Value | 32.360 | 20.610 | 12.930 | 7.060 | -5.370 | |

| Small-Cap Growth | 33.440 | 19.400 | 3.850 | 58.680 | -9.020 | |

| Small-Cap Value | 24.560 | 25.320 | -6.700 | 5.430 | 17.310 |

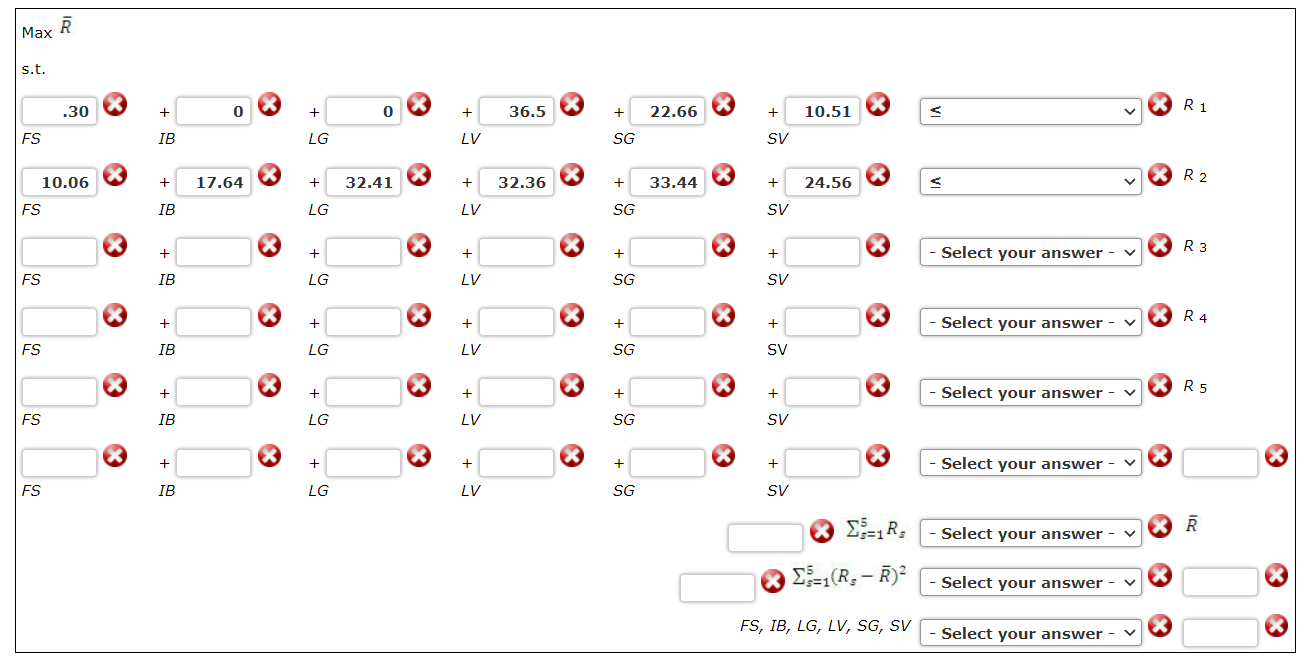

| (a) | Construct this version of the Markowitz model for a maximum variance of 40. | ||||||||||||||||||

| |||||||||||||||||||

| (a) | If required, round your answers to two decimal places. For subtractive or negative numbers use a minus sign even if there is a + sign before the blank (Example: -300). If the constant is "1" it must be entered in the box. If your answer is zero enter 0. |

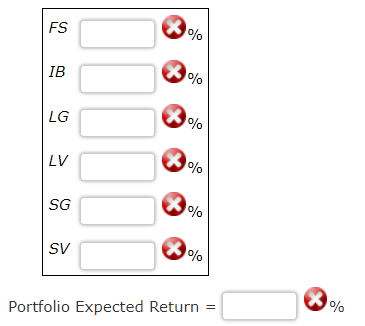

| (b) | Solve the model developed in part (a). |

| If required, round your answers to two decimal places. If your answer is zero, enter 0. |

What does "needs reference" mean?

Max R s.t. x .30 o + 0 8 + 36.5 R 1 $ + 22.66 + 10.51 s + SG FS 3 8 IB LG LV SV . 10.06 X 3 + 32.41 17.64 + 32.36 + R2 X + + [ 33.44 24.56 + FS IB LG LV SG SV 8 8 X x 8 3 R3 + + + + + + - Select your answer - FS IB LG LV SG SV X X 8 8 R4 + + + Select your answer + + SG + 9 FS IB LV SV X 3 R5 + + - Select your answer - to + + SG + 2 FS IB LG LV SV X 8 3 + + 8 + + + Select your answer FS IB LG LV SG SV 2 R - Select your answer - XR X (R.- 2 - Select your answer - 3 FS, IB, LG, LV, SG, SV Select your answer X Max R s.t. x .30 o + 0 8 + 36.5 R 1 $ + 22.66 + 10.51 s + SG FS 3 8 IB LG LV SV . 10.06 X 3 + 32.41 17.64 + 32.36 + R2 X + + [ 33.44 24.56 + FS IB LG LV SG SV 8 8 X x 8 3 R3 + + + + + + - Select your answer - FS IB LG LV SG SV X X 8 8 R4 + + + Select your answer + + SG + 9 FS IB LV SV X 3 R5 + + - Select your answer - to + + SG + 2 FS IB LG LV SV X 8 3 + + 8 + + + Select your answer FS IB LG LV SG SV 2 R - Select your answer - XR X (R.- 2 - Select your answer - 3 FS, IB, LG, LV, SG, SV Select your answer XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started