Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer a) b) and c) of this problem and show all work. Thank you! Tesla is considering a major expansion of its product line

Please answer a) b) and c) of this problem and show all work. Thank you!

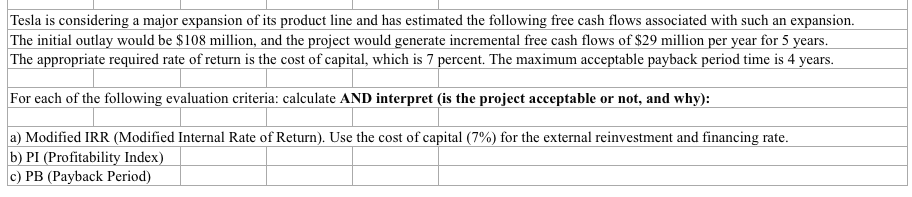

Tesla is considering a major expansion of its product line and has estimated the following free cash flows associated with such an expansion. The initial outlay would be $108 million, and the project would generate incremental free cash flows of $29 million per year for 5 years. The appropriate required rate of return is the cost of capital, which is 7 percent. The maximum acceptable payback period time is 4 years. For each of the following evaluation criteria: calculate AND interpret (is the project acceptable or not, and why): a) Modified IRR (Modified Internal Rate of Return). Use the cost of capital (7%) for the external reinvestment and financing rate. b) PI (Profitability Index) c) PB (Payback Period)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started